Macro Theme:

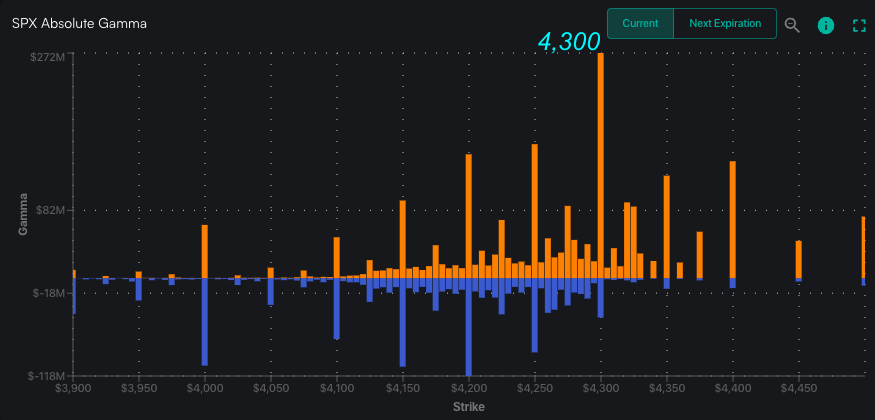

Major Resistance: $4,300

Pivot Level: $4,200

Interim Support: $4,250

Range High: $4,300 Call Wall

Range Low: $4,000 Put Wall

‣ We are neutral on the S&P while it remains >$4,200

‣ S&P500 may close its performance gap to Nasdaq based on IV and call positions

‣ June FOMC 6/14

‣ June OPEX 6/16

Founder’s Note:

Futures are off fractionally to 4275, with SG levels unchanged. Resistance above remains at 4,300 SPX

Call Wall – 4,310 (SPY

Call Wall). Support below shows at 4,250.

We continue to look for the 4,250 – 4,300 area pin for todays session, and look for trade to mean revert off of

large gamma strikes in this region, as per recent forecasts.

While levels did not change, the 4,300

Call Wall level picked up in gamma size, likely increasing its resistance/stickiness.

Initially, as per

HIRO, it was call sellers that came in on the test of 4,300 (all exp

call delta flow = orange, 0DTE call flow = green). However, the data reflected longer dated put buyers accelerating into the afternoon. This is implied through the dark blue “all exp” put line being materially beneath that of the light blue “0DTE puts”.

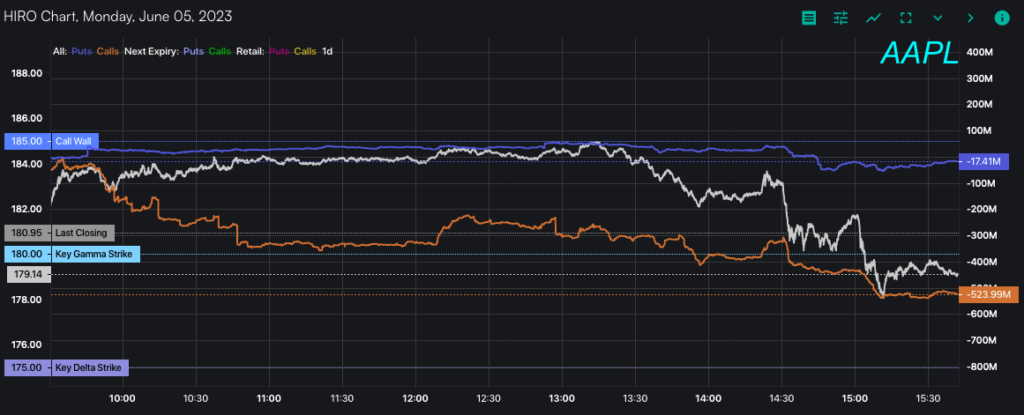

We also saw many of the market leaders turning at or near their individual

Call Walls. Case in point was AAPL, below, which saw a sharp increase in call selling (orange) as the stock tested its 185 Wall. Interestingly this 185 level marked an all time intraday high for the stock, and coincides with its major VR release.

With this, many of the AI names have lost momentum, and that ultra-high IV (particularly call skew) is burning up. As an example you can see NVDA’s skew below, with today’s IV significantly under that of 1 week ago (red) – while the stock price was essentially flat over this period. The green box highlights that it was upside strikes which were asymmetrically bid up during the chase, and are now those are call IV’s are dropping hard. We do think that a lot of volatility players enter these names to short IV when its so explosive, and those dynamic hedgers may help to support the stocks price while (or despite) the IV comes down.

IV declining, along with those

Call Walls outlined above, all serve to stall upside price action.

This could all read as bearish, but we take it more as “neutral” and in line with expectations. One could argue that overwriting longs or taking advantage of that rich call IV makes sense here as we approach next weeks Fed and the huge June OPEX. While traders may want to hedge the FOMC, they are unlikely to want to carry those positions over the next 5 days of (what should be) boredom/decay.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4282 | $427 | $14546 | $354 | $1806 | $179 |

| SpotGamma Implied 1-Day Move: | 0.83% | 0.87% | ||||

| SpotGamma Implied 5-Day Move: | 2.16% | |||||

| SpotGamma Volatility Trigger™: | $4195 | $427 | $12425 | $349 | $1770 | $176 |

| Absolute Gamma Strike: | $4300 | $425 | $15125 | $350 | $1800 | $180 |

| SpotGamma Call Wall: | $4300 | $430 | $15125 | $360 | $1790 | $182 |

| SpotGamma Put Wall: | $4000 | $425 | $14480 | $332 | $1700 | $170 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4162 | $426 | $0 | $351 | $1829 | $180 |

| Gamma Tilt: | 1.62 | 0.961 | 3.386 | 1.075 | 0.894 | 0.857 |

| SpotGamma Gamma Index™: | 2.319 | -0.039 | 0.127 | 0.020 | -0.009 | -0.025 |

| Gamma Notional (MM): | $1.095B | ‑$92.081M | $16.254M | $142.958M | ‑$10.12M | ‑$222.357M |

| 25 Day Risk Reversal: | -0.041 | -0.04 | -0.028 | -0.032 | -0.037 | -0.039 |

| Call Volume: | 827.894K | 1.952M | 9.789K | 634.895K | 20.42K | 467.282K |

| Put Volume: | 1.277M | 2.937M | 8.156K | 1.186M | 54.371K | 626.33K |

| Call Open Interest: | 6.506M | 7.142M | 74.482K | 4.762M | 213.208K | 3.784M |

| Put Open Interest: | 12.631M | 14.089M | 65.925K | 9.849M | 373.002K | 7.811M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4300, 4250, 4200, 4150] |

| SPY Levels: [430, 428, 425, 420] |

| NDX Levels: [15125, 15100, 15000, 13850] |

| QQQ Levels: [360, 355, 350, 340] |

| SPX Combos: [(4475,79.98), (4449,93.12), (4424,85.04), (4402,77.16), (4398,99.51), (4377,95.49), (4364,83.72), (4359,79.58), (4355,85.70), (4351,99.25), (4347,76.55), (4338,82.07), (4329,88.06), (4325,98.76), (4321,98.59), (4308,90.90), (4304,93.55), (4299,99.94), (4295,88.19), (4291,77.53), (4282,77.21), (4278,88.65), (4274,95.77), (4270,78.20), (4265,80.08), (4248,97.58), (4227,87.39), (4201,88.48), (4098,85.90)] |

| SPY Combos: [428.8, 438.62, 433.92, 431.36] |

| NDX Combos: [15129, 15099, 14765, 13848] |

| QQQ Combos: [340.15, 371.36, 371.01, 362.85] |