An interesting quote – one of many from the book. I believe pertains greatly to market gamma and what we are trying to model. These were pulled from a great twitter thread, linked at bottom.

“LTCM’s basic error was believing its models were truth,” Patterson says. “We never believed our models reflected reality — just some aspects of reality.”

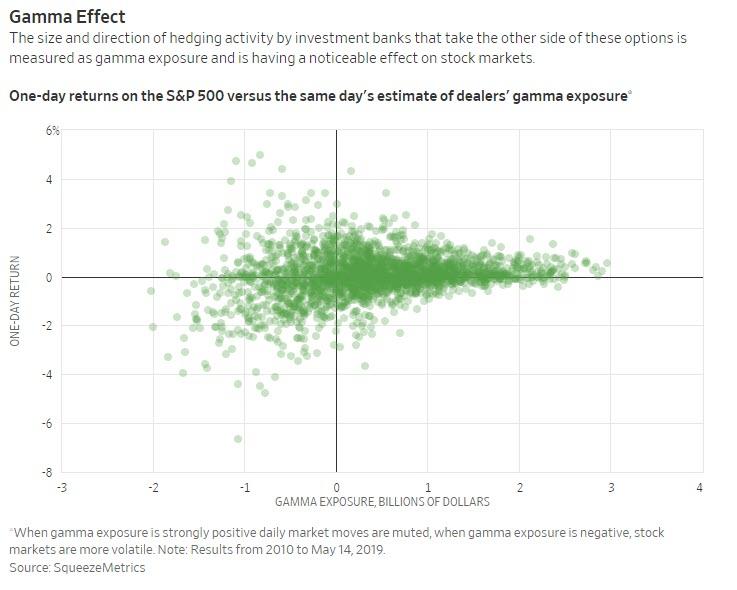

Many take issue (rightly so) with the basic premise that we assume all call options are bought by dealers and all put options are also sold to dealers. Said another way: customers are selling calls and buying puts. Obviously this cannot be 100% true. It is also impossible to know where and how contracts are hedged, and when market makers do their hedging. Yet the data produced by the calculations based on these assumptions produce compelling results. Its not capturing total reality – just some aspects.

1/ The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution (Gregory Zuckerman)

— Darren (@ReformedTrader) November 10, 2019

Thread with quotes from the book and links to related podcasts and articleshttps://t.co/t4zLWCJ5Ck pic.twitter.com/E8ivBXrhDW