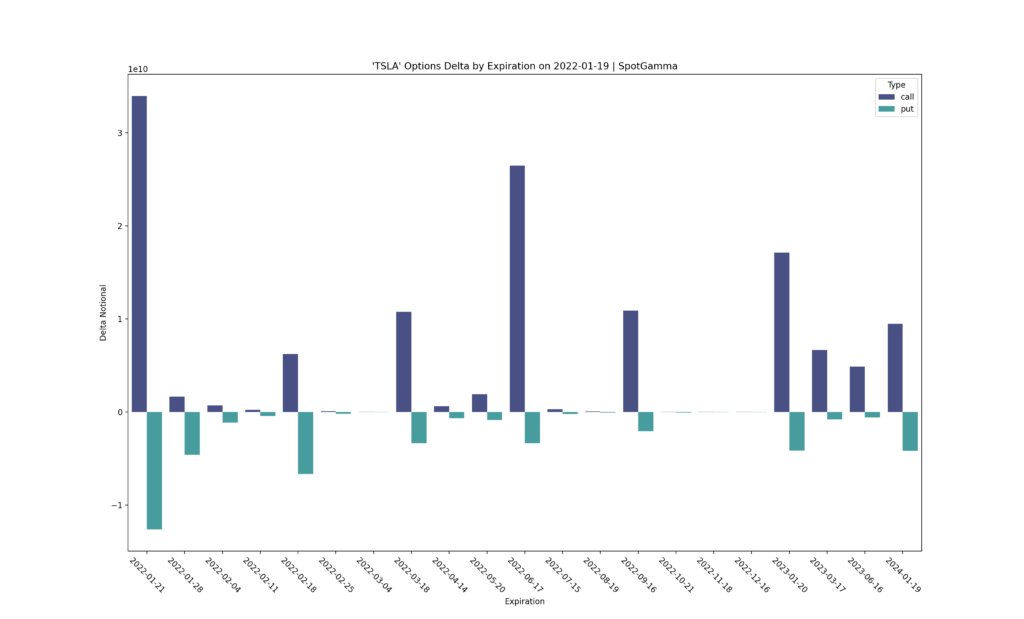

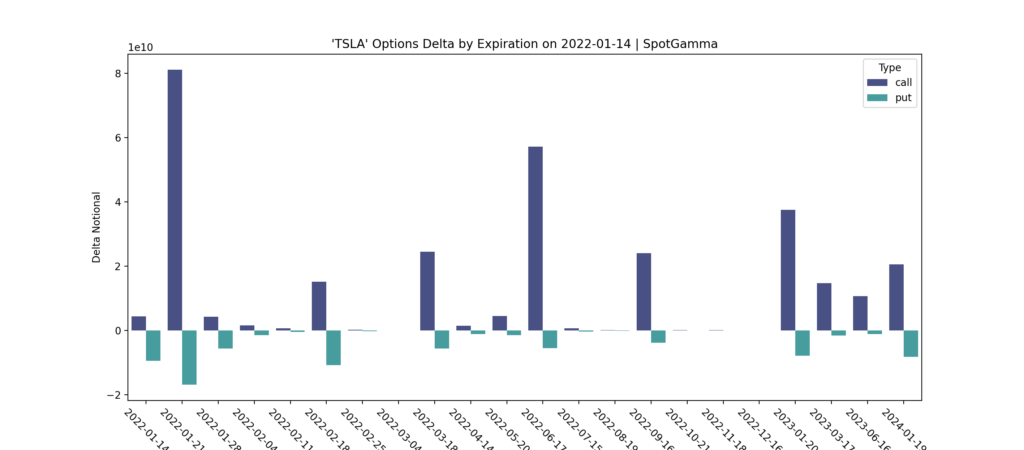

SpotGamma has detected a large amount of call options expiring this Friday in many single stocks (see here). The stock with the largest size (on a delta basis) expiring is TSLA. As such, we’ve setup this page to track the daily change in TSLA’s delta position, to monitor what any options impact may be.

In these calculations we are assuming all calls are long delta, and all puts are short. The reality is that there are many calls which are held both long & short, so the true delta figure is some degree less than shown.

POST OPEX Update: TSLA saw its price crater on Monday as the last of any OPEX delta hedges were removed. We also suspect that a fair amount of assigned call positions were removed, too. Details below.

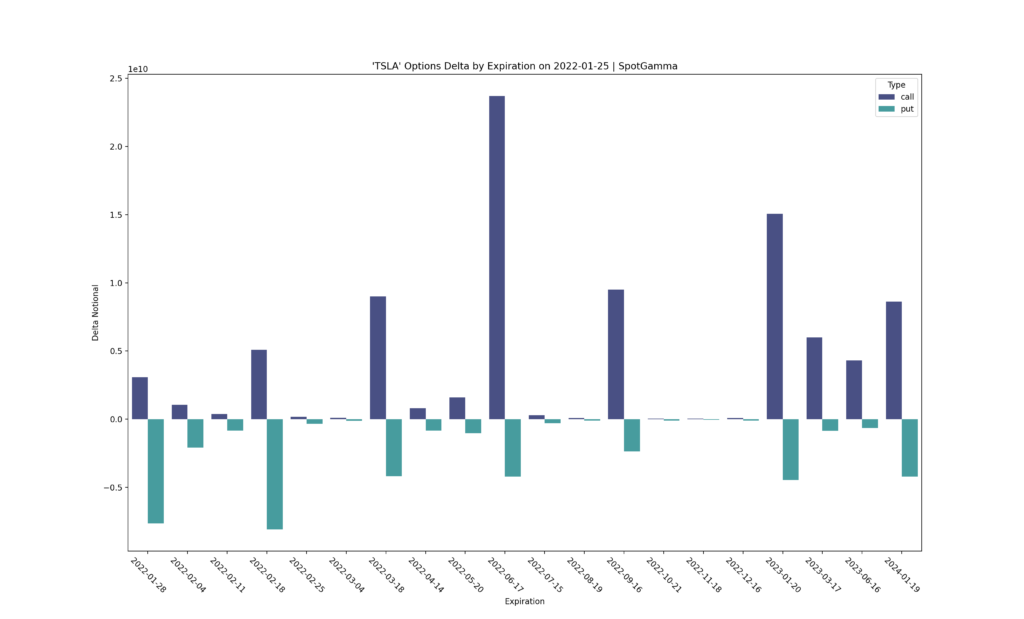

Close 1/25/22:

TSLA’s options deltas are now quite flat, after Fridays options expiration was fully cleared. We estimate that there were > $15 billion in long deltas that settled on Friday. Coincidentally Monday saw TSLA’s stock push down nearly 8.5%, substantially lower than the SPX & QQQ (down 4% on lows).

Close 1/21/22:

There were no major call sales today, on net, for TSLA. This implies that there are large call deltas that will be settled on expiration. TSLA shares were down sharply -5.26%, to $943. With this large delta position rolling off, shares lost roughly 8% this week.

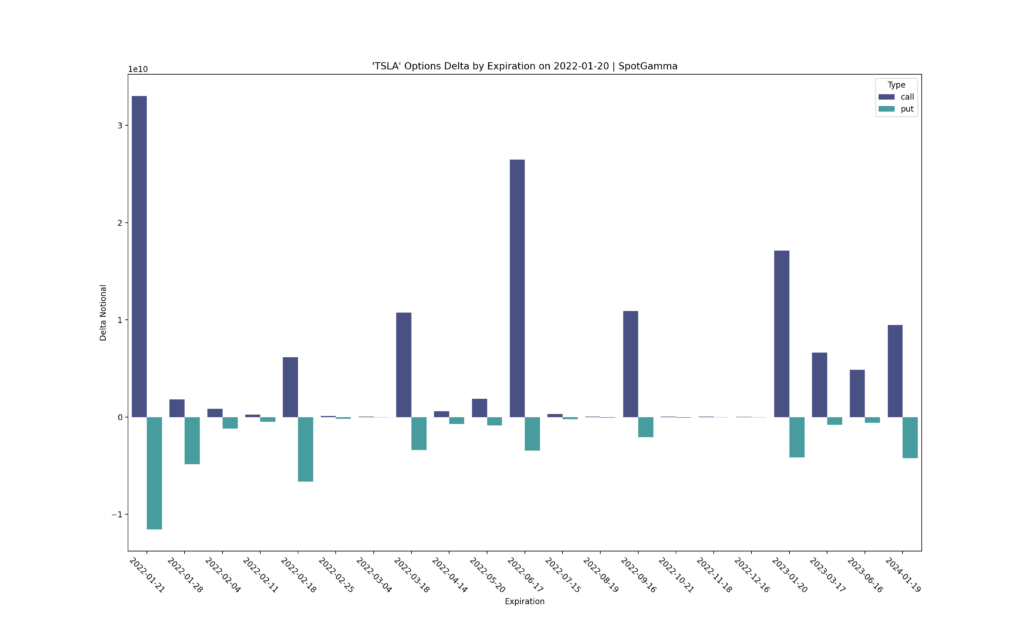

Close 1/20/22:

Friday 1/21 Delta Update: $21bn in net positive deltas remain, which is fairly flat to yesterdays readings. We anticipate high volatility in TSLA today.

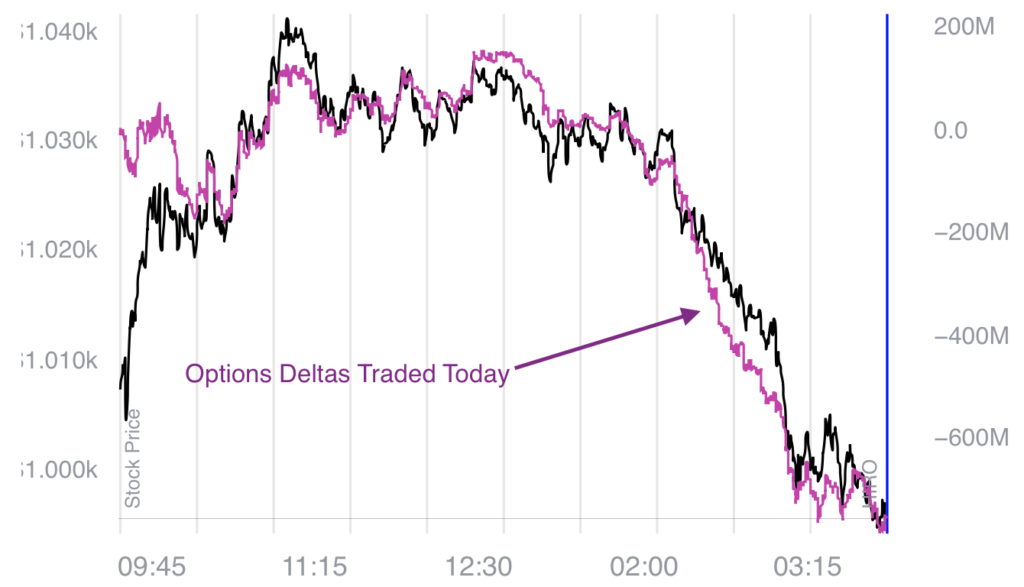

TSLA declined 1.19%, with deltas turning sharply negative into the close. We saw roughly -$600mm in negative deltas trading today, and therefore anticipate a decent drop in TSLA’s 1/21 OPEX positions for tomorrow.

Close Date 1/19/22:

1/20 AM Update:

We saw a continued decline in TSLA deltas, as anticipated. This is a function of boths calls being closed, and the reduction in TSLA’s stock price (lower stock prices reduces the values of call options). We measure max net delta to be now $21bn.

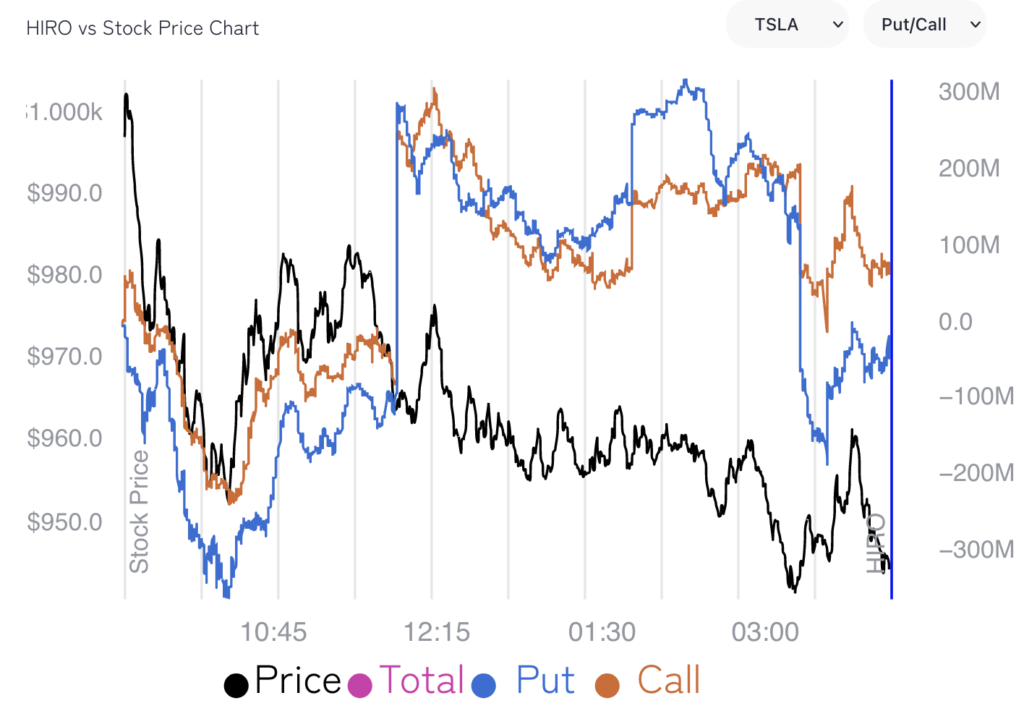

1/19 trading session notes:

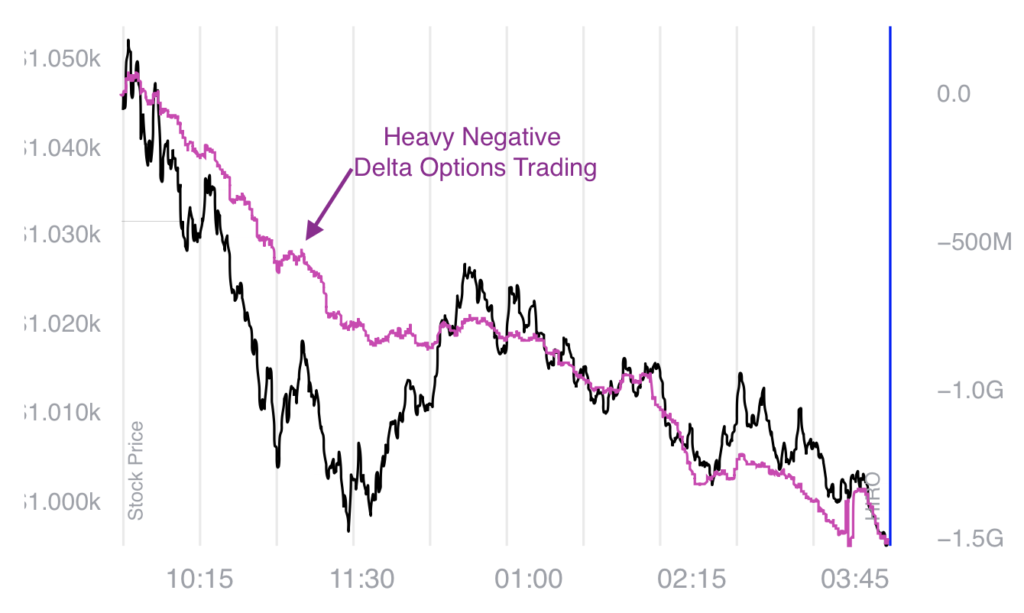

TSLA was down -3% on the session, closing at $995. Today we saw very large negative deltas in our HIRO system. We measured heavy call selling throughout the session, with put buying adding to the stocks pressure after 2pm ET. Looking at just the 1/21 expiration and strikes <900, over 4,000 calls traded. The implication here is that these deep in the money calls are indeed starting to close.

The total call interest (all strikes) for 1/21 expiration to start the day was 786k, we will update the day tomorrow AM.

Close Date: 1/18/22

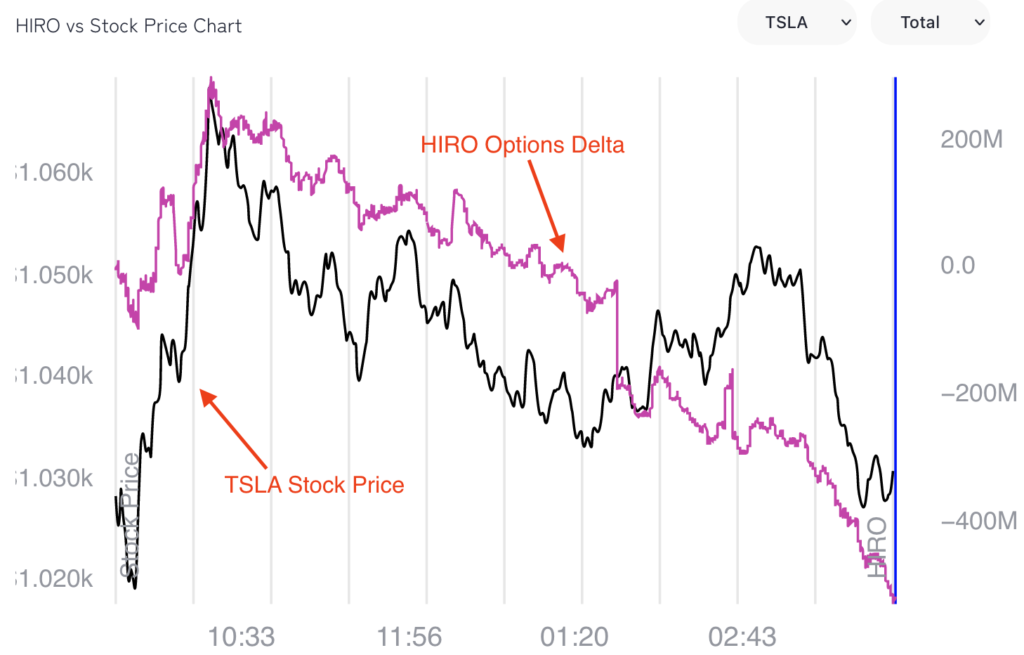

Our intraday HIRO system showed strong negative delta trading today in TSLA, mainly from selling call options. This as the stock closed -1.8%.

The open interest readings will be updated in the AM.

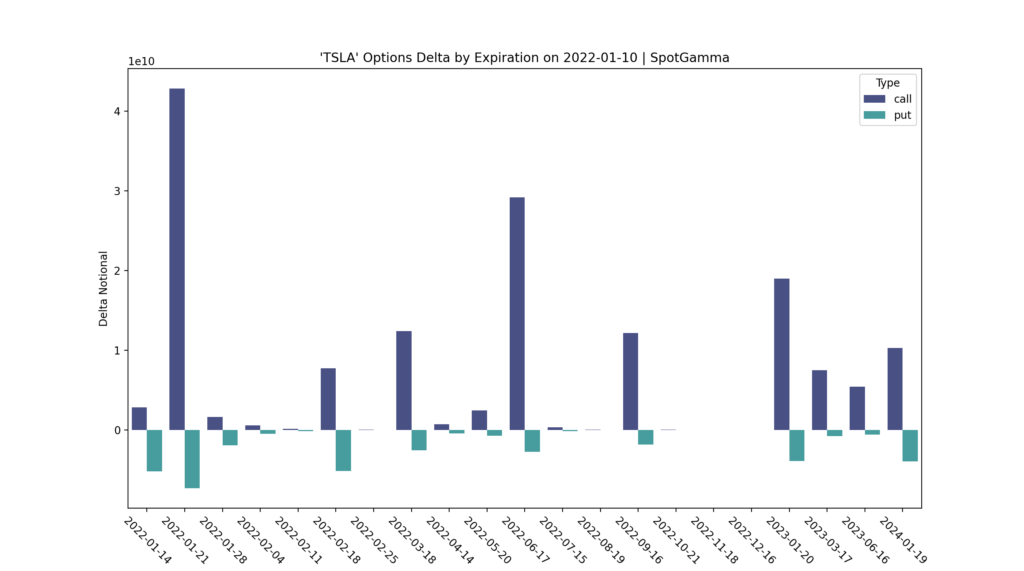

Close Date: 1/10/2022, net estimate $64 billion.

Close Date: 1/10/2022, net estimate $35 billion.