Below we have posted some recent updates regarding the JPMorgan Hedged Equity Fund (JHEQX) roll. Scroll down further to read & watch about the mechanics of the collar trade itself.

UPDATE: 3/30/23

The current JPM position:

- 40,000 contracts, each, of the 3/31 expiration:

- short 4065 call

- long 3630 puts

- short 2860 puts

These positions will expire tomorrow, and roll to a new position for June expiration.

On expiration, the JPM fund will sell a new June expiration call position 3-5% out-of-the-money, and use funds generated from that call sale to purchase a ~5% out-of-the-money put spread.

UPDATE: today (9/30/2021) JPM rolled their collar trade (sell a call to fund a put spread hedge) to:

• Sell 45,000 contracts of the Dec 31st 4505 calls at a delta of 34

• Buy 45,000 of the Dec 31st 4135 puts at a delta of 30

• Sell 45,000 of the Dec 31st 3480 puts at a delta of 7.

The net of this trade is a negative delta of ~57 (34+30-7). You can see the impact of this trade in the image below. The top chart is the ES futures, and the bottom blue line is the rolling sum of deltas traded on the day. As you can see there was a big drop in that metric at 10:26ET, when this trade went up.

What is the J.P. Morgan Collar Trade?

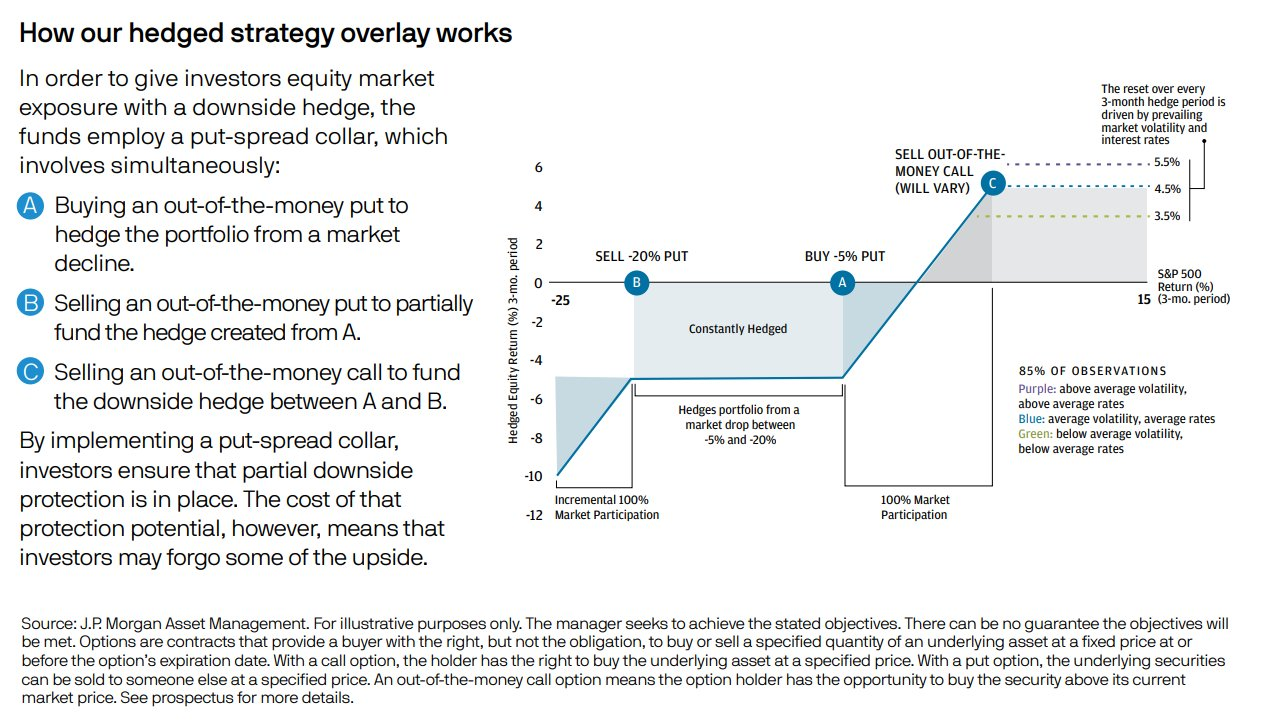

Each quarter the JPMorgan Hedged Equity Fund (JHEQX) add hedge protection to their long equity portfolio in the form of an options collar trade. The fund sells a 3-5% out of the money call, and uses those proceeds to buy a 3-5% out of the money put spread.

This typically results in contracts sizes north of 40,000 per leg, with several billion dollars of notional value. Further, it can result in some unusual market impact on the day of the trade – which is the last trading day of each quarter.

Here is an infographic that the JHEQX fund provides potential investors. It lays out how the collar strategy can hedge the funds equity exposure.

In the video below, SpotGamma covers this trade in detail:

The J.P. Morgan (JPM) Options Collar Trade Explained

*And three months later, in December 2021, here’s exactly what went down: