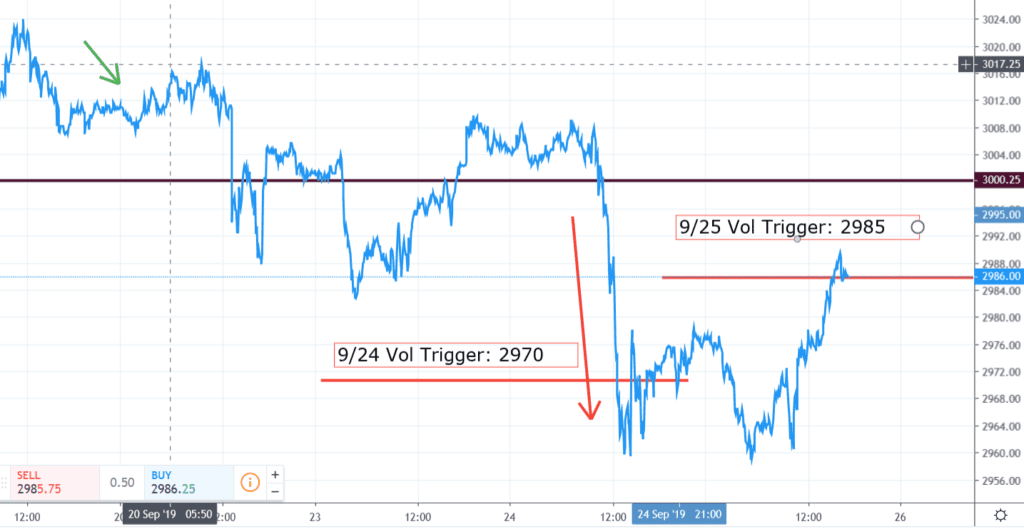

Going to Tuesday we noted 2970 as the 0 gamma volatility trigger and on Wednesday we pushed below that volatility trigger level indicating we should see some large moves in the SPX. The chart of the past two days in ES futures is here:

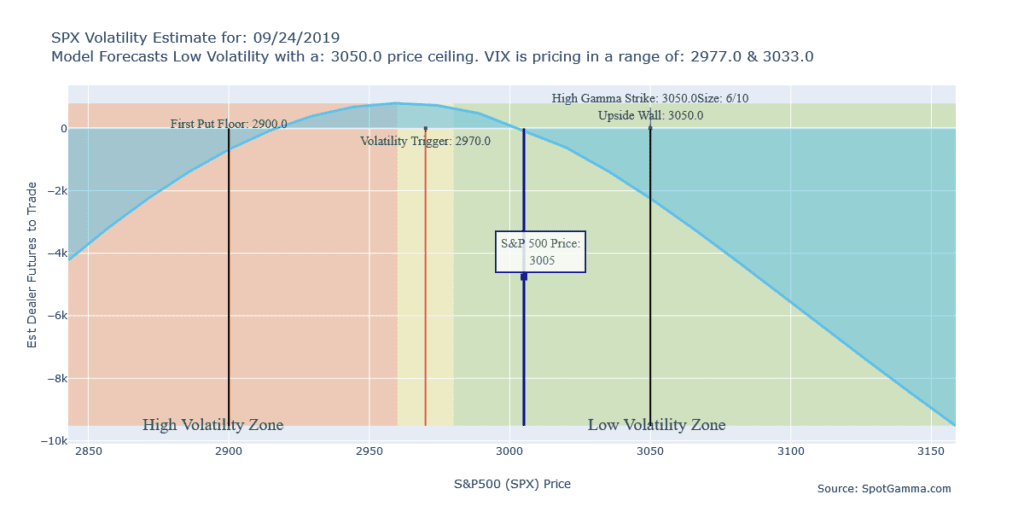

Here was our gamma run from 9/24:

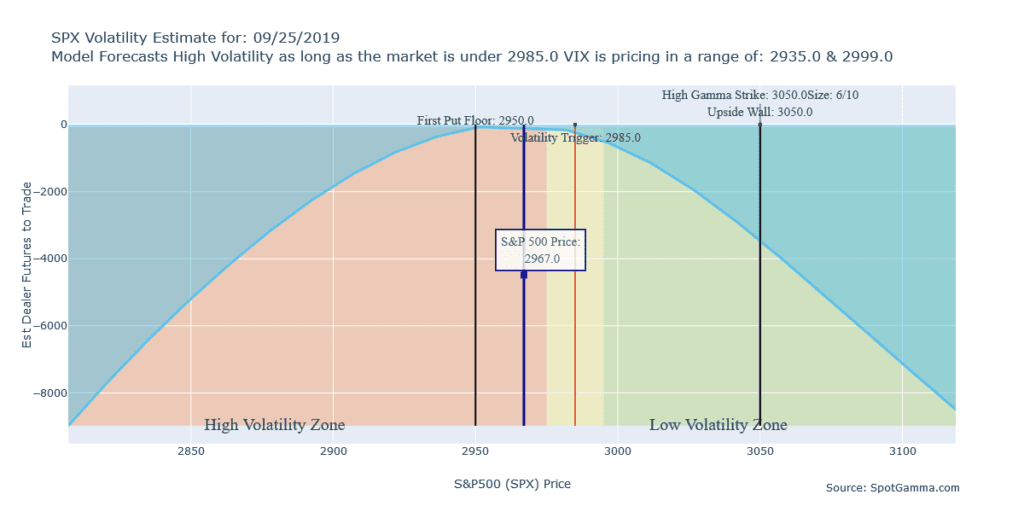

After the close on 9/24 we calculated the gamma had shifted providing support at 2950 but also a new volatility trigger level of 2985. The shift up in the volatility trigger indicated dealers would help push any rally up to 2985. This is because if dealers are short gamma they trade WITH the market, selling as the market drops and buying as it rises. At 2985 they shift to 0 gamma, and over 2985 they start to sell into rallies.

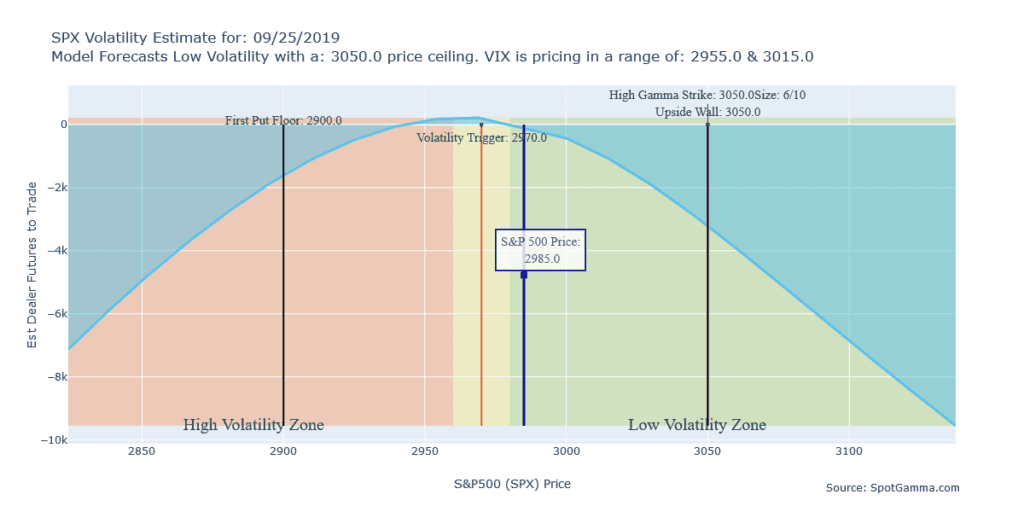

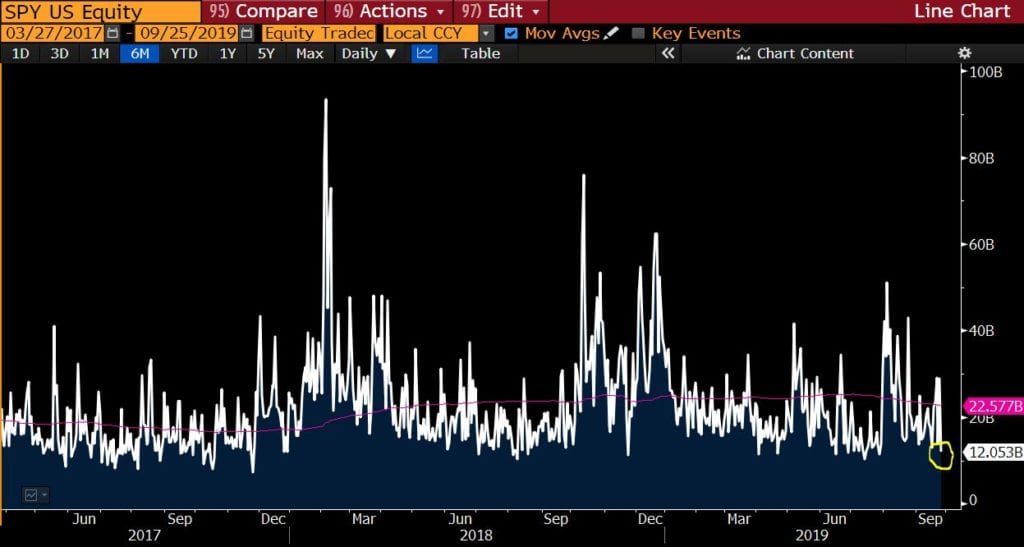

Because of this 2985 was a good resistance level on any light volume rally. Light volume is what we got as shown here:

As it stands at the close on 9/25 we are at 2985, with the volatility trigger shifting back down to 2970. We’re therefore showing dealers are long a bit of gamma here. We show options based resistance at 3000 with support at 2950.