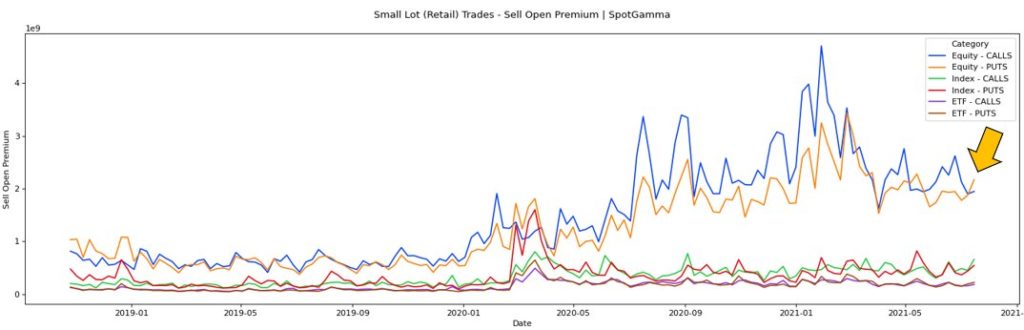

Recent data from the OCC shows that small lot traders from the past week shorted puts in more size than they did buying calls. At SpotGamma we’ve covered this topic extensively, highlighting the embedded risk of this trade back in January of ’20 (following that posts the markets had a 4% decline).

There are several issues if the market is in fact leaning short puts. The risk profile of being short puts versus long calls is completely different. When a trader is long a call, they are “long convexity” with defined risk. “Convex” here simply means increasing and/or exponential. The most they stand to lose is what they paid for the call, and their gains could be substantial. However, when you are short a put you’ve taken in a fixed amount of money (i.e. whatever you’ve sold the put for) but are subject to convex losses.

Therefore if the market is net short puts and the market declines this could indicate exposure to substantial losses. This short put position also implies that market makers are long put options, versus long stock hedges. Consequently, if there was a move lower in markets traders would be forced to buy back those short put options. This would push dealers from being long puts to flat or short puts and having to sell off their long stock hedges. As you could imagine, this could add pressure to market selling which may lead traders to buy put protection which could lead dealers to sell more stock.

Therefore the concern with markets as a whole shorting puts is that the act of having to quickly close that position can cause volatility to increase, and markets to further decline. Our concern is that is how the market is positioned at this moment (short puts) with notable sustained weakness a sustained threat.

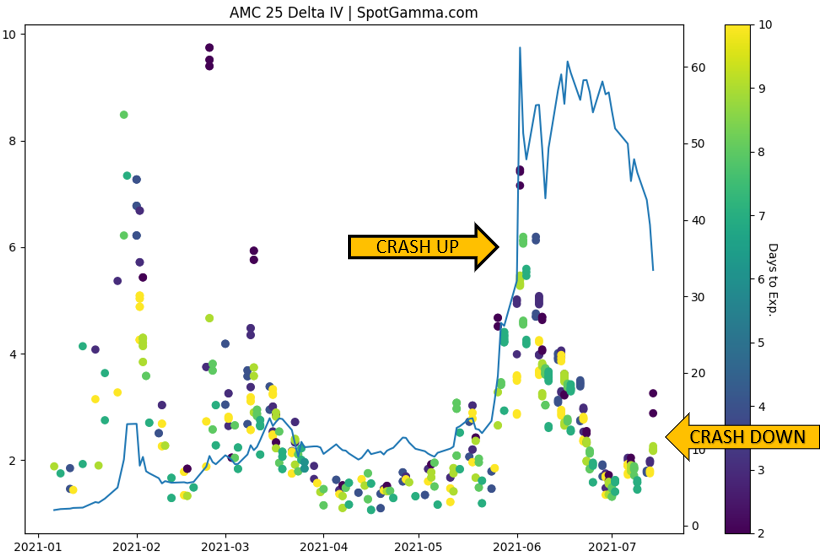

This is not to say that we are against selling puts as a trading strategy. In fact, we suggested that selling puts was an effective strategy in regards to the AMC and GME market rallies. Typically implied volatility goes up as stocks decline. However in this case we flagged selling puts as an interesting way to play these stocks because implied volatility was going higher as the stock was going higher. Essentially, these stocks were “crashing up”. This meant that if these stocks declined put values could initially decline which may be profitable for those shorting put options.

This strategy worked out well as implied volatility dropped and options prices generally declined. However, in the last several days AMC began to decline significantly, and now implied volatility is increasing as the stock drops. This means that traders need to be much more discerning in timing put sales.

For more on implied volatility, checkout this video with SpotGamma Founder Brent Kochuba, and Imran Lakha of Options-Insight.