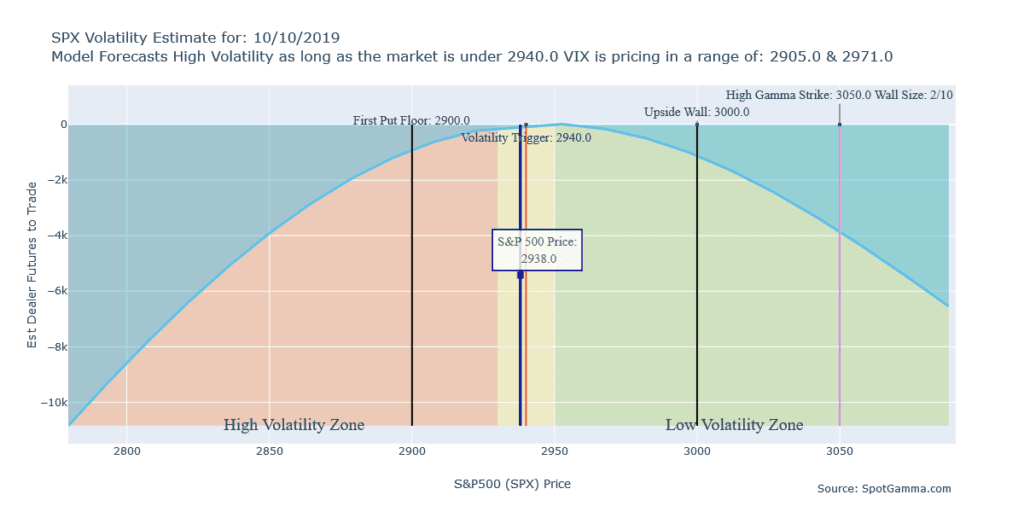

We started the day negative gamma but had a rally to just above the zero gamma level. There appears to be a sizeable market hedge at 2900 which could provide support for the markets. If volatility breaks the put hedges that dealers are holding will act as fuel to spark a strong rally. The 3000 strike call wall is not offering much resistance. While this is not a directional call it is a note that it appears (from a gamma perspective) the path of least resistance is higher.

Here is the snapshot of the current major gamma levels: