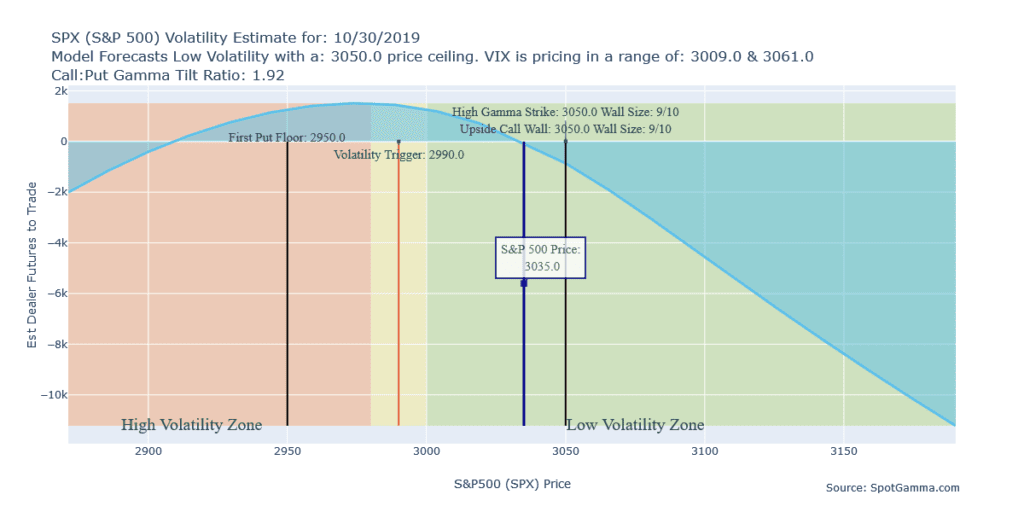

Today we have an interesting confluence of events: a FED FOMC rate day and ultra high S&P500 market gamma. As of this posting( 10/30 @ 10:30 AM EST) market gamma is ~$1.8 billion which is quite high and forecasts an S&P500 trading range of 50 bps (1/2%). The Fed is widely expected to cut rates today with market pricing a 99.5% chance of 25 bps cut.

Assuming he sticks to expectations we would anticipate implied volatility to drop and we might test the 3050 level in SPX. That is our high gamma strike and has ~$9 billion of gamma associated with it – we believe this provides quite a resistance wall. It will be very interesting to see if that holds true.

Additionally because gamma is so high any selling could mean revert due to that high market gamma.

Pre-Fed gamma snapshot:

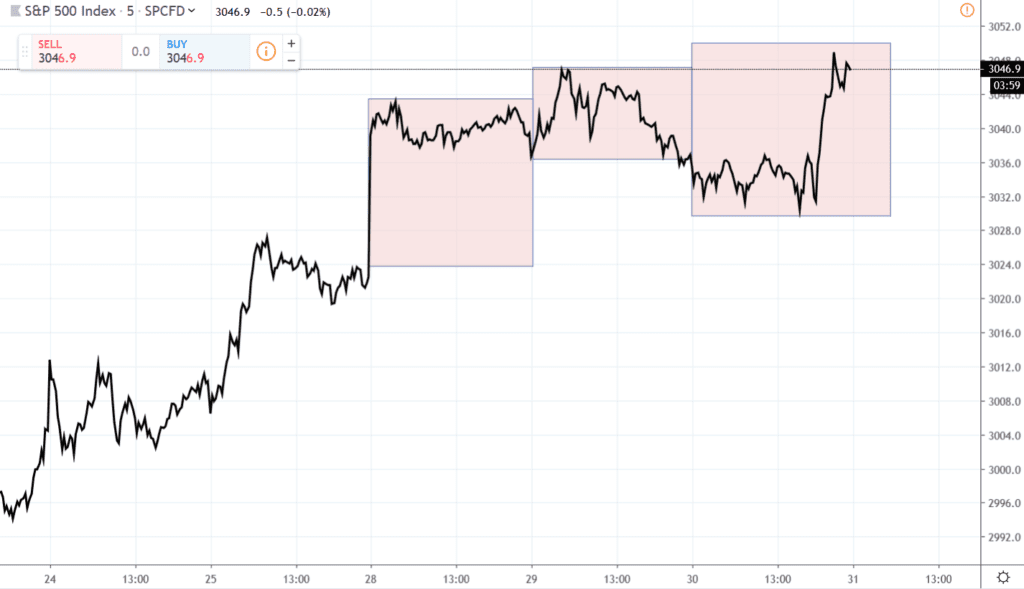

Closing Update – the 3050 wall held for today with a slightly larger SPX trading range than anticipated today. Gamma had priced a ~15 handle move and the actual range was a bit closer to 20.

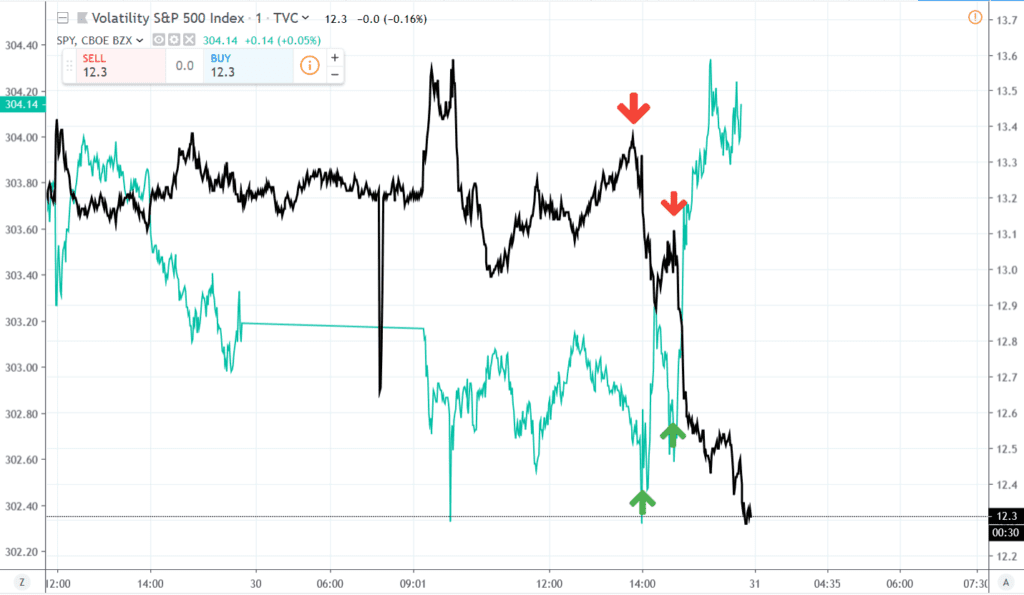

Once again the VIX is the market tell, forecasting the move up in SPX.