Last August, just before we learned that SoftBank was forcing a marketwide gamma squeeze in tech names, a little-followed quant at JPMorgan, Peng Cheng, came out with what may have been the most prophetic at the time market analysis, when he – unlike his “strategist” peers at major banks were trivially hiking their S&P year-end price target to keep in lockstep with the market – urged clients to take cover as he voiced concern about the near-term future of technology stocks. He was dead on, because what followed just a few days later – in no small part as dealers tried to savage SoftBank’s gamma exposure (which had been mostly closed by then) – was the fastest 10% correction in the Nasdaq from an all time high in history.

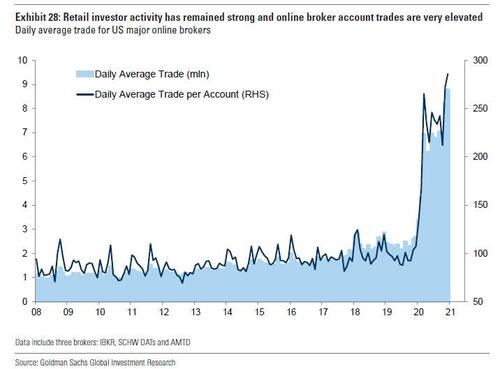

Fast forward to today when Peng looks at arguably the most remarkable phenomenon in today’s market, namely the unprecedented – “breathtaking” as Goldman puts it – explosion in retail trading activity…

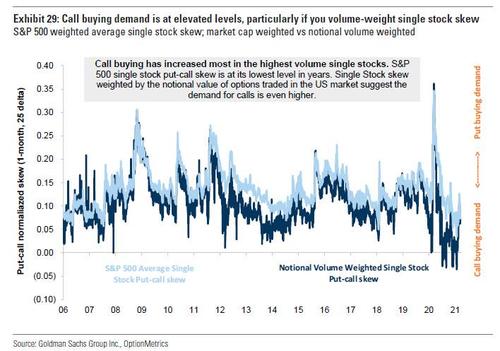

… with daytraders buying not only single-name stocks but aggressively loading up on levered bullish bets in the form of calls, resulting in “elevated” call volume with Goldman noting that “S&P 500 single stock put-call skew is at its lowest level in years” and adding that “single Stock skew weighted by the notional value of options traded in the US market suggest the demand for calls is even higher.”

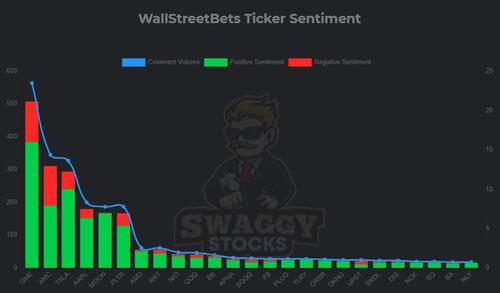

However, thanks to Peng’s work, it now appears that the narrative of retail buying which for the past year had been seen as one of blind purchases of risk assets coupled with layered call buying for outside returns (which in turns led to an aggressive gamma feedback loop) driven by the WallStreetBets reddit message boards…

… will need to be reworked substantially because retail investors are rapidly learning and adapting to how to trade the market.

First, here is a breakdown of a recent extensive analysis of retail trading which the JPM quant put together…

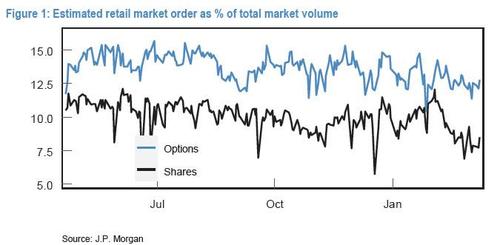

We are able to identify retail market orders in the US equity options market as seen in Figure 1, expressed as a % of total options maket volume. Our estimates on options are also compared against those on US cash equities. Retail activity appears to be substantially higher in the options market than in the cash equity market.

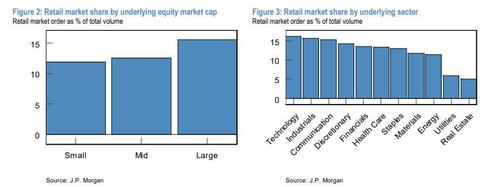

… and in which he found that retail does not appear to be overly active in small-cap stocks; in fact, the opposite appears to be true (Figure 2). In terms of sector preferences, most of the sectors are similar in retail exposure, with the exception of Utilities and Real Estate. In those two sectors, the retail participation is much lower than average.

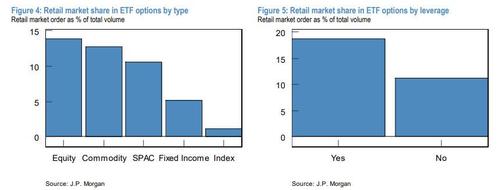

In addition to single name stocks, ETF options are also popular with retail investors. Equity ETFs, including SPY, VXX, and QQQ, have the highest retail participation (Figure 4). This contrasts with index options, which include SPX, VIX, and NDX. To illustrate, JPM finds retail orders make up about 0.2% of the SPX volume but 16% of the SPY volume. Fixed income and currency assets are the least popular ETFs among retail investors. Retail investors also have a preference for leverage on leverage: JPM finds that options on leveraged ETFs are much more likely to be traded by retail investors than non-leveraged ETFs (Figure 5).

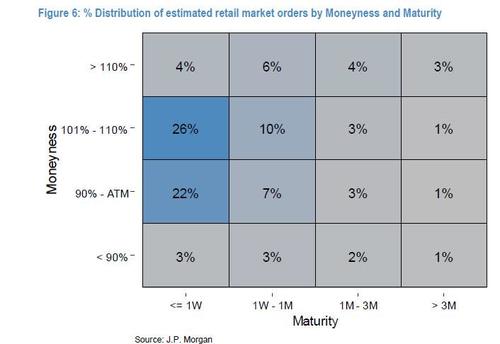

None of this is news. It is also not news that retail investors broadly prefer trading calls to puts (see the Goldman chart above). In JPM’s sample, activity in calls outweighs activity in puts by approximately 1.9:1, while on all trades other than retail market orders, the call/put ratio stands at 1.5:1. Retail investors also prefer to trade short-dated options, as Figure 6 shows that over 55% of all retail market orders are on maturities less than one week. At very short maturities, near the money options are the most actively traded. However, as maturity increases, the preference gradually shifts to more out of the money strikes.

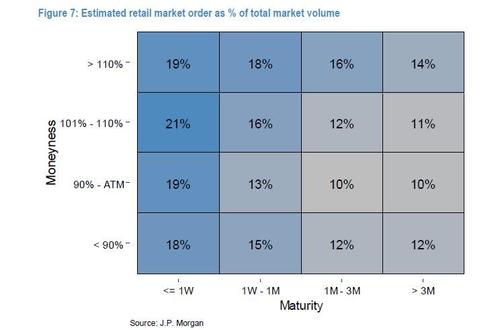

The report also finds that although shorter-dated options activity dominates the options market in general, the concentration of retail traders is still evident after controlling for overall market activity. Figure 7 shows the retail market orders as a % of total market volume. The pattern remains the same: retail investors are major liquidity takers at the very short tenor.

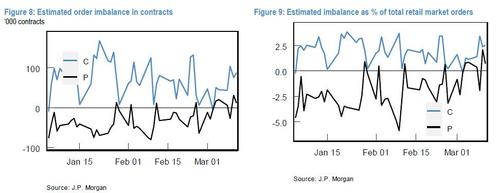

Again, none of this is strictly unexpected or news, and complies with widely accepted narrative on daytrader activity. Where a surprise did emerge, is when JPM looked into the directionality of retail the trades. Here, JPM finds that overall, “retail investors are net buyers of calls and sellers of puts (Figure 8). The net supply/demand imbalance only amounts to approximately 2-3% of the total retail market orders (Figure 9).”

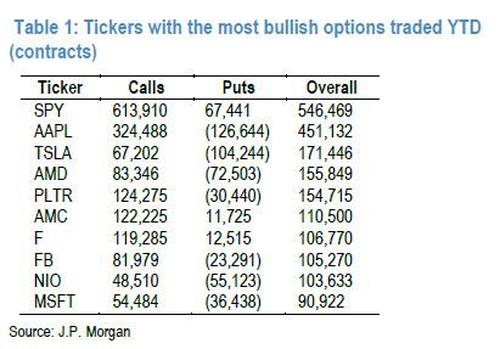

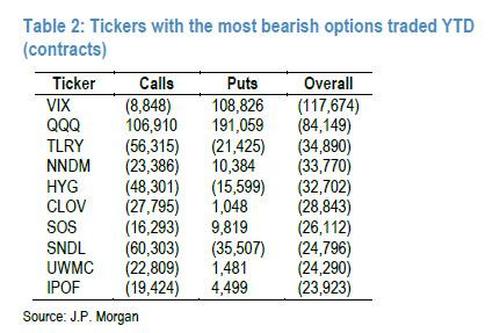

And while there is little surprise in the list of most bullish option flows (Table 1) as all of the names are also favorites based on our analysis of retail flow in cash equities, and it is clear that investors are using options to express positive directional views…

… where there was a notable surprise, was in the list of the names with the most bearish options flow (Table 2).

What this shows is that retail investors are heavy buyers of VIX puts, likely with the intention of earning the roll down of the VIX term structure. Also quite remarkably, the number of call-buying trades on QQQ is quite significant but is outweighed by put-buying trades. This is in stark contrast to the order flow in the underlying equity market, where retail traders have been net buyers of QQQ and related ETFs. This suggests to JPMorgan that retail investors are now buying Nasdaq/QQQ puts as likely hedges for the long cash equity positions!

On the other hand, and perhaps in response to the end of the Fed’s explicit end of backstopping IG/HY bonds, retail traders have shown a strong inclination to sell calls on HYG. Combined with JPM’s observation that HYG has seen net retail inflow YTD, it appears that buy-write on HYG could be a popular strategy with retail investors.

Finally, JPM’s Peng notes that the average implied volatility of the single names in Table 2 is also much higher than those in Table 1, which suggests that retail investors are generally buyers of calls on low-volatility names and sellers of calls on high-volatility names.

What are the implications?

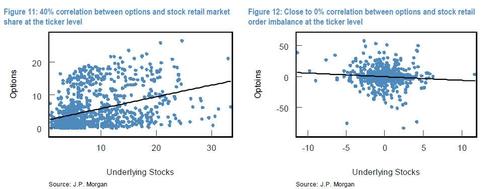

From the anecdotal observations above, JPM sees some interesting interactions between retail flow on the options and on the underlying equities. When systematically looking at the level of retail participation, retail market share to be around 40% correlated between the option and underlying equity market, based on JPM estimates.

But when the trade directions are taken into consideration, the relationship becomes weakly negative.

To JPMorgan, this could be due to the offsetting actions of two groups of investors: some investors use options as overlay on their long stock positions (e.g., covered call selling, protective put buying, etc.), whereas other investors use options as stock substitues (buy calls instead going long shares, buy puts instead of going short shares). The flows from the two groups offset each other and result in a net neutral relationship with underlying equities.

The bottom line is that retail investors, having suffered several bruising falls in their favorite basket of names, are learning how to trade like Wall Street’s top pros and hedging their profits by doing precisely what “hedge” funds do – not only going short the offsetting index pair trade, in the case of tech names that would be the QQQs, but doing so with substantial leverage.

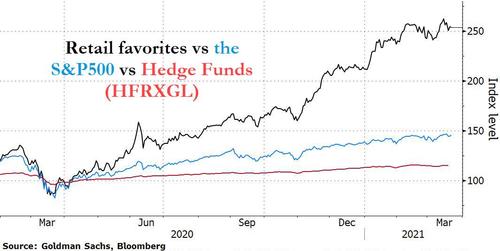

And with retail traders massively outperforming both the S&P500 and HFR’s broadest hedge funds index…

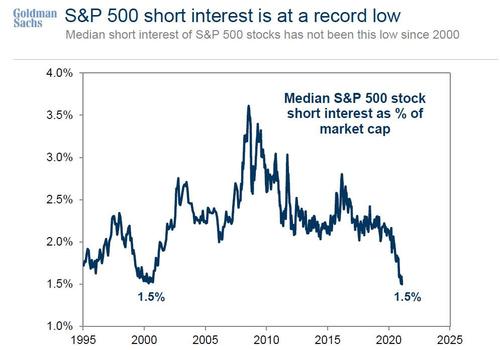

… how long before investors start shunning the old “smart money” which has clearly been quite dumb in recent years, and shift their attention to the new hedgies? Because if retail investors are indeed starting to hedge out their winners even as hedge funds go all-in on their long books while unwinding their shorts…

… there seems to be a silent revolution taking place below the surface of the market, one where retail investors – formerly the dumbest money around – are set to not only trounce hedge funds but to also lock in gains in case of a major market swoon (i.e. “hedge”). How long, we wonder, before LPs – disgusted by years of underperformance – pull their money from the Bridgewaters of the world (whose risk parity fund has been a total disaster in recent years) and start allocating money to traders with names like “Roaring Kitty”?