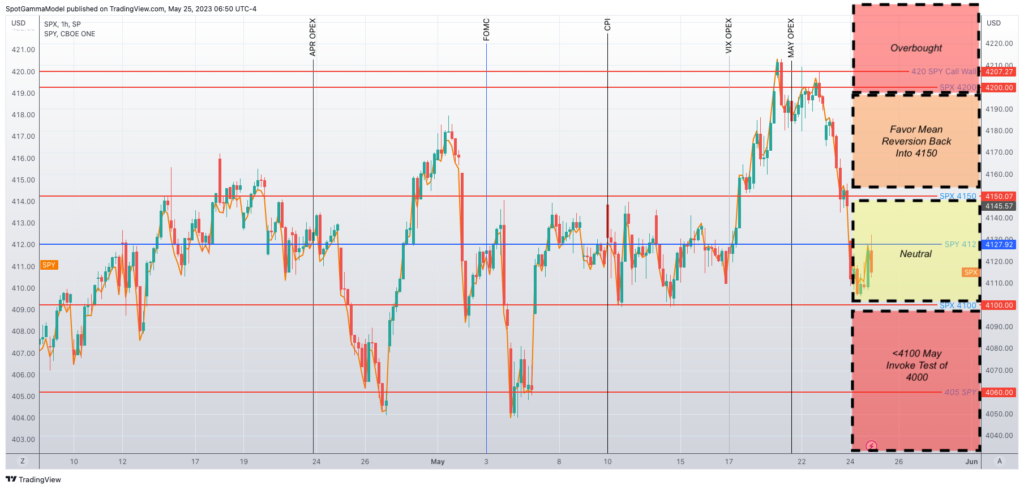

Macro Theme:

Major Resistance: $4,200 (SPY $420 Call Wall)

Pivot Level: $4,150 (SPY $415)

Interim Support: $4,100

Range High: $4,300 Call Wall

Range Low: $4,000 Put Wall

‣ A break of 4100 is “risk off”, likely invoking a test of $4,000

‣ $4,000 is considered material, long term support

Founder’s Note:

Futures are higher to 4,150 as NVDA smashed earnings expectations. First resistance today shows at a band from 4,150 to 4,160 (SPY 415) followed by 4,175. Support shows at SPY 412 (SPX 4125), then SPY 410 (SPX 4110) to 4,100.

Its a tricky path for traders to traverse this morning. On one side NVDA bolstered the bullish AI narrative, but on the other side is the looming x-Date. Compounding this for options traders is the long Memorial Day weekend – and no one likely wants to pay that theta bill.

The result of all this is that IV’s have generally come in a bit this morning, but with a slight increase in call skew.

Additionally, the decline over the last two days has also put a bit of vanna back in the tank, after OPEX had drained most of that factor off. The implication here is that short dated options traders may elect to step up and sell vol as the long weekend approaches, also figuring the Debt Ceiling is next week’s problem. Further we have to be on watch for 0DTE single stock call buyers who may have been reinvigorated by NVDA’s results.

The end result is that we may see some short term break down in correlation, somewhat similar to what we saw into OPEX. This showed as tech significantly outperformed, which dragged up the S&P. This week correlation seemed to increase a bit as all stocks consolidated.

Now we may see tech stocks, particularly those AI names, catch a bid while we think the S&P is neutral. To this point we see the AI names up starkly premarket: AMD +10%, AI +10%, MSFT +2.5%, GOOGL +2% vs SPY +0.6%

We are neutral as we see rally attempts over 4,150 as likely to be met with negative delta flow, particularly from call sellers & 0DTE put buyers. Conversely any test of 4,100 is likely to be met with a supportive, positive delta response (short dated put sellers).

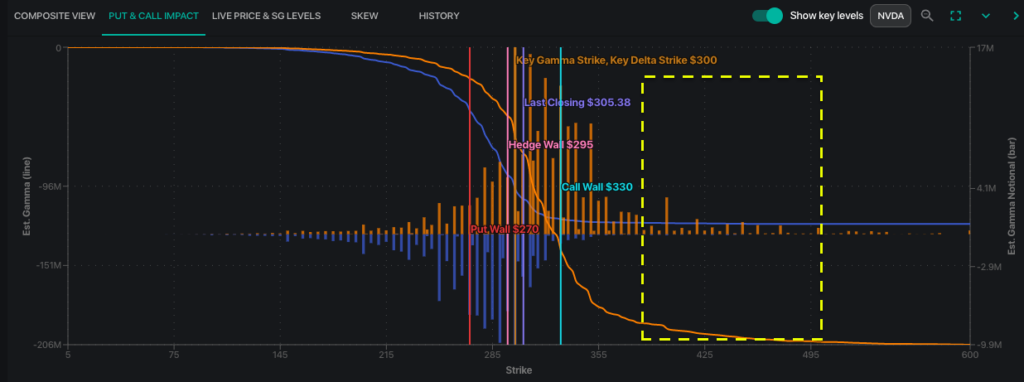

On the topic of NVDA, the +20% pop has pushed the stock well past any of its call positions as shown in the yellow box. Further, the IV is likely to open at extremely high levels. For this reason we think stock is due for some consolidation towards 350, as any pause in the stock will cause call values to fall sharply, which could invoke selling in the stock. The counter to this would be a strong bid to 0DTE (ie Friday’s) calls, which would be seen in

HIRO.

The trick here may be that NVDA implied volatility may fall if the stock declines. This makes outright puts a tough play. We think long put flies (+ 1 ATM, -2 OTM, +1 OTM) are an interesting fixed risk idea, as you can position so that you are directionally short the stock while benefitting from a decrease in IV.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4115 | $411 | $13604 | $331 | $1767 | $175 |

| SpotGamma Implied 1-Day Move: | 0.84% | 0.84% | ||||

| SpotGamma Implied 5-Day Move: | 2.20% | |||||

| SpotGamma Volatility Trigger™: | $4135 | $413 | $13175 | $332 | $1770 | $175 |

| Absolute Gamma Strike: | $4000 | $412 | $13850 | $330 | $1800 | $175 |

| SpotGamma Call Wall: | $4300 | $420 | $13850 | $340 | $1790 | $178 |

| SpotGamma Put Wall: | $3900 | $400 | $11000 | $325 | $1700 | $170 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4122 | $416 | $12586 | $333 | $1886 | $182 |

| Gamma Tilt: | 0.918 | 0.698 | 2.031 | 0.821 | 0.703 | 0.613 |

| SpotGamma Gamma Index™: | -0.456 | -0.344 | 0.068 | -0.066 | -0.022 | -0.071 |

| Gamma Notional (MM): | ‑$391.33M | ‑$1.466B | $10.105M | ‑$357.518M | ‑$24.148M | ‑$765.319M |

| 25 Day Risk Reversal: | -0.077 | -0.082 | -0.064 | -0.067 | -0.063 | -0.073 |

| Call Volume: | 593.69K | 2.547M | 12.075K | 815.209K | 40.95K | 319.739K |

| Put Volume: | 975.88K | 2.915M | 8.479K | 1.262M | 48.126K | 512.064K |

| Call Open Interest: | 6.335M | 7.222M | 69.896K | 4.513M | 199.364K | 3.522M |

| Put Open Interest: | 12.047M | 13.818M | 59.081K | 8.924M | 352.333K | 7.498M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4200, 4150, 4100, 4000] |

| SPY Levels: [415, 412, 410, 400] |

| NDX Levels: [14000, 13850, 13500, 13000] |

| QQQ Levels: [335, 330, 325, 320] |

| SPX Combos: [(4300,97.91), (4276,89.19), (4251,95.11), (4226,92.07), (4218,75.45), (4210,83.02), (4206,83.35), (4202,97.23), (4189,84.01), (4185,74.35), (4181,78.37), (4177,84.29), (4144,85.38), (4140,79.30), (4123,93.84), (4119,79.74), (4111,80.46), (4103,85.60), (4099,92.29), (4095,83.72), (4091,74.43), (4078,87.69), (4074,91.52), (4062,87.24), (4054,93.41), (4049,96.06), (4025,89.17), (4004,90.96), (4000,96.34), (3975,86.29), (3951,92.66)] |

| SPY Combos: [429.41, 419.47, 424.44, 399.6] |

| NDX Combos: [13849, 13945, 13332, 13536] |

| QQQ Combos: [337.65, 339.99, 329.99, 344.99] |

SPXSPYNDXQQQRUTIWM

SPX Gamma Model

May 25$3,314$3,764$4,214$4,938Strike-$1.6B-$858M-$158M$1.2BGamma NotionalPut Wall: 3900Call Wall: 4300Abs Gamma: 4000Vol Trigger: 4135Last Price: 4115

©2023 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/