There is a lot of talk recently about options Vanna and we wanted to address some of these points here. The basic concept as applied to our SPX/SPY models can be distilled to this:

• When implied volatility (i.e. VIX) declines stocks go up

• When implied volatility increases stocks go down

Obviously there are many caveats and nuances here, but our goal is to relay the general concept. In general we mark options dealers are short puts, hedged with short underlying. When those puts increase in value due to an implied volatility increase that means dealers must short more to stay hedged. Obviously if implied volatility drops, put values decline and dealers may buy back short hedges. You can see on a large scale how this may tie into large market movements.

What Is Options Vanna

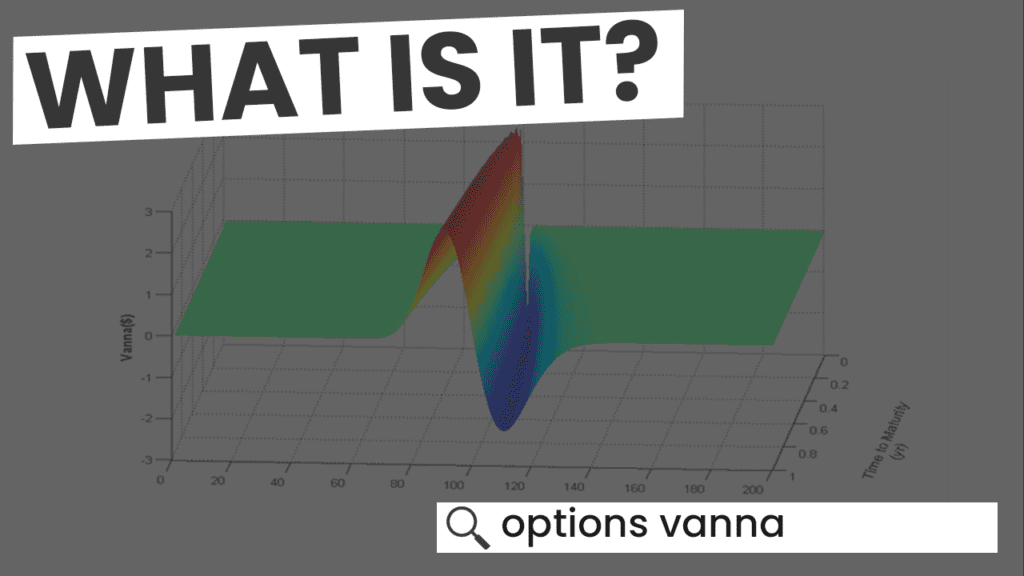

Vanna is typically defined as the change in option delta for a change in implied volatility. Usually it assumes a normalized form so as to show the change in delta for a 1% move in implied volatility. Call options have positive vanna, and puts have negative vanna.

VolCube

Our S&P500 models assume dealers are long calls, and short puts. Therefore they are LONG VANNA. This infers that as implied volatility increases their LONG deltas are increasing. To hedge this, they must SHORT futures.

Let’s take an example of a portfolio that is long calls, short puts, fully delta-hedged and vega neutral. This position will exhibit positive vanna, as both the long calls and short puts are vanna positive. Now, if the spot price is unchanged, it is true to say that the trader is not greatly concerned by her long vanna exposure. Whether implied vol rises or falls, he/she can simply re-hedge to maintain delta-neutrality with little or no profit and loss implications, since the spot price has not moved far, if at all, from where the original position was entered into.Now, however, consider two concurrent events; namely the implied volatility increases and the spot price falls. In this case, the trader is running into the short put position as implied volatility is rising, which is unfortunate. But things are compounded because he/she is also becoming longer delta in a falling market, due to positive vanna. The trader is long vanna; the implied volatility is rising, so the delta position increases. This is where you have double trouble.In short, vanna is a greater risk when multiple events occur.

VOLCUBE