SpotGamma was quoted in an Reuter’s article today concerning the 3/31 JPM Collar Strategy. The way the trade is structured means when the market starts to fall, options dealers – typically big financial institutions who facilitate trading but seek to remain market neutral – would have been forced to sell an increasing number of stock […]

JPM

JP Morgan Collar Trade

Below we have posted some recent updates regarding the JPMorgan Hedged Equity Fund (JHEQX) roll. Scroll down further to read & watch about the mechanics of the collar trade itself. UPDATE: 3/30/23 The current JPM position: These positions will expire tomorrow, and roll to a new position for June expiration. On expiration, the JPM fund […]

JPMorgan: Clients Are “Increasingly Nervous”, Fear “A Market Pullback In May Or June”

BY TYLER DURDEN SUNDAY, APR 18, 2021 – 08:49 PM Much to the delight of bulls everywhere, the past month has been a relentless meltup in stocks, commodities, cryptos, and – paradoxically over the past week when we have been bombarded with stellar economic data – Treasurys as well. After dumping at the end of […]

JPM Options Update

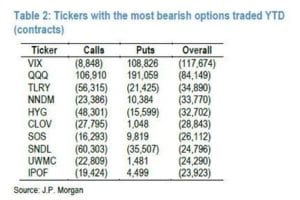

From ZH Last August, just before we learned that SoftBank was forcing a marketwide gamma squeeze in tech names, a little-followed quant at JPMorgan, Peng Cheng, came out with what may have been the most prophetic at the time market analysis, when he – unlike his “strategist” peers at major banks were trivially hiking their S&P year-end […]

Nasdaq Explodes Higher Amid Unprecedented Gamma/Futures Double-Squeeze

From ZeroHedge Heading into the weekend, we observed that despite the recent drift higher in the Nasdaq last week after its September correction, institutional investors remained skeptical with a near-record number of non-commercial spec shorts in the Nasdaq 100 mini according to the latest CFTC Commitment of Traders report, and after spiking to a historic […]

JPM Gamma Update

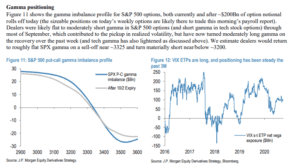

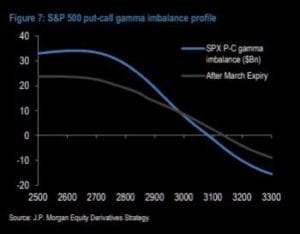

We present updated gamma figures from JPM this morning. It syncs with our AM note that 3300 is the key level.

The Case for Reduced Price Volatility

Our current view of markets is that we should see reduced price volatility following the large March expiration that took place this past Friday (3/20). One of the features of this expiration was a large number of in the money puts, which possibly created several billion in deltas for options dealers to hedge. As dealers […]

The Large 3/20 Options Expiration

Options expiration for this Friday 3/20 is getting a lot of attention because it is so large. It may also hold the key to a major change in our “negative gamma” situation. As you can see markets remain in negative gamma territory unless we move up towards 3100-3150 in the SPX. The other way we […]

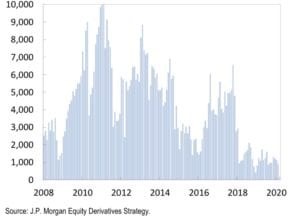

JPM Liquidity Rates & VIX Correlation

JPM says that liquidity disappears as VIX spikes. This seems to make intuitive sense. The fact that the VIX is higher means the market is pricing in larger moves which means dealers don’t want to get stuffed with large trades as the market rips through them. This chart doesn’t tell us what level this depth […]