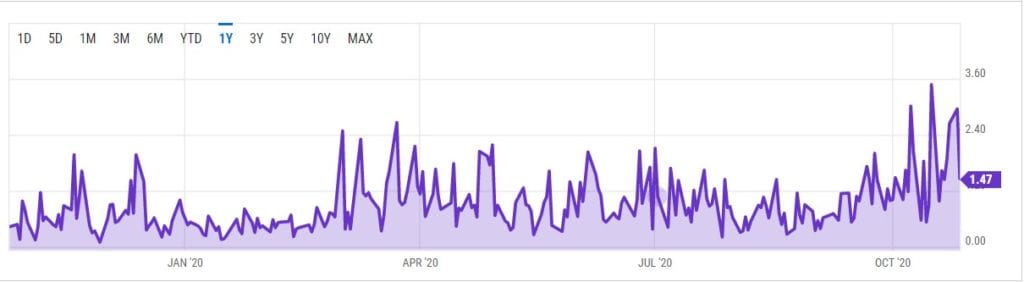

Shorting VIX has been the big pre election play, and we noted recently during market draw downs that VIX put volumes have increased. This indicates VIX sellers are taking advantage of higher VIX prices to bet on a collapse in volatility. Today we note the S&P is down ~3% and the VIX Put Call Ratio is 1.8 (as of 2:30EST).

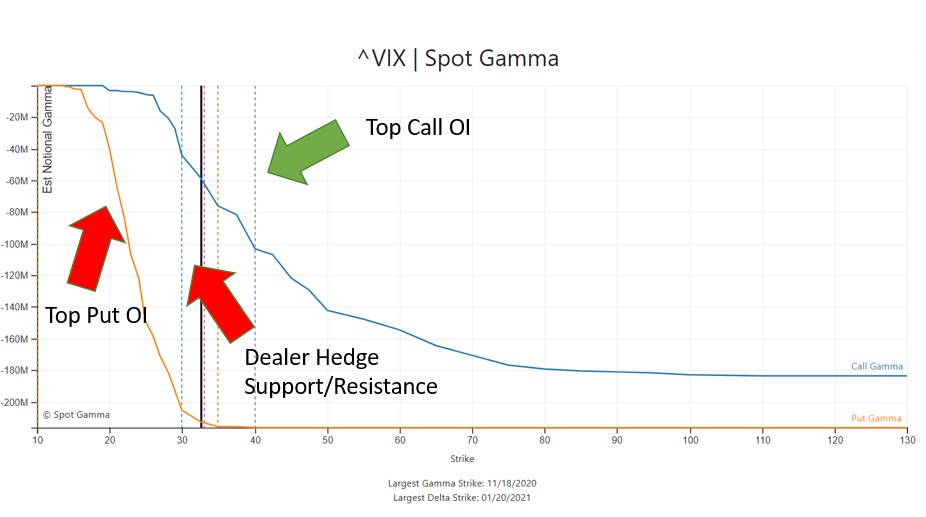

Our EquityHub data shows that puts are heaviest down at the 20 strike, but our model picks up the key dealer level at the 30 strike. This infers that a break of 30 will unleash shorting pressure in VIX. To the upside the 40 strike is the largest call strike.