This Friday, the market will experience one of the largest monthly expirations of all time. Over $1.9 trillion of delta is expiring for SPX alone, and the effects will certainly spread across the equities market.

Monthly OPEX often “clears the table” of major positions, removing both supportive flows and downward pressure. Based on this, we’ve included our analysis below for three names that we found most interesting ahead of this Friday’s expiration.

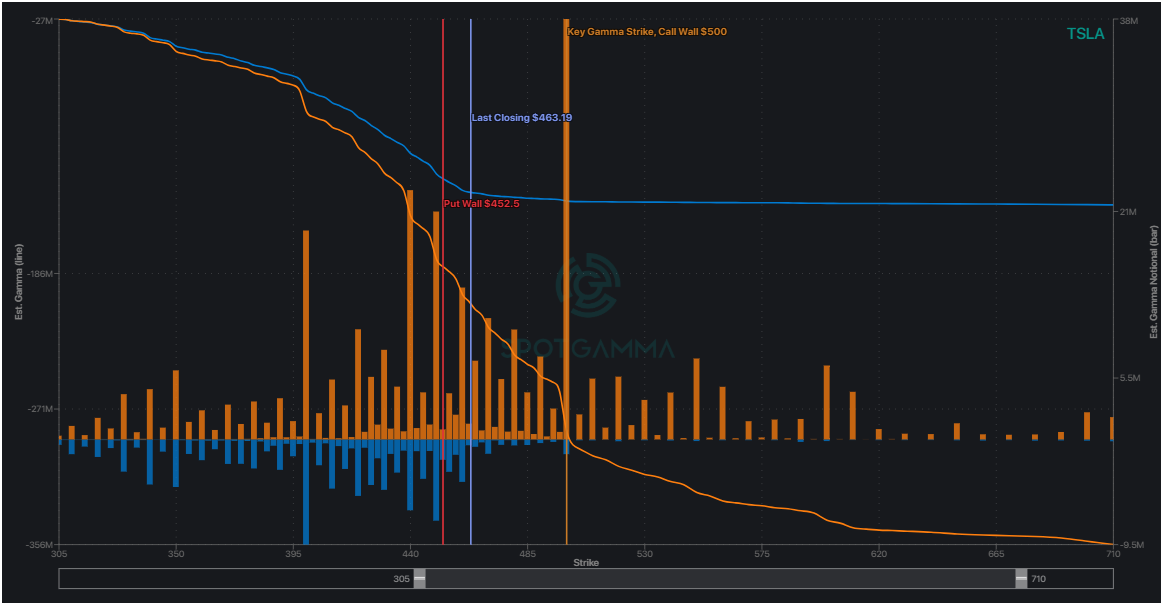

TSLA

More than 50% of TLSA’s options volume has been tied to Friday’s (12/20) expiration as the stock has been ripping higher. As a result, the IV Rank of TSLA is now above 81%, which is very rare for a stock that has been consistently rising in price.

More than 35% of total TSLA gamma expires on Friday, and we believe that much of this consists of long calls. This has the potential to reduce upside volatility, and as a result we think the stock will start to consolidate recent gains. Our eye is at the large $400 strike as support. To the upside, there is a massive amount of call interest at $500 which should form meaningful resistance.

MSTR

As a name that has certainly surged over the past month, MSTR is now facing 50% of gamma expiring on Friday, 12/20. We believe these gamma positions have been mostly stabilizing MSTR stock, which has largely been pinned to the $400 area for the last 2 weeks.

The removal of such significant gamma may lead to a shift away from the $400 strike into January, and post-OPEX we would expect volatility in MSTR to pick up.

NVDA

NVDA, the best performing stock for much of 2024, has been under major pressure throughout this past month. This Friday, the stock will lose over 30% of its total gamma. We think this may relieve the downside pressure that has been so persistent.

Additionally, NVDA highlights the potential “pinning power” of OPEX week with 149k calls and 59k puts struck at the 130 level for 12/20. We can expect this to limit price movement heading into Friday’s expiration.

What To Watch For this OPEX

This Friday’s OPEX certainly gives us an event to keep an eye on, reshaping the options-driven dynamics for a number of high-profile stocks. Such a large volume of expiring contracts on 12/20 can shift liquidity and volatility profiles for many commonly-traded names.

As these dynamics unfold, traders should prepare for an environment defined by recalibrated hedging flows into quarterly expiration (12/31) and beyond while searching for new opportunities.