Watch possible “gamma sweating” should this turn lower again

Nomura’s quant explains the move yesterday;

And here is why this this matters: as stated in the note to this point, yesterday was classic butterfly effect knock-on, with a “macro catalyst” from the COVID wave #2 risk-off trade which then triggered “profit-taking-turned-stop-loss selling” from both tactical discretionary traders and the super euphoric / frothy retail set

And yes, as aforementioned systematic “sell” flows kicked-in (pressing shorts or outright “long selling and flipping short,” this then ultimately created the “accelerant” for this very “GAMMA” –centered move as Vol Dealer hedging was heavy into close

But that too is a large part of why we’ve snapped back, especially as I don’t see much of any expected follow-through flows immediately here (although we will AGAIN need to reset these expectations into next week’s SERIAL / QUARTERLY Options Expiry)

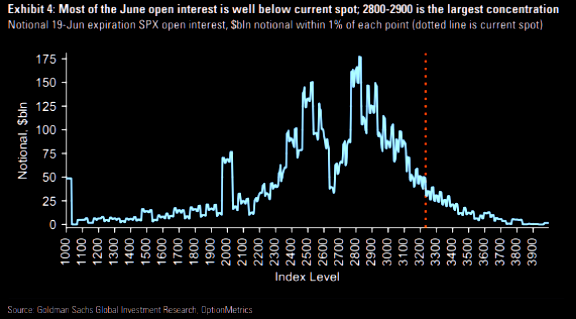

We showed the chart below 2 days ago, showing where the big open interest is for next big expiration.

Note we have obviously moved away from what is spot level on the chart.