Good article here about active/passive investing and the thread of robots breaking the market. There is a good description of “gamma traps” and liquidity around options gamma. Two interesting pieces:

When gamma is positive, options quickly get more valuable when the price of the related shares rise. The bank taking the opposite position to the investor then sells those shares. That damps volatility.When gamma is negative, it is the other way around, and banks buy shares when prices are rising and sell when they are falling…Banks have ended up being long gamma more often because of the strong demand from insurers and pension funds for strategies that generate income while limiting exposure to stock-market falls.”

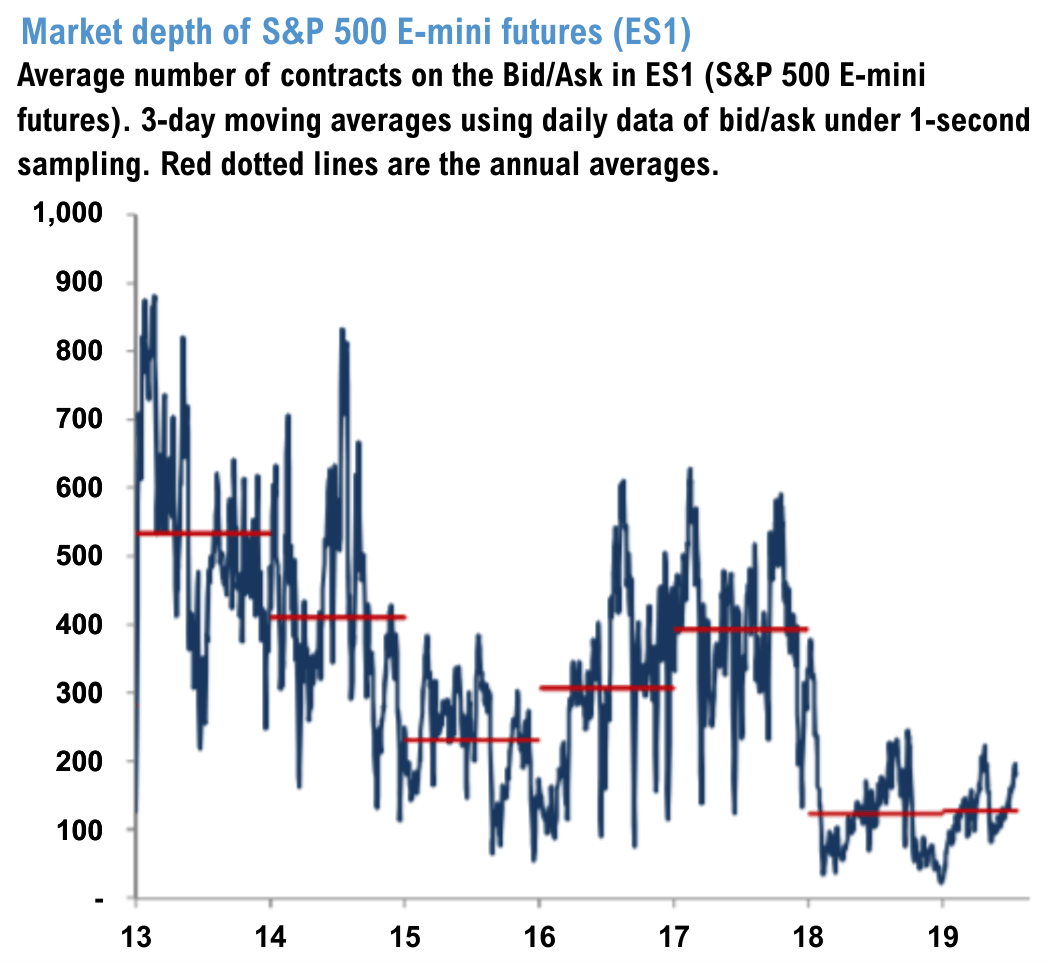

Each new chart that comes out shows less and less liquidity in futures….the SpotGamma model often has dealers buying/selling 1,000 futures with just 10-20 point SPX move. That’ll have big impact when depth is 200. Liquidity is an issue when dealers are short gamma because they will trade quickly and algorithmically when they need to hedge. These situations are called a gamma traps and liquidity is controlled by them.