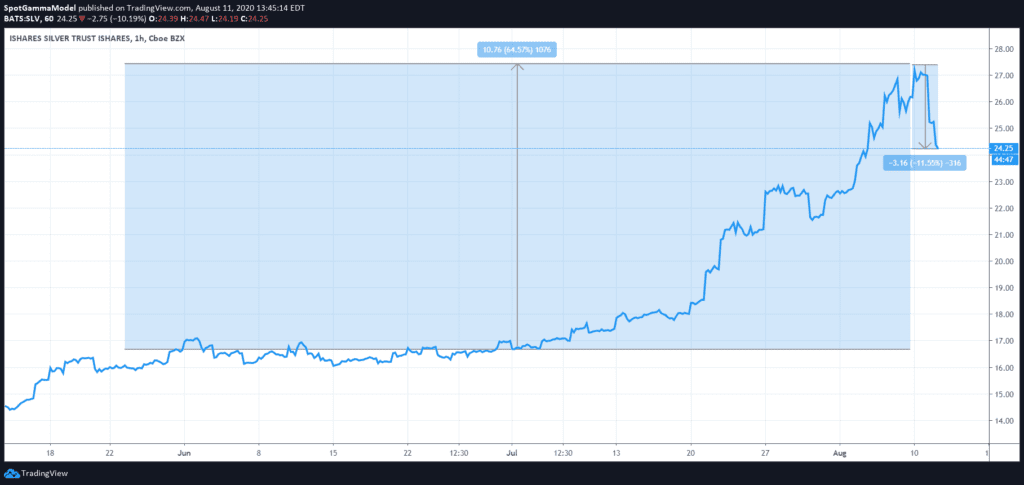

Silver and the SLV ETF are having some amazing volatility as of late, with a -10% move currently underway. We’ve been watching this setup for several weeks, anticipating volatility due to the large amount of call gamma building up. We believe its important to be aware of this position as these very large moves may be attributed to the amount of hedging flows linked to these large options positions.

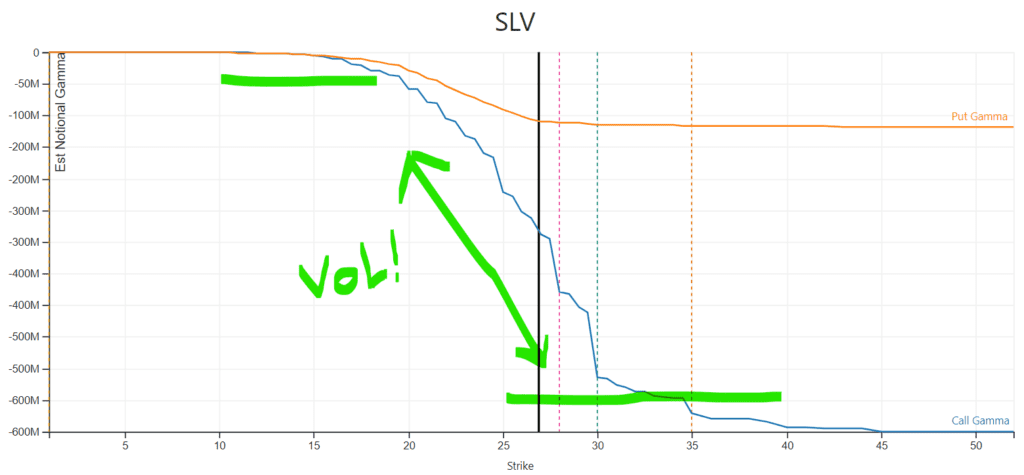

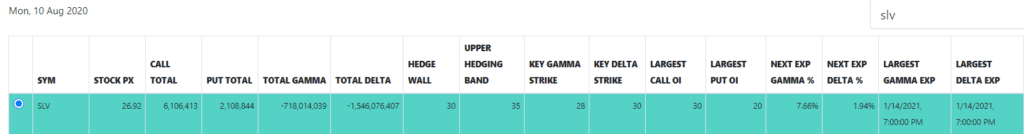

You can see in our Equity Hub™ graph below that call gamma (blue line) is very steep and negative gamma builds as the SLV price moves between 20 to 30. We estimate that dealers have a negative gamma position which infers they need to buy SLV as it rises and sell SLV as it drops. This expands volatility as there are about 6 million (!!!) calls currently open in SLV. As that blue gamma line flattens it may mean that dealer hedging subsides and volatility (aka price movement) settles down.

Originally we saw the greatest concentration of SLV calls at the 20 strike but now the largest gamma strike is 28 with 25 also having a lot of interest. These strikes may attract attention as hedging flows are linked to these strikes. Its clear that more out of the money calls >30 have been added recently and that trend may have been keeping SLV prices moving forward. As new long calls are added dealers (who are short those calls) may have to buy stock to hedge those new positions.

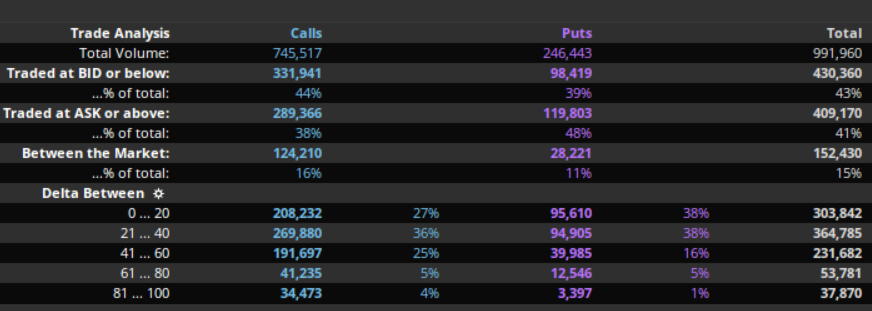

You can see in the chart below that Call options are still very active in SLV today as traders adjust to this drop in prices. We wouldnt be surprised if this equates to an even larger total call position in SLV for tomorrow despite the large drawdown.

SLV options update 8/11/20