TSLA has been on an incredible +50% move for the month following the 11/6 elections. SpotGamma wrote extensively about the very bullish setup we saw on 11/7 – a setup that was more bullish than general market expectations, and why we thought TSLA stock would reach previous all-time-highs of 400. Along that path, we called […]

vanna

Measuring Options Vanna, and its Impact, using VIX & Skew

In this video SpotGamma breaks down how to measure vanna impact, and why changes in options implied volatility can be a major driver of stock prices. We cover core concepts like, volatility premium, skew, and gamma.

The Fed Meeting May Spark The Next Stock Market Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Buy the Fed meeting. Sell the Fed minutes. It may be the name of the game for the stock market. At least since the start of 2022, the minutes have been a cause of concern for markets, while the FOMC meetings […]

‘Call AAA’: Santa Claus Is Having Sleigh Troubles

Through an options market lens, the following text will add color to some recent market movements.

How Changes in Implied Volatility Pushes Markets Around (aka the Vanna Trade)

Brent, Founder of SpotGamma, explains how the “Vanna Trade” works. As implied volatility changes, options dealers may have to adjust their hedges. Brent explains how this hedging flow can create large rallies or selloffs in markets. He also touches on the topic of charm, or the change in hedging delta due to time decay.

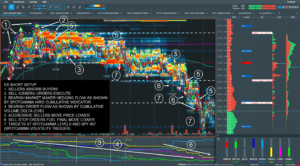

Trade Analysis: NQ Futures (29 November 2021)

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For NQ futures, I note Gamma Notional, and the Volatility Trigger, Put Wall, and Call Wall gamma levels for QQQ. I also look up QQQ in Equity Hub. […]

Trade Analysis: ES Futures (5 November 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Founder’s Note when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for […]

Weakening US Dollar Sparks Short-Squeeze Rally

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stocks ripped higher the week ending October 15. The spark stemmed from a sharp decline in the dollar index, as the currency market grew concerned about hotter than expected wage growth as part of the US Consumer Price Index the morning […]

Trading ES Futures Using HIRO and Vanna

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by gathering information to help develop a thesis for the day when I trade futures. My thesis includes the following items: Directional bias Anticipated volatility Trading range for the day My primary sources of […]

Trading ES Futures Using SpotGamma Levels and Vanna Model

The following is a guest post from Doug Pless. As I discussed previously, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Index, and Gamma Notional for SPX and SPY. The SpotGamma Gamma Index is a proprietary measurement […]