S&P 500 Stock Market Gamma Trading Levels Based on Options Open Interest

HIRO Indicator

See options activity in real time

Enabling traders to detect possible hedging flows tied to options trades and to anticipate their impact

See options trades impact the markets down to the second

HIRO Indicator: See What's Actually Moving the Market

HIRO (Hedging Impact Real-Time Options) translates live options activity into a single indicator — showing you when dealer hedging is pushing prices, and when that pressure is about to exhaust.

Why Price Moves "For No Reason"

You've seen it. A stock starts grinding up at 10:15am. No news. No catalyst. Within 20 minutes it's up 1.5% and the move is over.

What you didn't see: a large options position being placed, triggering a chain of delta-hedging by market makers. They had to buy. Price had to follow.

HIRO sees this. Your charts don't.

What Is HIRO?

HIRO stands for Hedging Impact Real-Time Options.

It monitors the options market in real time and estimates the hedging impact of every trade — translating millions of individual options contracts into a single, readable indicator.

When a large options position is opened or closed, market makers must delta-hedge to stay flat. That hedging creates real buying or selling pressure in the underlying. HIRO measures that pressure as it builds.

The result: you see momentum before it shows up on a price chart.

Three Use Cases

1) Confirm Momentum Before You Chase — Check HIRO rising alongside price before entering a breakout. Flat or falling HIRO = move lacks dealer conviction.

2) Spot Reversals Before They Happen — Divergence between rising price and falling HIRO signals exhausting dealer pressure. Exit before price gives it back.

3) Time Entries with Precision — Watch HIRO for the turn on a dip. Negative HIRO rolling over = dealers finished selling, real bid forming.

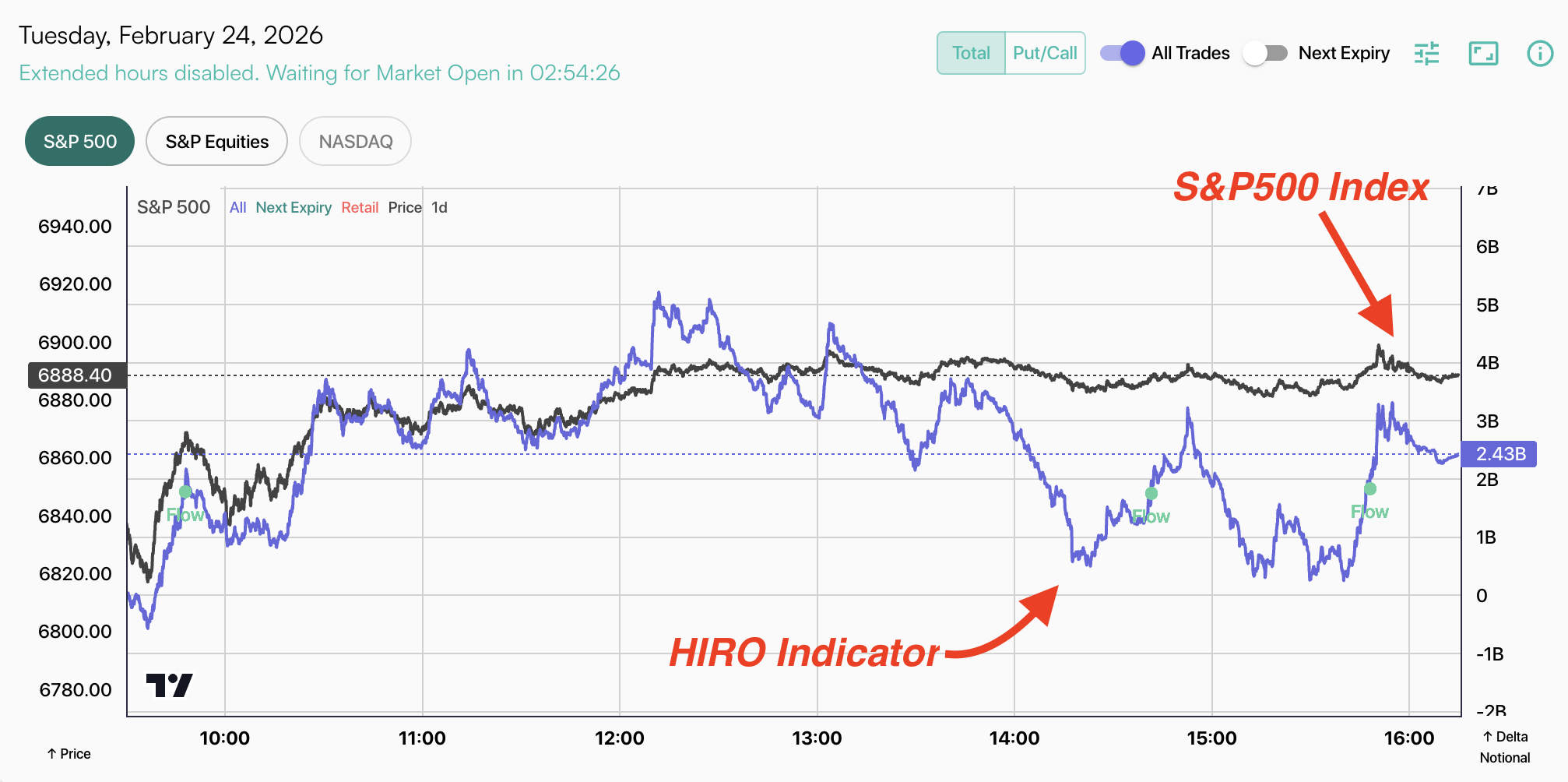

Below is the price action for 2/24/25 - the day this article was written.

As you can see, the HIRO Options Indicator surged higher (purple line), along with the S&P500 index (black line). HIRO signaled that over $5 BILLION in order flow (right Y axis) helped to push the S&P to the 6,900 level. At 12:30 EST, the HIRO indictor turned south, which coincided with the S&P500 stalling out. In effect - options flow killed the rally.

Tickers Available in HIRO

Indices & ETFs

Individual Stocks

Data updates in real time throughout the trading day.

Get HIRO with SpotGamma Alpha

HIRO is included in SpotGamma Alpha — our full-access tier.

HIRO — Common Questions

Q: What does HIRO stand for?

HIRO stands for Hedging Impact Real-Time Options. It's SpotGamma's real-time indicator that measures the estimated delta-hedging impact of live options activity on the underlying asset's price.

Q: How is HIRO different from options flow tools?

Options flow tools show you what trades are being placed. HIRO takes the next step — it estimates the hedging impact of those trades and displays it as a directional indicator. It's not "what was bought/sold," it's "what will market makers be forced to do because of it."

Q: Does HIRO work for individual stocks or just SPY?

Both. HIRO covers major indices (SPX, SPY, QQQ, IWM) and the most actively traded individual stocks including AAPL, NVDA, TSLA, AMZN, META, and others.

Q: What subscription includes HIRO?

HIRO is included in SpotGamma Alpha. It's also available as a standalone add-on for Bookmap users at $49/month.

Q: Is HIRO a leading or lagging indicator?

Leading. HIRO reflects options hedging activity as it happens — often before the resulting price move fully plays out. This makes it most useful for timing entries and confirming whether a move has dealer conviction behind it.

Q: How often does HIRO update?

HIRO updates in real time throughout the trading day as options trades are processed and their hedging impact is calculated.

Q: Can I use HIRO in my existing trading platform?

HIRO is available on the SpotGamma web platform and as a native Bookmap indicator plugin. API access is available for Alpha subscribers.

For a HIRO Deep Dive, check out our video tutorial here.

AS SEEN IN:

HIRO Indicator Case Studies

Index Trading Example - SPY

January 24th, 2022

On January 24th, the stock market was down sharply, with the S&P500 (SPY ETF) being down nearly 4% near mid-session (black line, below). It was at that time that the HIRO Indicator started to register large levels of put selling (blue line, below) in the SPY ETF.

Initially this started as one large trade, taking place near 12:30 ET, with a cumulative wave of smaller put sales continuing unabated into the afternoon.

It is just after these put sales begin at 12:30 ET that the SPY ETF makes its intraday low, and subsequently rallies nearly 4% into the close.

We believe that these put sales allow options dealers to close short hedges, which results in buying pressure in markets. The more put sales there are, the more hedges (ie. stock) that dealers must buy.

SpotGamma documented this session just after the close on 1/24, viewable here.

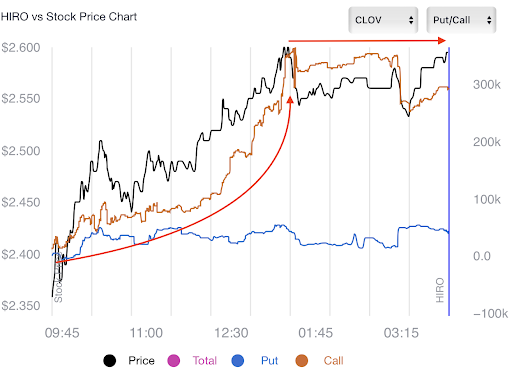

Stock Trading Example - CLOV

January 31st, 2022

CLOV, a speculative “meme stock” was up over 11% on the day, boosted by strong call options buying (orange line).

Note that the stock had a straight path higher, until the call options volume stopped - it was a this point that the stock stopped shifting higher, too.

Track large options trades, anticipate hedging pressures and gauge sentiment

Cumulative Indicator

By calculating the estimated deltas required to hedge trades, you can measure the hedge impact of all options trades taking place in real time

Strength of Signal

Watch the real-time HIRO signal plotted on a 5-day & 30-day gauge detailing the upper and lower bounds of the HIRO signal for any given stock

Powerful Filters

Change what you see about the stock: All Trades, Next Expiry, Retail, Total View of Delta hedging pressure or broken out by Calls and Puts, separately

Trending

See stocks identified by SpotGamma's proprietary algorithm currently experiencing massive activity relative to a stock's immediate movement

"Today, I did my first trade solely based on HIRO. I executed via some short-dated puts that multiplied in value. I’ve been singing your praises for a while, but this takes it to a whole new level."

- Alan I., SpotGamma Alpha Subscriber

Subscribe Now!

Access to HIRO is exclusively reserved for SpotGamma Alpha subscribers

SpotGamma Alpha provides subscribers with exclusive access to the all new HIRO interface, with monthly and annual subscriptions are available. PLUS! You'll receive our AM and PM Founder’s Notes and get access to Equity Hub analysis across 3,500+ stocks and indices.

secure order form

Billed Monthly

Billed Annually (Save 25%)

Pay every month.

Pay upfront for the whole year.