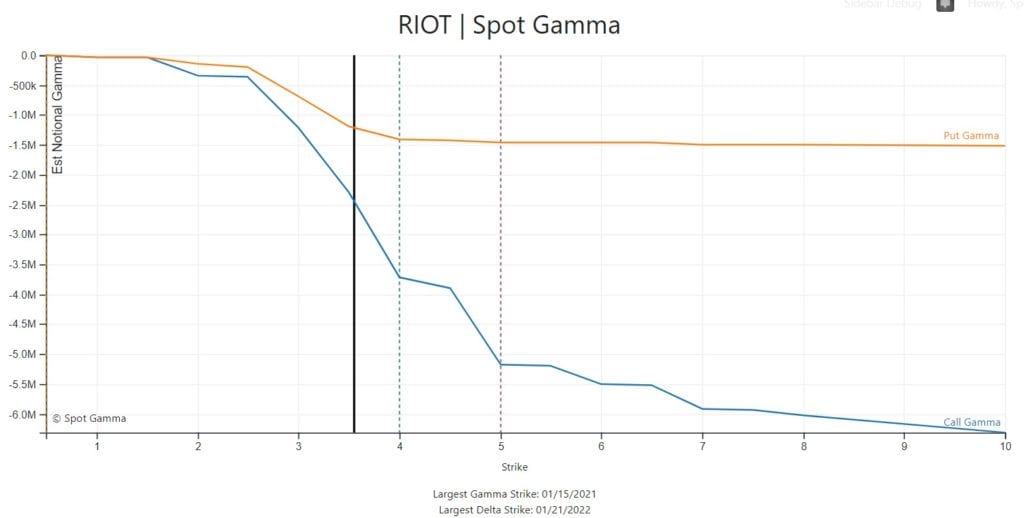

RIOT is quite interesting here as a potential bullish play. Its not a name with huge options volume, but being that its a trendy space (blockchain) and calls are low priced (retail can easily buy a bunch) we think the setup is interesting. If you note we pickup $4 strike as resistance (aka HedgeWall) and $5 is the largest call strike. Whats more interesting is that the bulk of those calls are out in January. If the active WSB/momo crowd starts in on it then we’d probably see the nearest term expiration as the largest position.

Note how the $4 has been resistance, but due to call OI at $5 this could ramp quickly.

If you’d like to run your own analysis, take a look at our EquityHub product.