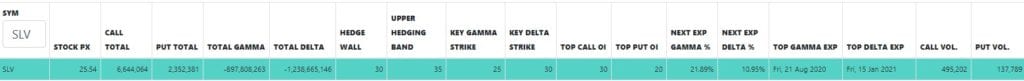

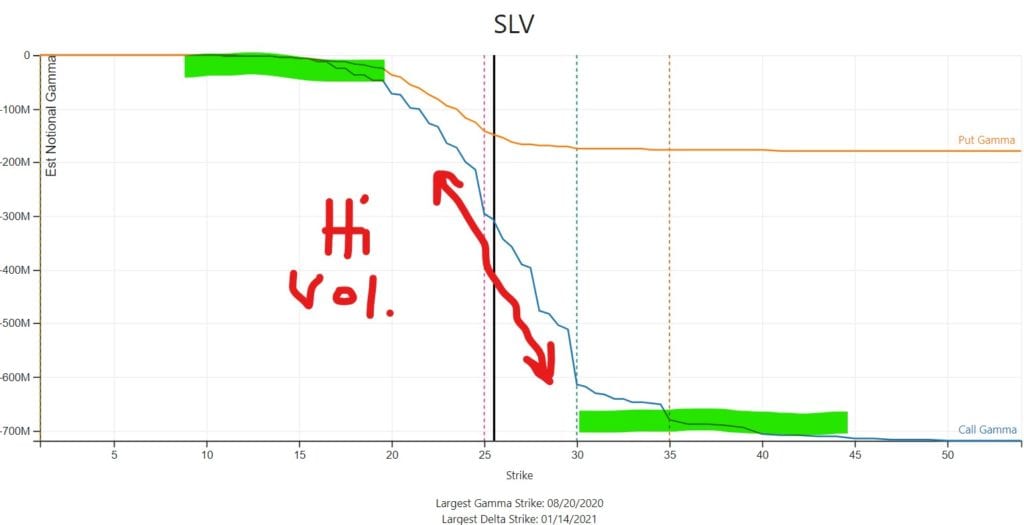

Below is our most recent data for SLV (silver ETF) going into Fridays August options expiration. Call option positions remain at or near the highs we’ve seen over the last several weeks. There is a large concentration of options at the 25 and 30 strikes which presents an interesting setup.

If SLV can charge ahead in the next day or two it can possible draw up into the 30 strike as dealers have gamma to hedge. You can see in the chart below we forecast high volatility along that red arrow. The tricky part here is that ~20% of gamma expires Friday, so a decent chunk of SLV options have high decay. If SLV pauses or stalls here this may add some short term selling.

This selling is because dealers are likely long stock to hedge calls. As calls decay dealers could reduce some of their long stock (aka hedge) position. For the longer term if people roll their expiring calls up and out that can keep the buy pressure on.

We think 25 remains a key area in SLV and may be a decent “swing area” on any selling pressure.