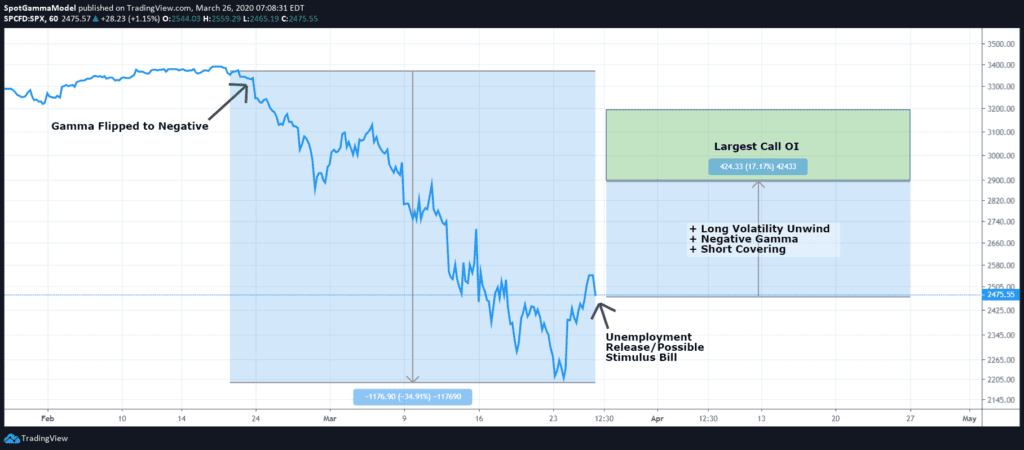

This is being written just before the 3/26 unemployment data release which is forecasting as much as 2 million unemployment due to the economic shutdown related to Coronavirus. There is also a Stimulus Bill “pending“. While we are all aware of the downside risks here, here is a scenario for a major move to the upside which may occur on any type of positive news. This is not a prediction for higher markets, just a view on upside risk.

As seen in the chart below the market was down almost 35% from peak to trough. We currently have large negative gamma due to the amount of put positions relative to smaller call positions. VIX is still in the 60’s after having peaked above 80. Given some fundamentally positive move markets could make a substantial move higher due to:

- Long Volatility unwind – many are long vol via SPX puts, VIX or other vol instruments

- Short Covering – large short interest could be bought back

- Large Negative Gamma could give fuel to market movement

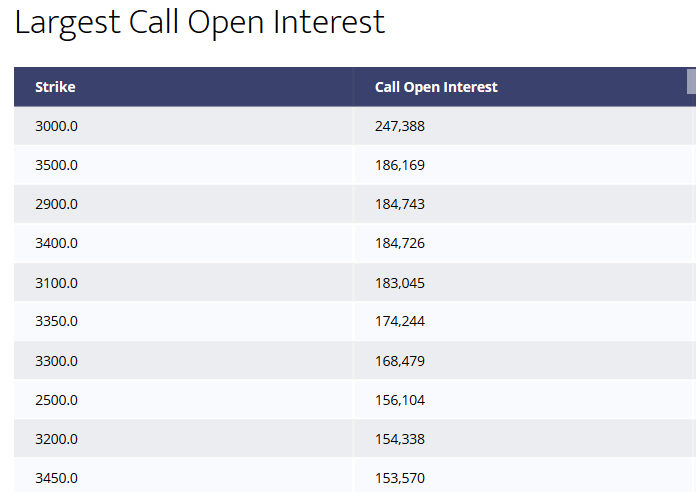

Its possible to see a rally up into the 3000 area due to the large call open interest in that area. As you can see in the chart below the most concentrated call interest is at 2900 and higher. In theory this is where positive gamma would kick in and dealers would start to sell into market rallies (and buy dips), helping to reduce volatility.