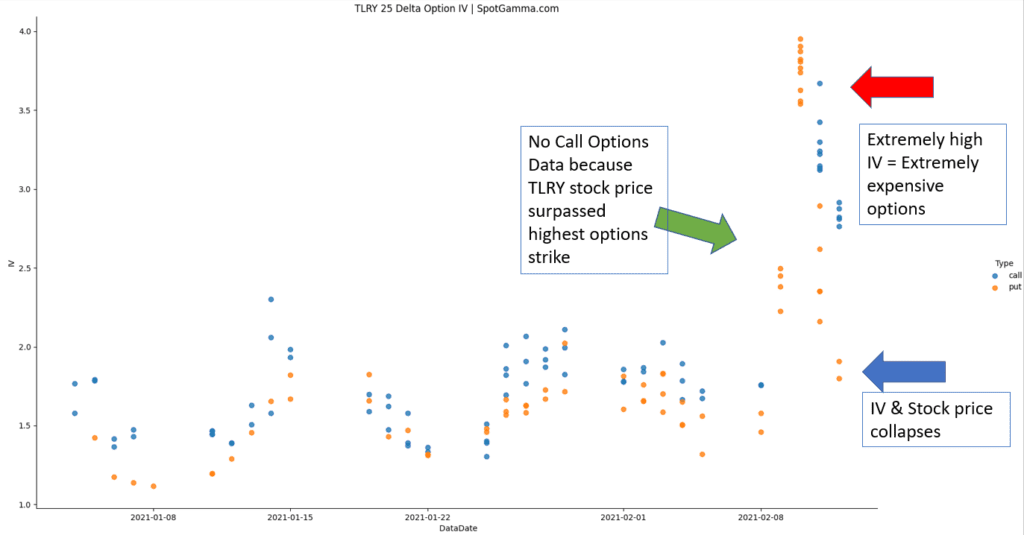

When a stock trades higher at a very rapid pace the price of the stock can pass the highest available options strike. For instance, at the start of the day on 2/9/21 the available call options strikes for Tilray (TLRY) ranged from ~5-$50. However the stock ripped over 50%, passing the 50 strike.

When a stock (like $TLRY) runs out of call strikes, the leverage mechanism driving these stocks is reduced. Lots of call buying can produce a gamma squeeze as when traders buy call options dealers (who are short call options) must hedge with buying stock. When the stock surpasses the the highest available call strike, that reduces the number of call options available, which reduces demand.

As you can see in the chart below, there was no available call data (blue) for out of the money strikes. The next trading day when new calls were made available they came a tremendously high implied volatility levels. This means that they are very expensive to purchase, and this can functionally limit demand.

This pause gives options dealers the opportunity to unwind their large stock hedges, and as the stock starts to sell off, dealers can sell more and more stock. This creates the “round trip” stock action seen in the chart above wherein TLRY trades from 28->64 and back to 28.

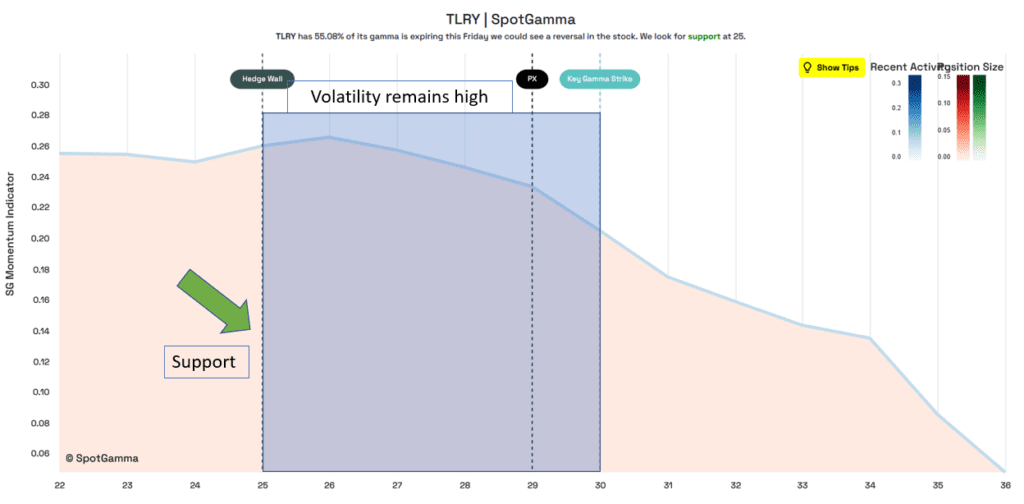

Our EquityHub model suggests that key support for TLRY forms at $25, with the stock remaining very volatile while between $25 support and $30. If call volume rebuilds and the stock can break up into $30 there could be another large spike in the spike, therefore $30 isn’t as much of a resistance point as a “refueling” point where we could see a “gamma squeeze”.