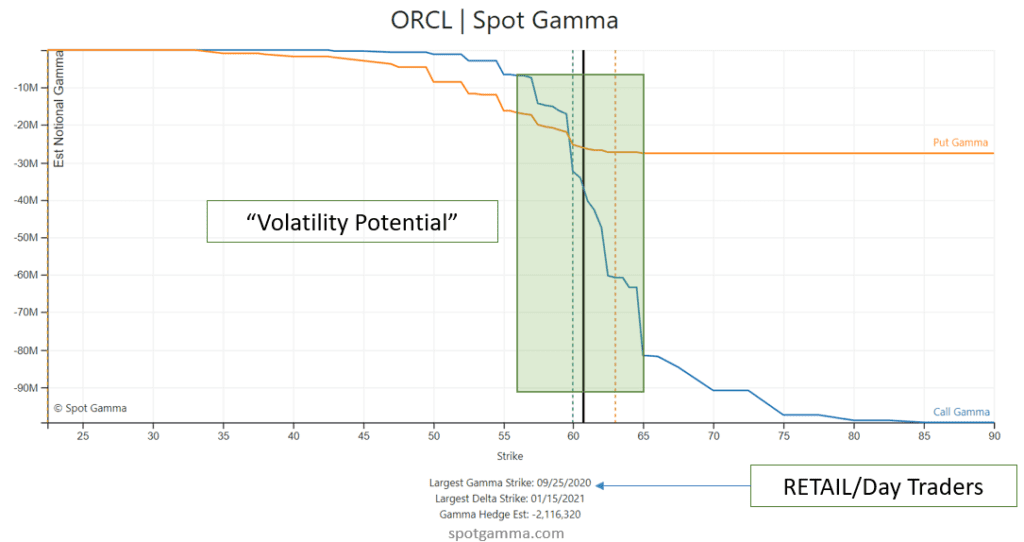

One of the names catching headlines recently is ORCL. They have a conditionally approved deal to takeover TikToc, and that appears to have call buyers excited. In the chart below our “Hedge Wall” (blue dotted line) is at 60 – this is a key support/resistance level in the name.

Note the blue call gamma line extends well below the orange put gamma line which infers that call positions are much larger here than puts, and this could bring some rapid price movement higher into the $65 area. The idea being that as the stock goes up dealers (who are short calls) will have to buy stock to stay hedged.

Disclaimer: SpotGamma employees may or may not have a position in this security and/or other securities. This post is not a recommendation to buy or sell securities, and we are not registered investment entity.