One of the biggest stories at the moment is that of Softbank and their massive options positions which many are attributing to the markets large runup in late August. There are a ton of stories and opinions floating around on this topic and we thought it warranted a bit of mapping to clear some truths and misconceptions.

In our view SoftBank likely did NOT have the impact the media is portraying. However, there was a large increase in call option activity likely from a wide array of sources which may have influenced volatility.

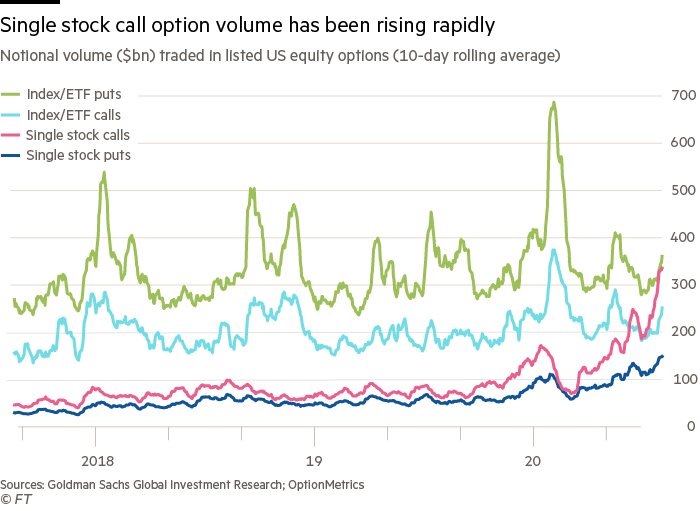

The pink link in the graph below highlights the rise in single stock call activity. This activity is something many have been talking about for several months.

Here are some background articles on this Softbank topic, the main narrative appears to be that SoftBanks’s options activity is particularly responsible for the recent volatility.

- ZeroHedge: Connecting The Dots: How SoftBank Made Billions Using The Biggest “Gamma Squeeze” In History

- FT: SoftBank unmasked as ‘Nasdaq whale’ that stoked tech rally

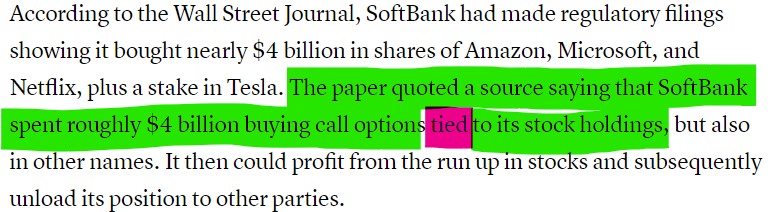

However, a key line from CNBC denotes these options positions were tied to stock, which is also backed by Ben Eifert’s twitter thread, below.

- Key quote from CNBC article:

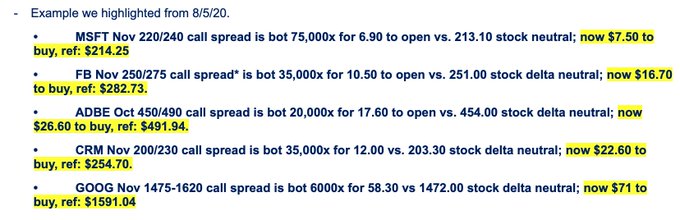

Courtesy of Yakob Peterseil, you can see where large trades were posted in some of the tickers SoftBank was reported to be in. Note these are all spreads, not single legs:

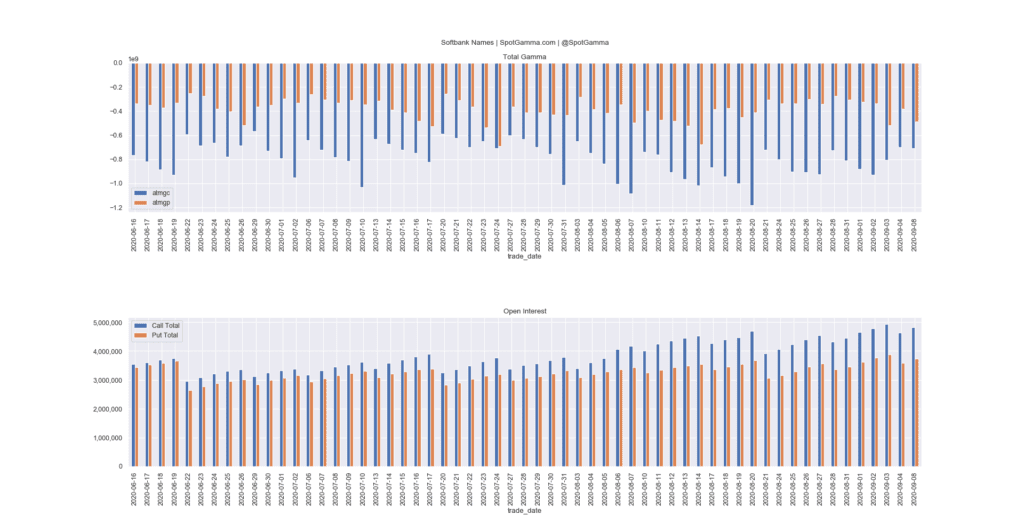

Below is a chart of the aggregate of options gamma and open interest for many of the names that SoftBank was invested in. Note that open interest levels in particular do NOT appear to materially change from June to September. You may also notice there is a “cycle” to this data tied to options expiration (6/19, 7/17, 8/21).

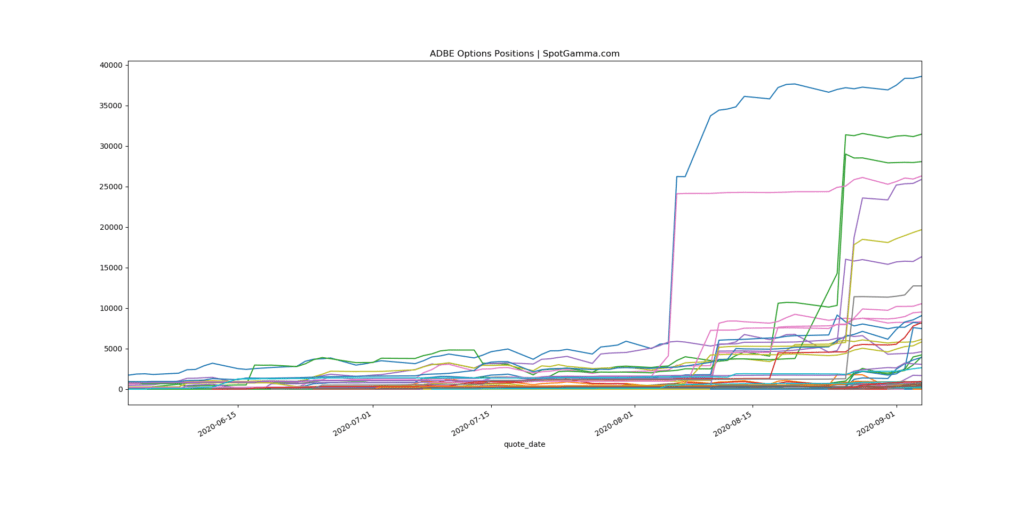

We plotted total open interest in the chart below for ADBE, and you can see some major positions popped up in early August. Those strikes that spike earliest are the 450 (blue) and 490 (pink). The fact these spike on the same day would support the idea that this was a spread position added, not a single position. This also ties back into the dates noted in Yakob’s image above.

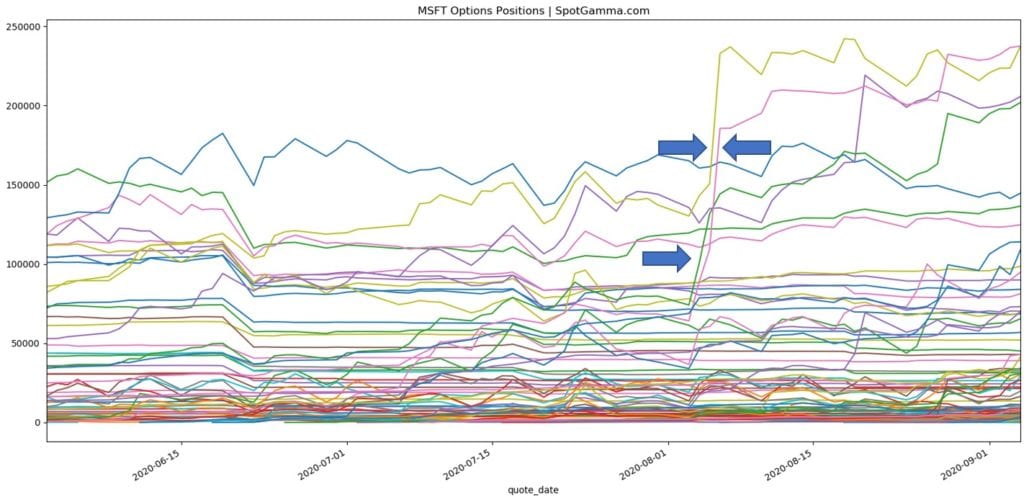

MSFT is another stock mentioned in the SoftBank articles. Right around the same time as the large ADBE increase we see moves up in MSFT open interest. In this case the largest position increases appeared to be in the 220 and 240 strikes. As MSFT options activity is much larger than ADBE there is a bit more noise, but you can see the two strikes increase sharply on the same day.

Our view is that these trades may have been done for the following reasons:

- Stock replacement – replace long stock positions with call spreads to reduce risk

- Long volatility – in theory these call positions would make money if call implied volatility spiked higher.

With this in mind it seems like these trades would have reduced overall exposure to higher stock prices, and likely not had the “gamma impact” that many pundits projected.