Daily Note:

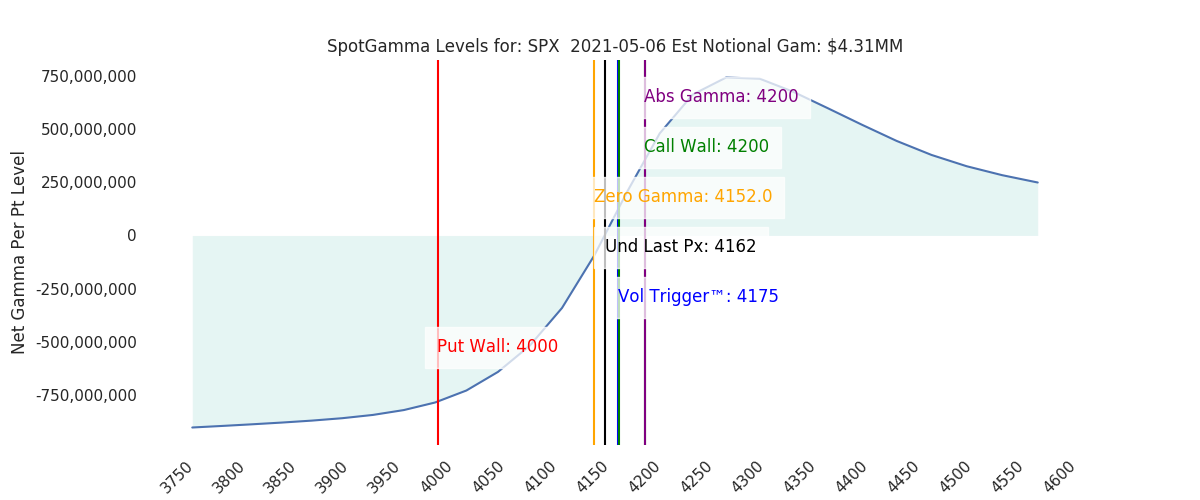

4160 is the current futures price – flat to last nights close. There was little change in key levels overnight, with our models looking for a 90bps max move with 4200 resistance, 4150 support. We think a break of 4150 brings a quick test of 4100.

Our sentiment remains the same: that markets are poised for volatility but needs a catalyst to get the ball rolling. While we give odds that this volatility expresses in a downward move, we recognize the fact that it can also manifest in a quick move higher.

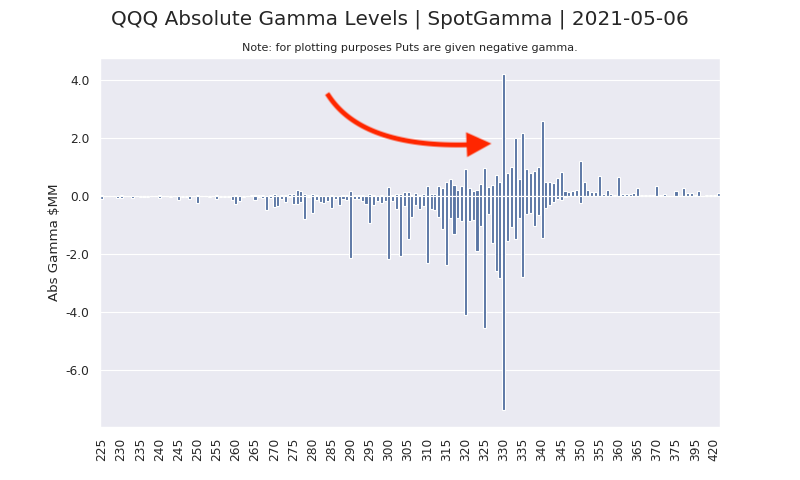

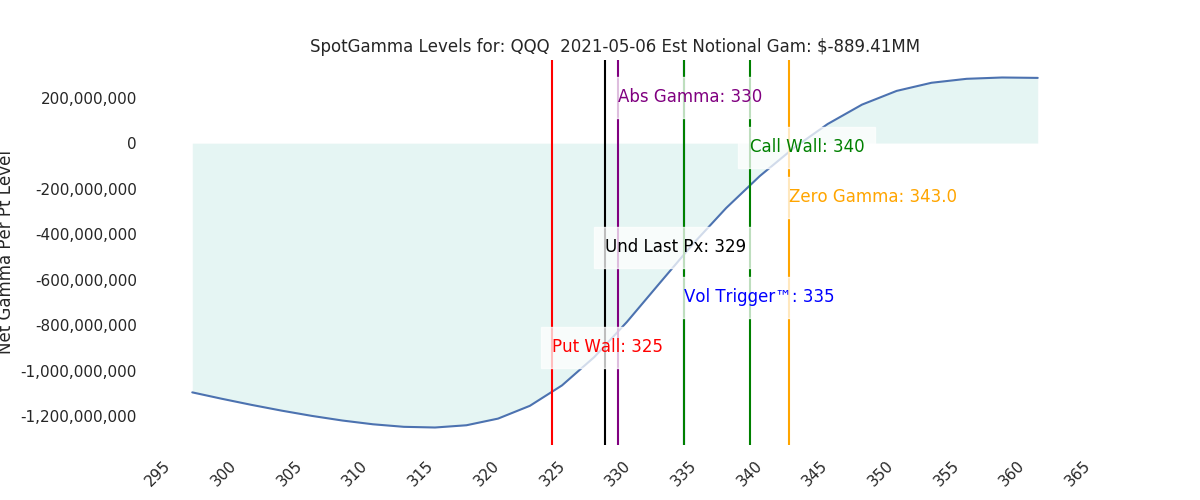

There is much more pent-up energy in QQQ, which remains under “put” pressure. We see only about 15% of that position rolling of Friday, and that does not give tech much of a “charm” bid (i.e. put options decay leads to dealer short cover). Of particular interest in QQQ is the 330 strike, which stands out as a very large level.

Some are looking to tomorrows 8:30AM EST employment numbers as a catalyst. Tomorrows expiration is not particularly large for any of index/ETF’s and is unlikely to change the “gamma picture” much. It will likely be index/ETF price that first shifts to determine gamma’s influence. Higher prices resolve the volatility risk, lower prices invoke higher risk.

Model Overview:

4100-4250 is the range into May OPEX. Gamma is currently high which should lead to low volatility. As long as markets are >4170 we anticipate a low volatility market which grinds higher.

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

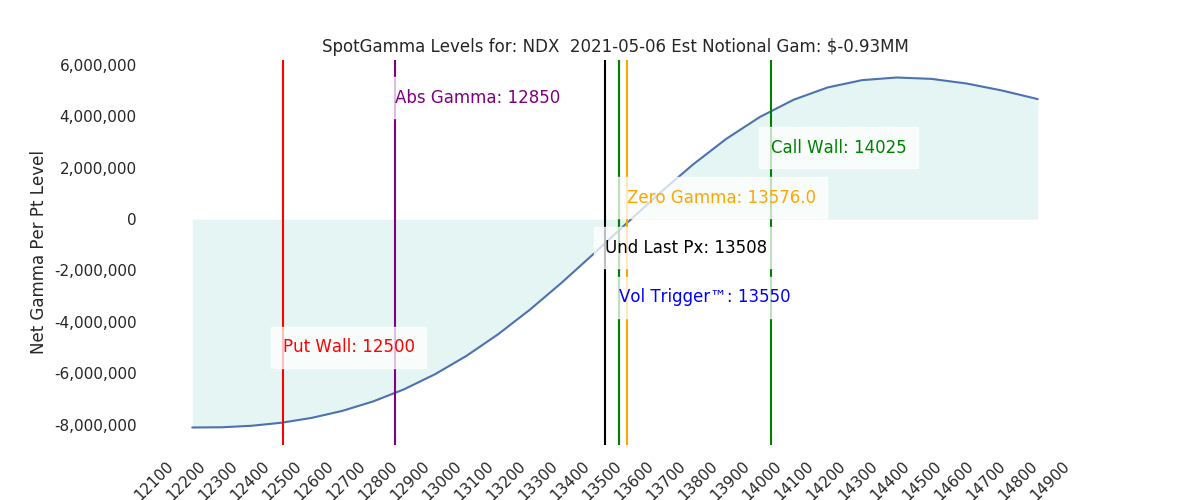

| Ref Price: | 4162 | 4159 | 415 | 13508 | 329 |

| SpotGamma Imp. 1 Day Move: | 0.91%, | 38.0 pts | Range: 4124.0 | 4200.0 | ||

| SpotGamma Imp. 5 Day Move: | 4185 | 6.64% | Range: 3907.0 | 4463.0 | ||

| SpotGamma Gamma Index™: | 0.43 | 0.41 | -0.07 | -0.01 | -0.15 |

| Volatility Trigger™(ES Px): | 4175 | 4160 | 415 | 13550 | 335 |

| SpotGamma Absolute Gamma Strike: | 4200 | 4150 | 420 | 12850 | 330 |

| Gamma Notional(MM): | $4 | $-7 | $-362 | $-1 | $-889 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level(ES Px): | 4152 | 4148 | 0 | 0 | 0 |

| Put Wall Support: | 4000 | 3900 | 410 | 12500 | 325 |

| Call Wall Strike: | 4200 | 4200 | 420 | 14025 | 340 |

| CP Gam Tilt: | 1.14 | 1.0 | 0.9 | 0.93 | 0.54 |

| Delta Neutral Px: | 3988 | ||||

| Net Delta(MM): | $1,298,783 | $1,345,402 | $194,973 | $40,068 | $84,845 |

| 25D Risk Reversal | -0.08 | -0.08 | -0.07 | -0.08 | -0.08 |

| Top Absolute Gamma Strikes: |

|---|

| SPX: [4200, 4175, 4150, 4000] |

| SPY: [420, 418, 415, 400] |

| QQQ: [335, 330, 325, 320] |

| NDX:[14025, 14000, 13750, 12850] |

| SPX Combo: [4196.0, 4246.0, 4221.0, 4204.0, 4217.0] |

| NDX Combo: [13344.0, 13547.0, 13142.0, 13466.0, 13263.0] |

| Sub Login Support Follow @SpotGamma Strike Charts Historical Chart Gamma Expiration Tool |

| ©TenTen Capital LLC d.b.a. SpotGamma Please leave us a review: Click Here |

| See the FAQ for more information on reading the SpotGamma graph. |

| SpotGamma provides this information for research purposes only. It is not investment advice. SpotGamma is not qualified to provide investment advice, nor does it guarantee the accuracy of the information provided. This email is intended solely for subscribers, please do not distribute the information without the express written consent of SpotGamma.com. |