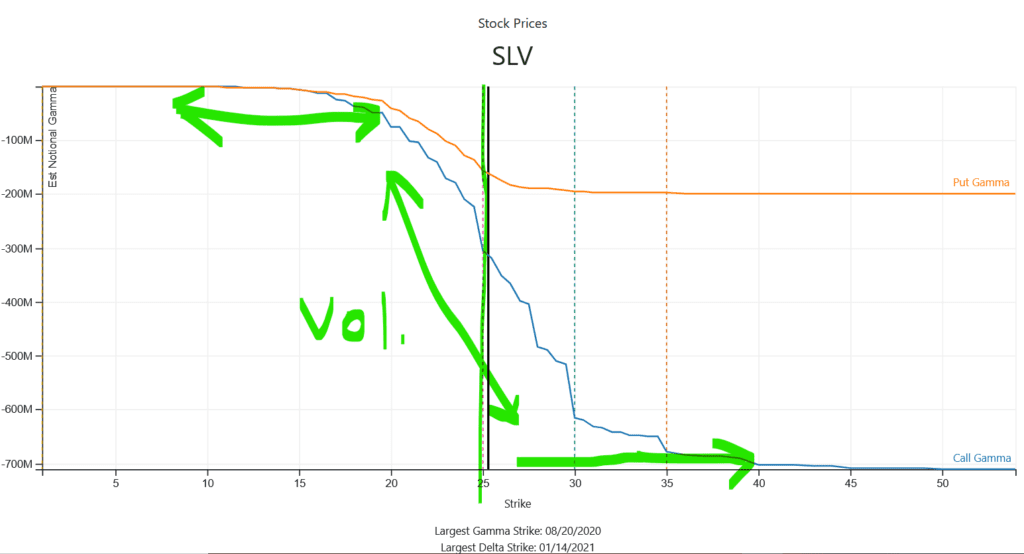

We’ve been tracking SLV & Silver closely for several weeks now. Originally there were many Jan ’21 calls struck at 20, but those have largely been either closed or rolled, such that 25 is now the key strike. Much of the gamma in SLV expires next Friday 8/21 which could add a short term dynamic here.

Below you can see the slope of the blue line, and consider that a measure of volatility. You can see that the slope flattens out under 20, and over 30. We could see a bit of a pinning effect into next week as all that options gamma expires, the caveat to this would be if SLV is able to rally sharply and more calls are added at higher strikes. If more higher strike calls are added then the curve would steepen past the 30 strike, which may imply “room” for higher prices.