In a recent Member Q&A session SpotGamma discussed how traders can analyze implied volatility and potential stock movements by comparing the relative moves and reaction of stocks in similar sectors. Here we look at the volatility & setup into SMCI’s earnings report, and its subsequent reaction, to guide us on what may happen for AMD […]

implied volatility

TSLA Volatility Falling Despite Being Down 10%

TSLA is down 10% after earnings, and our data is suggesting that if anything, TSLA options are now cheap! One would think that may lead to an increase in options implied volatility, as the implied move was just 6%. You can see this in the legend in our earnings dashboard, below. This shows us the […]

Subscriber Webinar: Implied Volatility & The Release of The IV Dashboard

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

Next Week’s Fed Meeting May Create Massive Moves In The Market

The following is a guest post courtesy of Michael Kramer of Mott Capital Management. Stock market volatility has picked up, and it may only be starting. Investors are eagerly awaiting the next FOMC meeting on January 26 to try and gauge which way the Fed may choose to go in its fight with inflation. With […]

How Changes in Implied Volatility Pushes Markets Around (aka the Vanna Trade)

Brent, Founder of SpotGamma, explains how the “Vanna Trade” works. As implied volatility changes, options dealers may have to adjust their hedges. Brent explains how this hedging flow can create large rallies or selloffs in markets. He also touches on the topic of charm, or the change in hedging delta due to time decay.

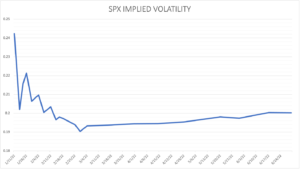

Implied Volatility Reading in the SPX & VIX

Brent Kochuba, Founder of SpotGamma, joins Imran Lakha of Options-Insights to talk about the current volatility readings in the SPX and VIX. This covers both realized and implied volatility which are shifting ahead of a large options expiration.

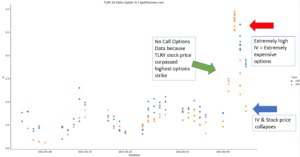

TLRY & Pot Stock Gamma

When a stock trades higher at a very rapid pace the price of the stock can pass the highest available options strike. For instance, at the start of the day on 2/9/21 the available call options strikes for Tilray (TLRY) ranged from ~5-$50. However the stock ripped over 50%, passing the 50 strike. When a […]

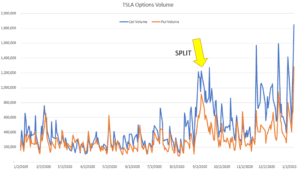

TSLA Options For Sale

The week ending 1/8/21 saw a record high in TSLA options volume, with the stock surging nearly 20%. Traders have been flooding into weekly options as the way to express their views on the stock which was just recently added to the S&P500 Index. We view increased buying of call options as a driver for […]

SPX Options Vanna Rally

Recently we have been discussing with subscribers the elevated implied volatility in the S&P500 due to the 1/5 election events. The VIX is a decent measure of implied volatility in the S&P, and you can see that despite the market being at all time highs, the VIX was well off lows. Our feeling was that […]