Here’s why paying too much for a call option can actually go against a stock squeeze

It was just a few months ago that the effects of “Gamma Squeezes” became main stream knowledge. YouTube streamers and Reddit message boards now espouse the impact of call options in the markets, pushing their tribes to “buy stock, buy calls” to inflict a “squeeze”.

What we rarely, if ever, hear is these groups discussing that paying too much for a call option can actually go against the stock squeeze. This is because when traders pay an extremely high price for calls it could actually be reducing market makers hedge demand.

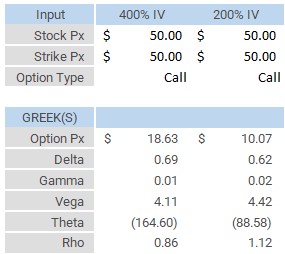

Take this very simple example. AMC stock is currently trading at $50 per share. Using a basic options calculator, we looked at the value of the June 18th $50 call with two different levels of implied volatility.

The first column below, 400%, is the current level of implied volatility(IV) for the June 18th $50 call as quoted by Interactive Brokers. This is an ultra-high IV that comes with the rampant FOMO call buying that we’ve been seeing in AMC. The second column reduces that implied volatility in half to 200%. We’d note that 200% is still an extremely high level of implied volatility (just for comparison we’d note that the equivalent AAPL call option has an IV of 30%).

As you can see above, when implied volatility is at 400%, the cost of that option (“Option Px”) is nearly double that of 200% IV ($18.63 vs $10.07). This means that market makers collect twice the premium, and have a whole lot more time decay (theta) on their side. Though collecting more premium they may be able to reduce their hedging requirements, which could in turn reduce the gamma squeeze.

Second, check out the delta requirement. With IV at 400%, market makers may have to sell 69 shares of stock to hedge on the initial options trade. Yet with IV at 200%, they need to buy 10% fewer shares, or 62. You’re probably thinking that means less impact to the stocks price – and initially that is correct.

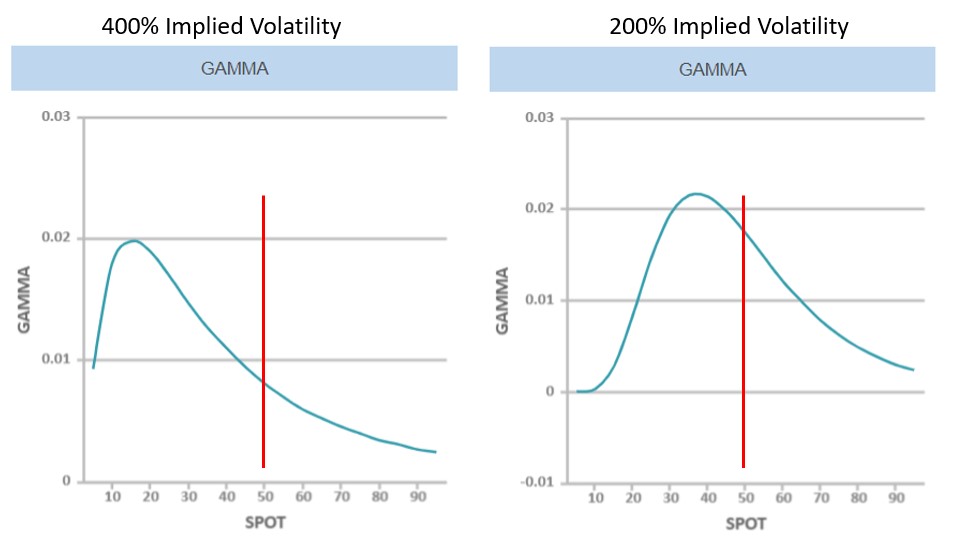

However, look at the gamma of these trades. The gamma of the 200% IV call is double that of the 400% call. Yes, that is only one share but as you can see below that higher level of gamma is sustained at higher strike prices. In other words, there is more gamma squeeze fuel when implied volatility is lower.

How Put Selling Can Fuel A Gamma Squeeze

Now that we’ve outlined why paying too much for call options can actually cap a gamma squeeze, lets turn to a theory which may help fuel the squeeze when options get really expensive.

Put options are most often associated with providing protection to your portfolio when the market crashes. When you buy a put, you have a negative delta exposure – that is you profit when the market declines, but can lose if the market goes higher. However, if you sell a put option you are flipping that profit and loss dynamic. That means you make money when the market goes up, but can lose if the market declines.

From a market makers perspective, when you sell a put, they are the buyer. To hedge out that long put, they would buy stock. If the stock starts to decline, their put options would gain in value but they would need to buy more stock as a hedge. In theory if a stock was dropping and the retail masses all started to sell puts, they could push market makers to start buying large blocks of shares. This could stabilize a dropping stock.

The Implied Volatility Kicker

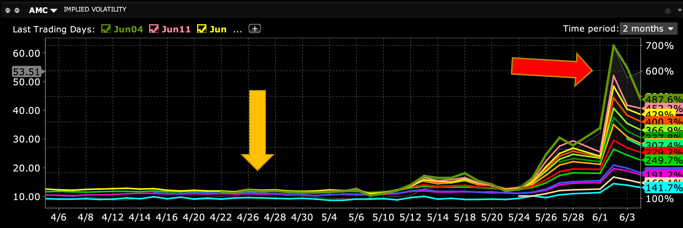

But wait, there’s more! Earlier we discussed how high AMC’s implied volatility was. Below we’ve shared the historical AMC implied volatility readings from Interactive Brokers. As you can see current IV levels (red arrow) are a massively higher than just a few weeks ago. If you think of IV as the price of an option, then this chart is telling you that options cost much more now than back in April.

Generally high levels of implied volatility are associated with stocks crashing. This is why the VIX index typically spikes as the market tanks. What’s interesting about these meme-stock rallies is that the implied volatility spikes as the stock goes higher. These stocks are essentially crashing up!

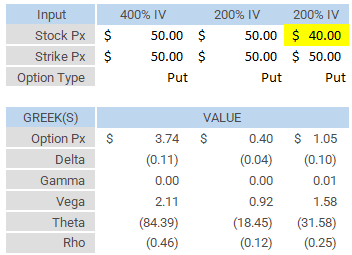

This means that if the stock goes down then implied volatility could also go down. To test this we’ve mapped out what happens to put prices in the table below. As you can see, when the IV drops (all else equal) from 400%->200% that put option loses most of its value, going from $3.74 to $0.40!

We noted above that in situations like we currently have with AMC, its likely that implied volatility drops when the stock prices goes down. Note the 3rd column, in which we keep IV at 200% but also shifted the stock from from $50->$40. Despite the the stock being lower, the price of that put (“Option Px”) still dropped from $3.74 to $1.05!

Therefore when you sell a put (or put spread), not only could you in theory profiting when the stock declines, but you are also incentivizing market makers to purchase stock as it declines.

Want more insights like this and access to all SpotGamma levels and tools?

Sign up today and join the thousands of other traders in our community.

Disclaimer

Nothing we’ve written here should be considered investment advice. Do NOT trade off of the content in this post.