The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Hard Landing Worries Are Driving Volatility Volatility in the market has been high as traders and investors look to hedge risks associated with the Fed and the potential for an economic slowdown. The concerns seemed to evolve, starting with inflation and growth worries. Now […]

FED

The Fed Meeting May Spark The Next Stock Market Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Buy the Fed meeting. Sell the Fed minutes. It may be the name of the game for the stock market. At least since the start of 2022, the minutes have been a cause of concern for markets, while the FOMC meetings […]

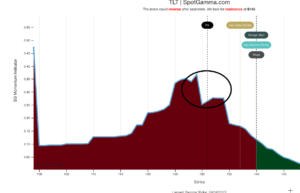

The TLT’s Recent Plunge May Be Over

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Bond yields have soared in 2022, sending ETFs like the iShares 20+ Year Treasury Bond ETF (TLT) lower by around 10%, but almost 25% off its 2020 highs. The ETF now comes to a critical juncture, signaling rates pushing significantly higher […]

When Might this Volatility End?

We have been targeting next weeks OPEX 3/20 as a key time in this “volatility cycle” as there is very large open interest. As that open interest is closed or rolled it may allow some calm as call options are re-struck closer to at-the-money and put options are rolled out and down. This could effectively […]

Fed Versus High Gamma

Today we have an interesting confluence of events: a FED FOMC rate day and ultra high S&P500 market gamma. As of this posting( 10/30 @ 10:30 AM EST) market gamma is ~$1.8 billion which is quite high and forecasts an S&P500 trading range of 50 bps (1/2%). The Fed is widely expected to cut rates […]