0DTE is not Volmageddon

0DTE is likely not Volmageddon per BOFA, and for that to happen you would need a major 0DTE flow imbalance. This is exactly what SpotGamma laid out to members on our Feb 2nd Q&A, here.

Wednesday, Feb 22, 2023 – 05:25 PM

One week ago, JPMorgan’s Marko Kolanovic, who had urged clients to sell every rally since the September lows (after previously telling them to buy every dip ever since the all time high), lashed out at the very structure of the market in hopes of sparking more risky sentiment and spooking the marginal buyer, when instead of relying on conventional tropes to convey his bearish message (fundamentals, geopolitical risks, hawkish central banks, i.e., things that have been long ago priced-in), he decided to invoke one of the hot buzzwords of 2023 finance, namely 0DTE (or zero-days to expiration) options, warning that this relatively opaque corner of finance is a potential ticking time bombs embedded within the market’s microstructure, and could be enough to bring about a new Volmageddon-like crash.

Having previously discussed the issue of 0DTE (we profiled 0DTE first in late 2022 in “What’s Behind The Explosion In 0DTE Option Trading“, and more recently here “Why 0DTE Is So Important, And Why The VIX Is Now Meaningless“), we disagreed with Marko’s hyperbolic conclusion, taking a somewhat more sarcastic view of things, namely that “every market period has a distinct bogeyman for when a trade doesn’t go your way: “8 years ago, every most hated rally was “explained” with HFTs; 4 years ago it was gamma. Now it’s 0DTE.”

Alternatively, in some cases strategists are so bearish (and wrong) they will go as far as sparking borderline market panic to be proven right (eventually), and this was one of those cases.

And while Kolanovic’s warning added to a confluence of factors that precipitated the risk-off mood and selling observed in the past week, the question remains: is 0DTE really another potential Volmageddon (i.e., liquidity cascade) catalyst? We presented one answer from our partners at SpotGamma, which we published last Thursday.

Today, a more comprehensive response came from the highly regarded BofA equity derivatives team led by Nitin Saksena and Benjamin Bowler, who say that the reality behind 0DTE is far more nuanced than just “Volmageddon 2.0.”

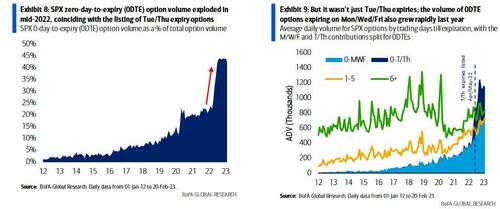

Picking up where we left off in our previous 0DTE posts, the BofA team first observes that “the dominant flow theme recently in US equity derivatives has been the sharp increase in S&P 0-day-to-expiry (0DTE) options, which now account for 40-45% of total SPX options volume compared to 21% on average in 2021…”

… with questions naturally abounding over who’s involved, typical strategies being employed, and potential market impact, “with some raising the alarm that directional end-users are net short out-of-the-money 0DTEs, thus sowing the seeds for a “tail wags the dog” event akin to the Feb-18 “Volmageddon”.”

However, Saksena counters, “a closer study of intraday trade-level data suggests reality is more nuanced” than that laid out by Kolanovic:

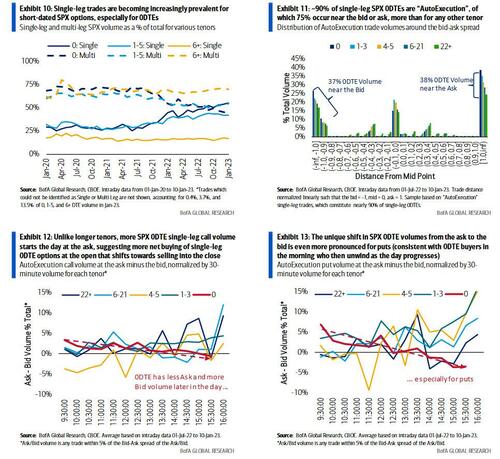

First, half of all SPX 0DTE option trades are “single-leg auto-execution”, a category for which (i) 75% of trades occur near the bid or the ask – more than for any other tenor, and (ii) volume is uniquely skewed towards the ask early in the day but towards the bid later in the day (consistent with 0DTE option buyers in the morning who then unwind as the day progresses) – see Exhibits 12 & 13.

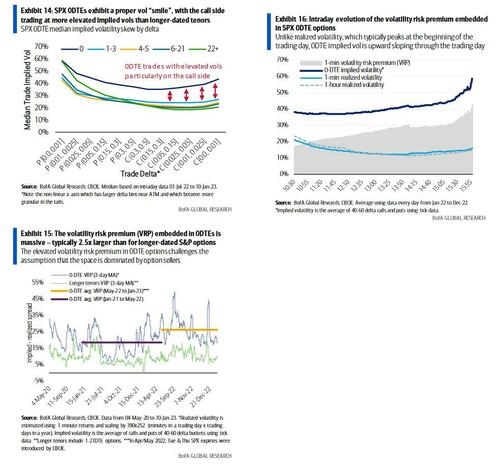

Second, BofA calculates that near-ATM 0DTE implied volatility typically trades at a 10-15 vol point premium to longer-dated tenors and at a massive gap to S&P intraday realized volatility. Indeed, the volatility risk premium (VRP) embedded in 0DTEs is typically 2.5x larger than for longer-dated S&P options, and at levels that are likely inconsistent with a market that has been overrun by option sellers (i.e., contrary to Kolanovic’s assertion that 0DTE is dominated by vol sellers, that is not the case).

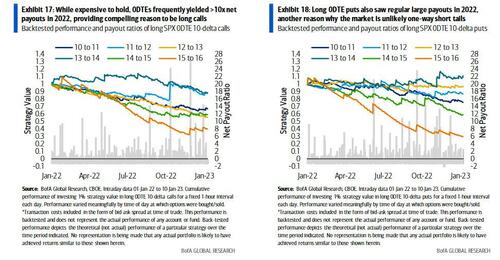

Third, while BofA says that it is aware of services that appear to cater to retail investors and offer automated intraday execution of risk premium harvesting strategies like iron butterflies and iron condors (continuing a longstanding tradition in the US of retail involvement in longer-dated SPX option selling programs for income generation), history also shows the merit of owning 0DTE “lottery tickets” despite paying inflated vols. Indeed, owning SPX 0DTE 10-delta calls or puts during fixed 1-hour intraday intervals in 2022 would have frequently yielded (net) payout ratios exceeding 5x, with upside to 20-25x on occasion. And those are precisely the lottery tickets that retail investors love and buy at pennies on the dollar.

Incidentally, it’s the lottery ticket aspect of 0DTE why, as we first revealed last week, 87% of all same-day options traded one Tuesday of last week finished at zero point zero value.

- 83% of 1 day calls expired at a zero (585k was total volume)

- 91% of 1 day puts expired at a zero (620k was total volume)

BofA concludes by noting that while 0DTE options could – in theory – be “weaponized” in the future to exacerbate intraday fragility and/or mean reversion, “thus far the evidence presented above suggests that SPX 0DTE option positioning is more balanced/complex than a market that is simply one-way short tails.”

Translation: those waiting for 0DTE to spark the next market crash may want to not hold their breath.

More in the full note available to pro subs.