Here is a note we from JPM Equity Derivatives Strategy about SPX Gamma for August:

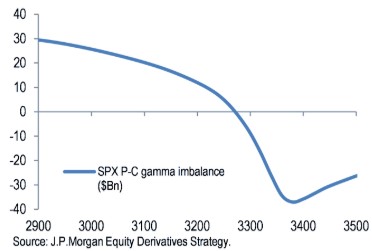

Thought I would pass along: Our Gamma Imbalance Monitor shows the largest gamma imbalance to calls we have seen since early Feb20. This points to sizable dealer long gamma positioning. As this imbalance has grown, realized vol has ticked lower alongside it. 20d realied vol is 11v, that is in the 37th percentile over the past two years. 30d vol right around 2y average. Based on our monitor, dealer activity should continue to put pressure on vols. Couple this with a slow summer week with not much on the calendar. We have been active in VIX downside here.

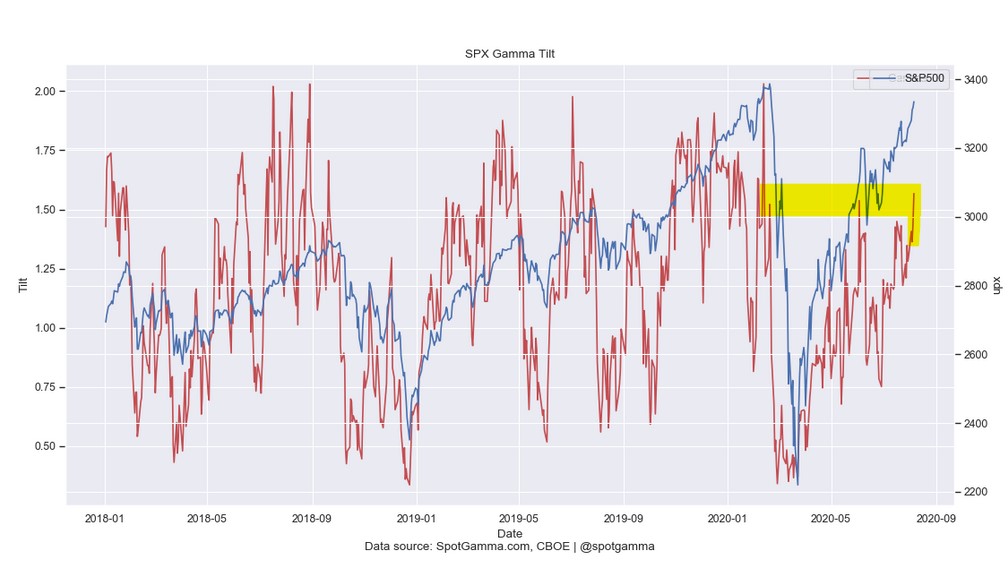

When JPM refers to “Gamma Imbalance” they may be referring to the ratio of Call Gamma to Put Gamma. You can see here in our Tilt indicator that there was a spike this past week in the CALL:PUT gamma ratio. You can see its near levels last seen in Feb ’20. Note this is a RATIO and not a net number, because on net call gamma has not been very large. We see options positions in SPX as rather light.