Investing in Zero Days to Expiration (Zero DTE) options strategies through exchange-traded funds (ETFs) has gained popularity in recent years, particularly for investors seeking to generate income through premium selling. These ETFs, such as the Defiance S&P 500 Enhanced Options Income ETF (JEPY), employ a strategy focused on selling put options with very short expiration periods—often just a single day.

While these funds offer the allure of high, consistent income through premium collection, investors must be aware of the substantial risks involved. Here’s an in-depth look at why premium selling Zero DTE ETFs can be perilous for your portfolio.

Limited Upside, Unlimited Downside

The JEPY fund strategy revolves around selling in-the-money (ITM) or at-the-money (ATM) put options on the S&P 500 Index. This strategy generates income by selling options premiums; however, it significantly limits the fund’s participation in any upward movements of the underlying index. This is because once the strike price is met, the fund stops participating in any further gains beyond the strike price. For instance, if the S&P 500 index increases above the strike price, the fund will not benefit beyond the level of the strike price.

On the other hand, the fund is fully exposed to downside risk. If the index falls below the strike price, the ETF is obligated to cover the difference between the strike price and the actual market price, potentially leading to substantial losses. The “fixed” upside and unlimited downside make this strategy inherently risky during volatile or bear market conditions.

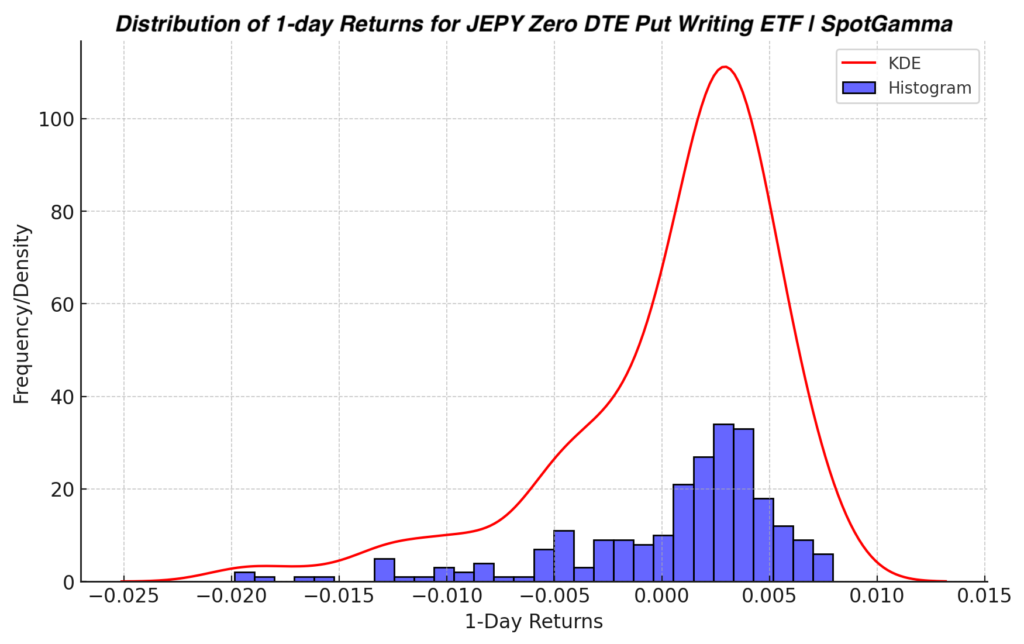

Skewness of Returns: A Signal of Risk

An important aspect of analyzing premium-selling strategies like those employed by JEPY is examining the skewness of returns. Skewness is a measure of asymmetry in a return distribution, and in the case of JEPY, the distribution of 1-day returns shows significant negative skewness. This negative skewness is a red flag, as it indicates that while small positive returns occur frequently, they are often punctuated by large, infrequent losses. Essentially, investors earn small, consistent premiums from selling options, but when the market drops unexpectedly, the losses can be disproportionately large. This negative skewness reinforces the inherent risk in the strategy: the fund collects limited, capped premiums in stable or rising markets but is exposed to large downside risks in falling markets. Investors relying on historical average returns may miss this critical detail, potentially underestimating the severity and frequency of losses in more volatile environments.

This pattern is consistent with the fundamental structure of selling put options, where the payoff is capped on the upside but has theoretically unlimited downside, making the fund highly vulnerable during periods of market stress or volatility spikes.

Increased Volatility Risk

One of the key determinants of option premiums is volatility. Higher volatility means higher premiums, which in theory should benefit premium sellers like JEPY. However, increased volatility also heightens the risk that the market will make large adverse movements. A sudden market drop can push the underlying index far below the strike price, quickly wiping out the premiums collected and resulting in large cash outflows.

The fund’s daily goal of earning a minimum income of 0.25% from options selling is predicated on being able to sell premium at favorable rates. During periods of low volatility, achieving this target may force the fund to take on more risk by selling options deeper in-the-money (ITM), thus increasing its exposure to market downturns.

Short-Term Focus and Frequent Trading Risks

By its very nature, a Zero DTE strategy relies on extremely short-term trades. The JEPY fund frequently sells put options with expiration periods ranging from one day to a week, which allows it to generate income from the time decay (theta) associated with these options. However, frequent trading can increase transaction costs and portfolio turnover, which can erode gains over time, particularly in unfavorable market conditions.

Moreover, because these options are so short-term, the margin for error is razor-thin. A single day of unexpected market movement can have a disproportionate impact on performance.

Counterparty and Liquidity Risks

ETFs like JEPY also face counterparty risk due to their reliance on derivatives. As the fund transacts in options, it depends on clearing members to ensure the integrity of trades. If a clearing member fails or experiences financial trouble, the fund may not be able to execute its strategy as planned, which could lead to significant losses.

Liquidity is another concern. The short-term nature of the contracts and the fund’s niche strategy could mean that options positions are harder to unwind during periods of market stress, exacerbating losses.

Taxation Considerations

For investors, it is also essential to consider the tax implications of distributions from a fund like JEPY. The fund’s distributions are generally taxable as ordinary income, which may not be advantageous depending on your tax situation. Because of the frequent trading and turnover in options, investors may also incur more short-term capital gains, which are taxed at higher rates than long-term gains.

Conclusion

Premium selling Zero DTE ETFs like JEPY offer an appealing promise of steady income, especially in low-interest-rate environments. However, the risks of significant downside exposure, increased volatility, short-term trading pitfalls, and counterparty and liquidity risks make these funds a double-edged sword. Investors should be fully aware of these risks before diving into a strategy that may not just cap their upside potential but expose them to substantial, potentially unlimited losses.

Investors who are not comfortable with actively managing these risks or understanding the complex dynamics of options markets may want to consider alternative, less risky ways of generating income.