Presented by the NinjaTrader Ecosystem, Trader’s Workshop is dedicated to serving and developing real futures traders. Brent Kochuba discusses the impact that the options market has on futures trading and why paying attention to options should be in every future’s trader’s toolkit.

futures

Trade Analysis – NQ Futures – 24 September 2021

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and […]

Trading NQ Futures Using QQQ Equity Hub Data and Vanna Model

The following is a guest post from Doug Pless. As discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put […]

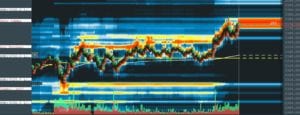

SpotGamma Levels at Work

We publish key levels based off of S&P500 options gamma and interest levels before the open. We can push these levels into various trading systems like Bookmap. As you can see in the Bookmap screenshot below the ES futures played off of our trading levels throughout the day. The market opened and immediately tested 3025 […]

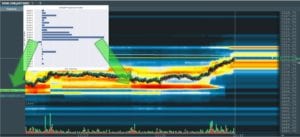

SG Combo Gamma Index In Action

Our combined gamma SPX/SPY gives many fascinating levels for traders. As you can see in the chart the market will often use the large gamma strikes in this indicator as support and resistance areas. This proprietary indicator is for subscribers only.

Mondays Market SPX Slide 5/12/20

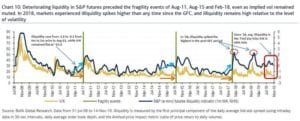

Yesterday markets fell apart pretty quickly and that leads us to highlight ES volume and the poor liquidity seen. You can see in the chart below that ES volume was higher than its recently been and a lot of that was concentrated into the close. This leads us to an interesting point about ES Futures […]

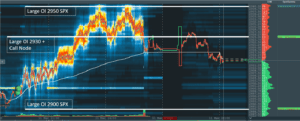

SPX Options Levels & ES Futures Trading

We believe that strikes with high open interest in the SPX create support and resistance lines for ES Futures trading. Here is one prime example. At top is the morning note we sent to subscribers at at the bottom you see those levels noted in the Bookmap futures trading platform. Futures currently trade at a […]

Options Market Gamma Theory is All About Volume

Options market gamma numbers proliferate the market but its important to understand what exactly those numbers mean. Yes, positive gamma may indicate lower stock volatility. And when gamma flips from positive to negative that may indicate higher volatility. But the actual gamma number itself is an estimate of how much stock dealers will have to […]

Saudi Oil Attack Options Gamma

Here is a quick snapshot after the Saudi Oil attack – options gamma is still quite long with over $1bn long gamma per point in the S&P500. This may have had an effect on muting or “deleveraging” the reaction to the news about the Saudi Oil attack. There was a very large move in crude […]

Pre Open Gamma Snapshot 8/26/19

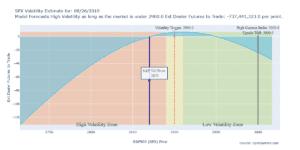

SpotGamma Model Outlook for today using a futures reference price of 2870. Dealers are short a healthy amount of gamma meaning they are going to fuel the market move at open. A short gamma position means a higher market means dealers will start buying and if the market drops at open they will sell along […]