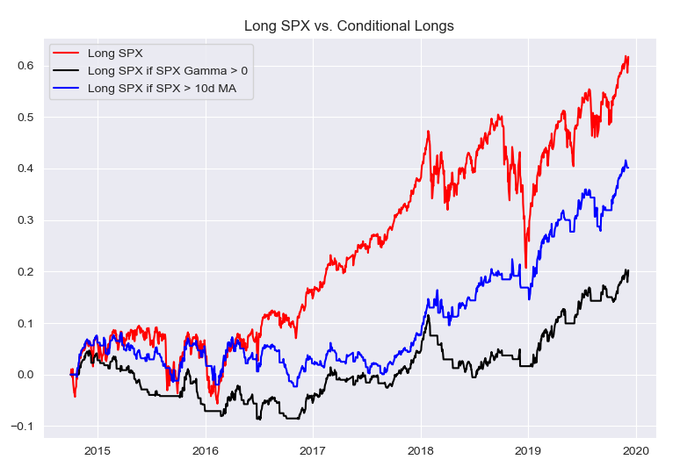

Recently an interesting chart was posted on twitter with the backtest of the SPX vs a strategy of owning the SPX only when gamma was positive. This brings up a few interesting points about long gamma and what we think its viable for. Below this chart are some comments and notes regarding the value of the long gamma indicator.

Being Long the SPX when Gamma is Positive

- The volatility of the return when using Gamma as your buy/sell trigger is much lower.

- You will underpeform the SPX if you only use “market gamma” as your buy/sell indicator. One big reason for this is because you miss out on the large dips.

- “Volatility” is usually associated with negative SPX returns – but in reality volatility can go in both directions. So by only investing during low volatility (i.e. high gamma) environments you miss price movement up.

- We know from our own testing that you can get “chewed up” at times where the indicator flips back and forth between positive and negative.

- All gamma data we’ve seen has been collected during a very large bull market. Therefore any backtest from this period shows you cannot beat being fully invested in the SPX. But I’d wager those following the “gamma trigger” at the end of 2018 were sleeping better.