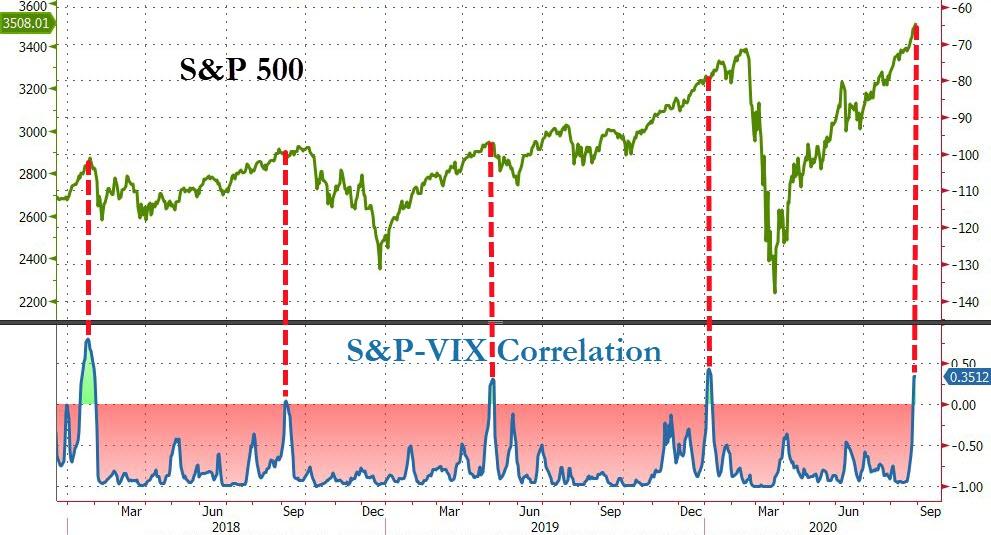

On Saturday, when we published our lengthy compendium of bizarro market charts showing the paradoxical melt up in both risk assets and the VIX, leading to the most positive correlation between the S&P and the VIX since the Feb 2018 Volmageddon event…

… we said that “one reason why no conventional indicator seem to matter is because it now appears that gamma has become a primary driver in the market’s latest meltup.”

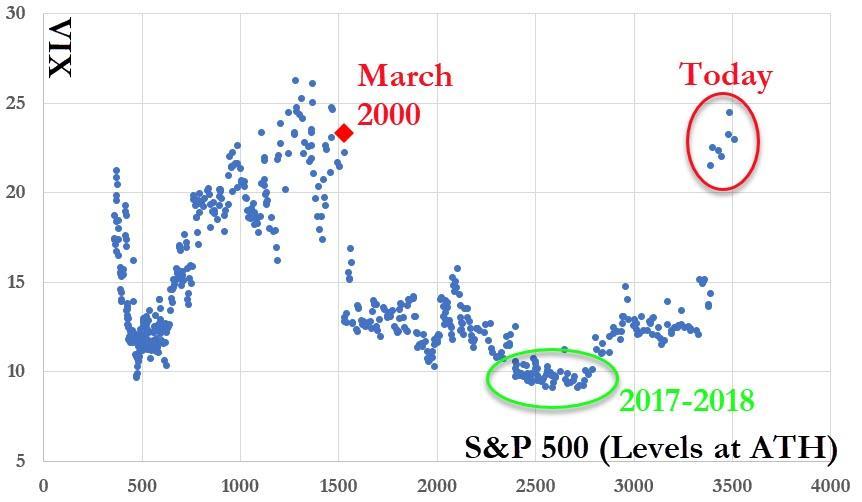

One day later, when we showed that the VIX is now at the highest level at a a new all time high in the S&P since March 2000, i.e., the day the do com bubble burst…

… it was the world’s most important “market maker” (or taker as some may joke), Citadel that laid out its own take on this unprecedented “gamma grab”. For those who missed it, this is what Citadel said:

Over the past few weeks, there has been a massive buyer in the market of Technology upside calls and call spreads across a basket of names including ADBE, AMZN, FB, CRM, MSFT, GOOGL, and NFLX. Over $1 billion of premium was spent and upwards of $20 billion in notional through strike – this is arguably some of the largest single stock-flow we’ve seen in years. “The average daily options contracts traded in NDX stocks to rise from ~4mm/day average in April to ~5.5mm/day average in August (a 38% jump in volume).

Given this group of 7 stocks accounts for a ~40% weighting in the NDX, the outsized volatility buying in the single names is having an impact at the Index level. So why are Vols moving Wednesday and Thursday when this call buying has been taking place for weeks? Yesterday CRM, one of the names we have seen outsized flow, rallied 26% on earnings – a less than ideal outcome for those short volatility from all the call buying.

As the street got trapped being short vol, other names in the basket saw 3-4 standard deviation moves higher as well – on Wednesday FB rallied 8% (a 3 standard deviation move), NFLX rallied 11% (a 4 standard deviation move), and ADBE rallied 9% (a 3 standard deviation move).

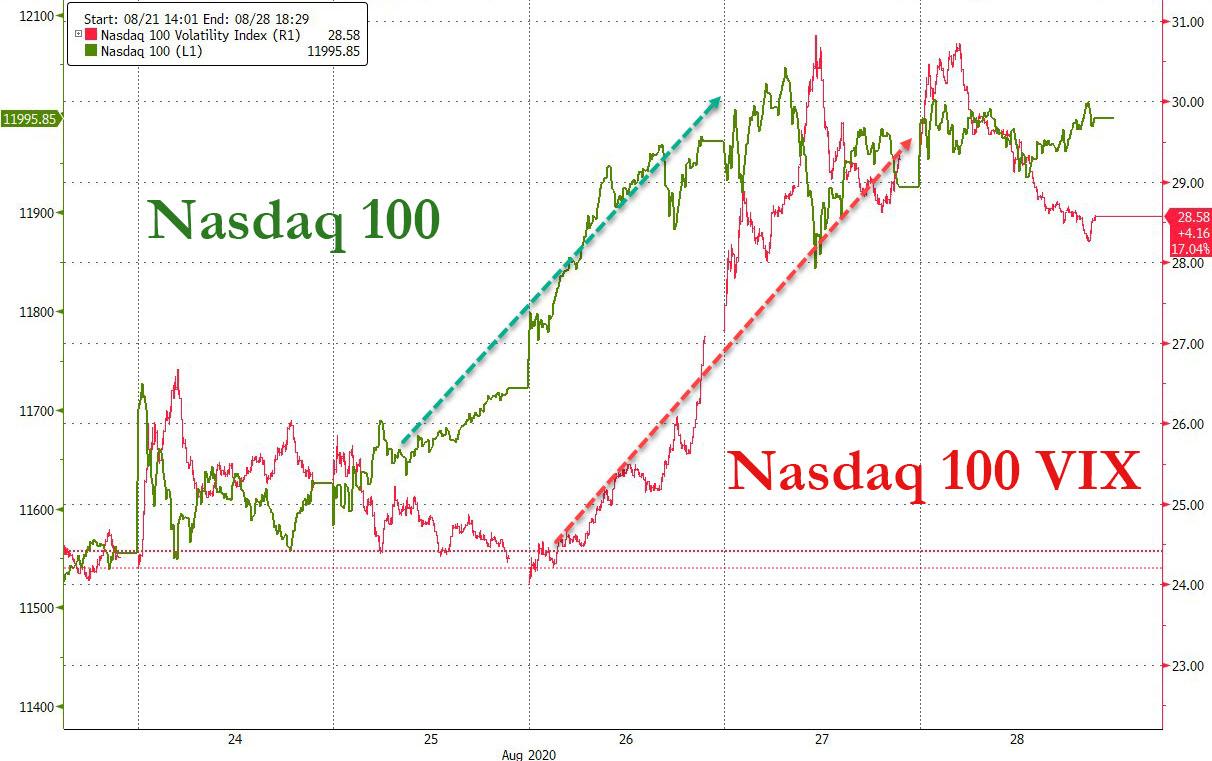

The most natural place to hedge being short single name Tech volatility is through buying NDX volatility. As such, there has been a flood of NDX volatility buyers with NDX vols up about 4 vol points in 2 trading days. And if NDX volatility is going up, SPX volatility/VIX will eventually go up too.”

Of course, if gamma is discussed Charlie McElligott can’t be far behind, and in a note this morning, the Nomura cross-asset strategist echoes what we said about this underlying reflexive beast that is propelling the market higher, saying that Gamma hedging has become “the most important flow in the market, with the convexity of said short-dated “lottery ticket” options creating an ‘all-or-nothing’ binary-options market behavior into weekly expiries, seen in these increasingly exponential ramps in names like TSLA.”

In his explanation of the “spot up, vol up” moves seen across major indices, McElligott repeats what we explained over the weekend, saying “it’s as simple as this: Street-wide, Dealers are short Gamma / short Calls off the back of the MASSIVE upside premium buyer (as in BILLIONS spent) who has been in the market over the past month or so in a number of mega-cap single-name Tech cos.”

This, according to McElligott (and Citadel), “is why CRM had its freakish +26% post-EPS single-day move last week (lolwut), and dragged-up a number of other high-profile big name Tech which have also been part of the upside buying program (AMZN, ADBE, NFLX, FB, MSFT) all enormously “over-shooting” thereafter, as generically, the Street was short 1m 20d Calls which turned 25d real quick, forcing Dealers to grab Delta to stay hedged, in classic “tail wags the dog” feedback loop.”

Another way to describe the feedback loop of course is what we said on Sunday: calls spiking higher amid this gamma squeeze, leading to more buying of the underlying stock, leading to even higher call prices, even more call squeezing, even more delta-hedging and buying the underlying, which eventually spills over into more and more of the market, and so on until there is one massive marketwide meltup.

Then there was the added matter that this flow was simply larger than an August illiquid single-name market could take, with McElligott noting that “the hedging of single-names becomes forced lookalike buying in NQ- and likely ES- as well (because it looks relatively “cheap”)—spot up, vol up, as this “upside-crash” has to be hedged.”

As a result, we are now also seeing the VVIX exploding higher (+9vols yday!) “as market makers are forced into grabbing upside tails, while too, this dynamic is also evidenced by the spread btwn UX1 (front VIX future) as implied vol vs SPX 30d realized vol (so heavily weighted in US Tech) currently stands at 17.5, the most in 10 years.“

* * *

It’s not just the “self-fulfilling” gamma grab flow of course, and at a time when retail traders have become the most improtant marginal price setter (as we explained in May), the larger multi-month theme of “Robinhood-esque” speculative buying in short-dated deep OTM Calls continues to iterate McElligott’s refrain that “Gamma” hedging “is the most important flow in the market, with the convexity of said short-dated “lottery ticket” options creating an “all-or-nothing” binary-options market behavior into weekly expiries, seen in these increasingly exponential ramps in names like TSLA.”

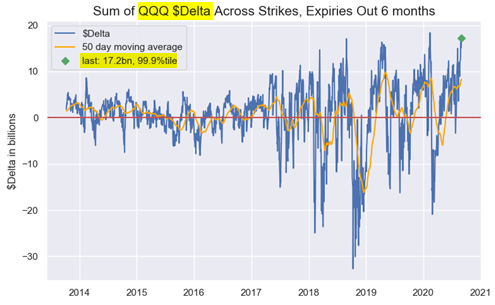

As a result, broad index and ETF options-wise “are as extreme as it gets (QQQ $Delta 99.9%ile, SPX / SPY $Delta 96.9%ile)..

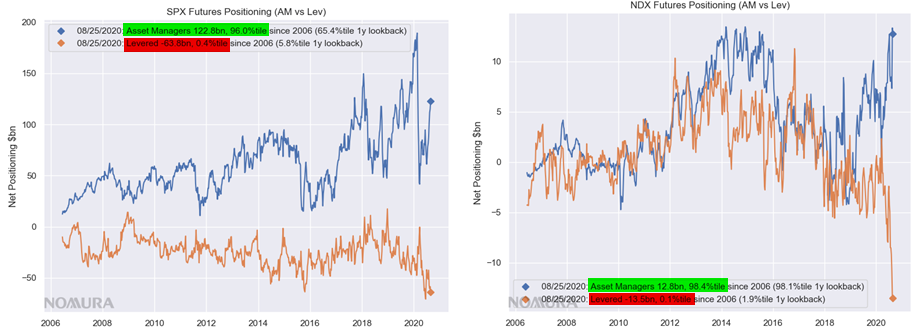

… while too CFTC TFF futures positioning data shows the “Asset Manager” extreme net $long at 98%ile in NQ and 96%ile in ES, while the “Leveraged Fund” net $position is at extreme SHORT (hedging underlying “longs,” of course) with 0.1%ile in NQ and 0.4%ile in ES net positions since 2006.”

Finally, for those who have no idea what this post is about, we storngly urge you to re-read “All You Ever Wanted To Know About Gamma, Op-Ex, And Option-Driven Equity Flows.” In a market as broken as this one, where fundamentals don’t matter, it just may the most important thing you read today.