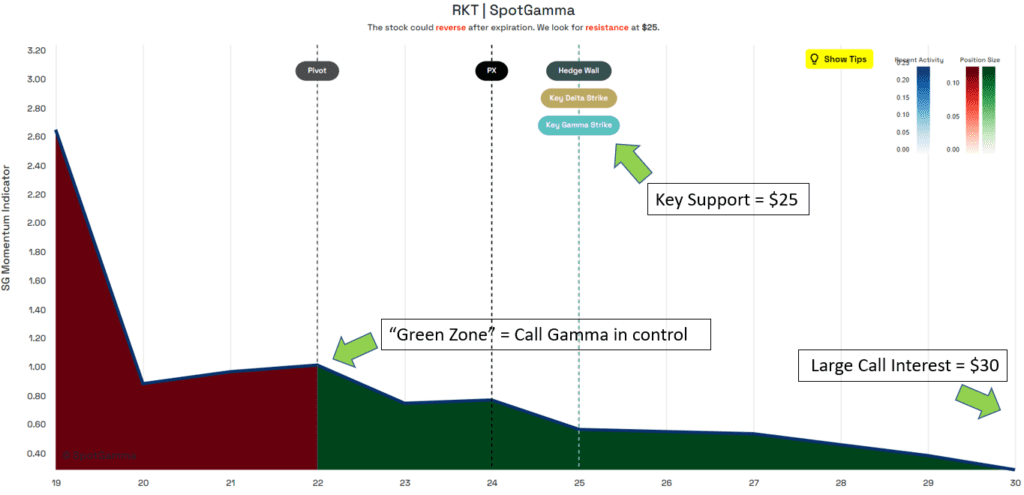

We noted in a video last night that RKT was setup for a gamma squeeze, and the stock is up ~20% this morning. The stock has been rangebound for months and our proprietary indicators identified the setup for a gamma squeeze / stock breakout. As call positions increase, options market makers may need to purchase increasingly large amounts of RKT stock.

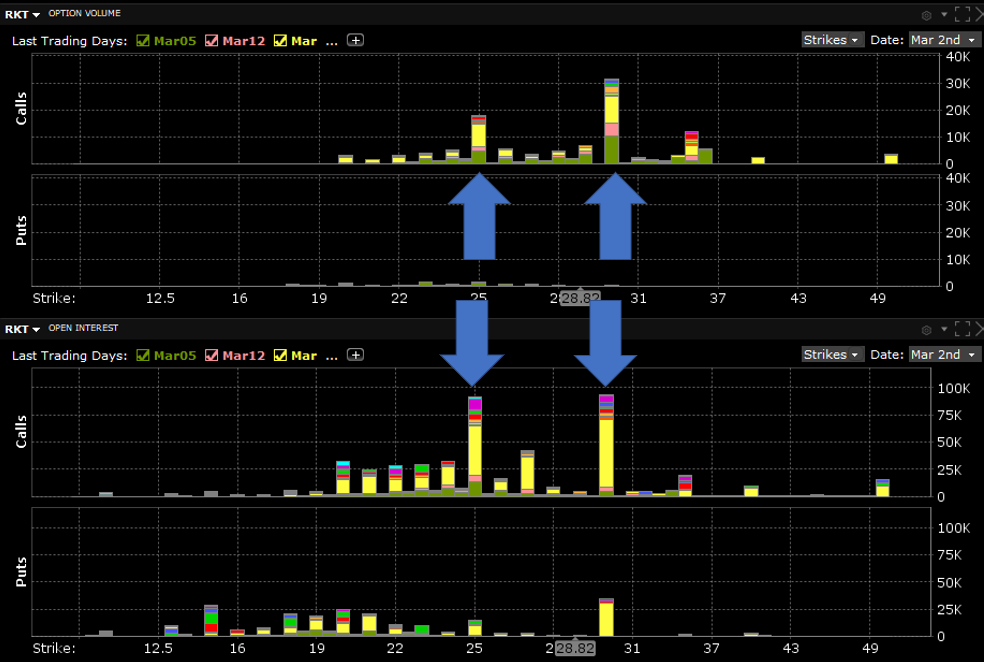

There is significant increase in call volumes and open interest at the $25 and $30 strikes. We think this will be the immediate range for RKT stock. The top pane of the chart below shows the volume taking place so far this morning, with over 30k calls trading at the 30 strike (in 15 mins of trading). If this call volume and open interest (bottom pane) can shift up over 30 then the stock may continue its squeeze.

Our EquityHub options scanner shows that over $22 call options hold a high amount of call gamma. This combined with increasing call volume and large call positions at overhead strikes is what made/makes RKT an interesting gamma squeeze candidate.

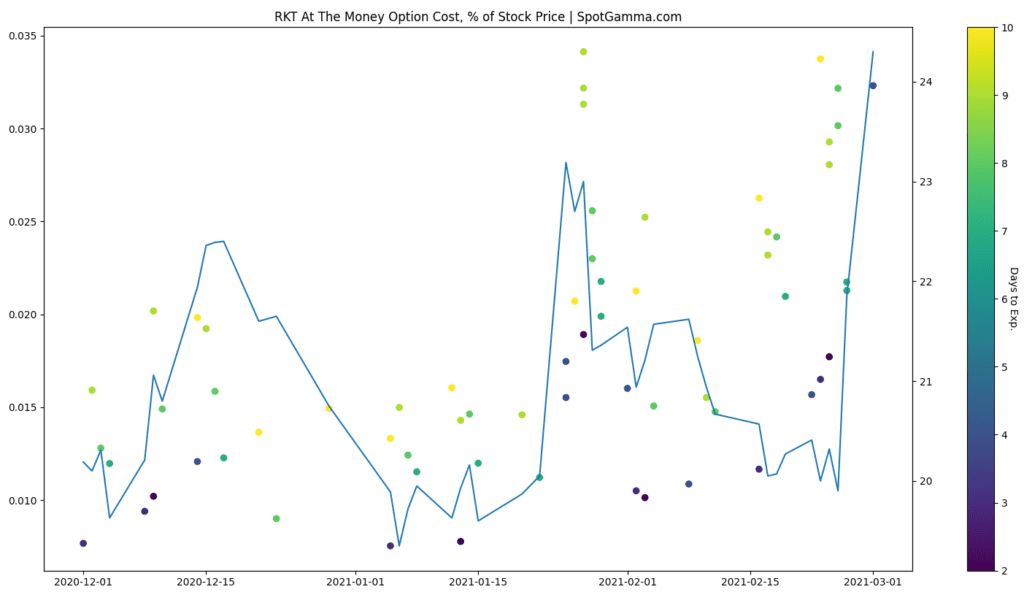

The issue buyers must now contend with is how quickly implied volatility and the price of call options has risen. Since the late January GME gamma squeeze we’ve seen market makers be very quick in raising the cost of calls that are in “squeeze mode”. This effectively reduces the amount of leverage that call buyers can inflict on a stock. It also invites call selling which can lead to market makers selling RKT stock in increasing amounts.

Below we measure the cost of an at-the-money option in RKT. You can see that in mid February it cost roughly 1.5% of 1 share to buy at-the-money call. At closing yesterday it cost nearly 3.5%, and we note this morning is >10%.