From MarketEar:

What about those CTAs and gamma dealers here?

Yesterday people were quoting Nomura’s quant and his take on positioning:

“…now increasingly outright ‘long gamma’…less spastic market moves”

Per our post yesterday “Where is that long gamma today…” we pointed out;

“Watch the downside should they “flip” to short gamma again….back to magnifying the moves once again.”

Nomura is out since then stating;

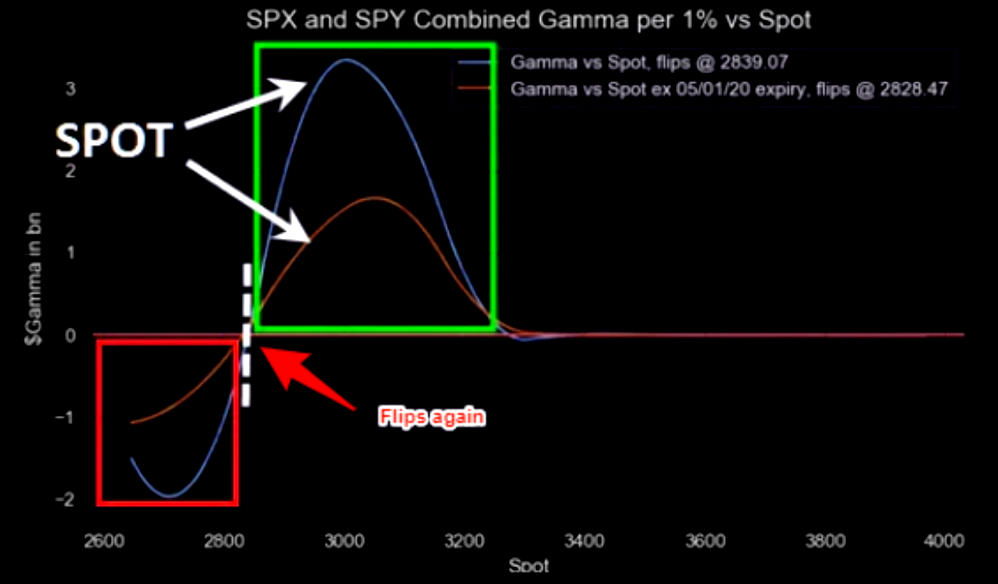

1) it has seen us trade back below the trigger level where the CTA position signal would yet-again pivot back “short” as the 84.6% loading in the 6m window would “flip” (a close below 2926 has signal to -69% short, while below 2805 goes back -100% short—albeit all on smaller gross $ exposure) while also critically (especially into weekly expiration),

2) this current spot ref ~2840 level is actually back (lower) to the “Gamma Neutral” level from yesterday’s typically insulating “Long Gamma”…now capable of slipping into outright “Short Gamma” on another surge lower.