by Tyler Durden of ZeroHedge

Tuesday, May 16, 2023 – 03:05 PM

In February, JPMorgan’s Marko Kolanovic dropped his now infamous warning that 0-DTE options trading will lead to Volmageddon 2.0 :

“these options are net sold by directional investors, and supply of gamma is likely causing a suppression of realized intraday volatility… if there is a big move when these options get in the money, and sellers cannot support these positions, forced covering would result in very large directional flows.”

So he is saying that 0DTE suppresses vol (Minsky-like) artificially which could lead to the Minsky moment of Volmageddon on a big directional move with low liquidity because, he claims, 0-DTE is all one-sided…

BofA strategists responded shortly after in February agreeing that 0-DTE suppresses vol but highlighting the nuance that the vast majority of these lottery tickets expire worthless (and this don’t have the bleed over into a systemic gamma impact) – 0DTE options could – in theory – be “weaponized” in the future to exacerbate intraday fragility and/or mean reversion:

“thus far the evidence presented above suggests that SPX 0DTE option positioning is more balanced/complex than a market that is simply one-way short tails.”

In fact BofA strategists said that:

“The 0DTE space has likely absorbed the initial demand impulse but has also drawn in more sellers.”

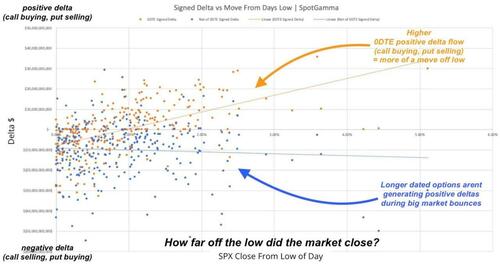

SpotGamma also jumped into the debate in February, saying that the explosive rise of 0DTE options has actually acted as a positive market force:

“0DTE does not seem to be associated with betting on a large downside movement. Large downside market volatility appears to be driven by larger, longer dated S&P volume,” Kochuba said.

“Where 0DTE is currently most impactful is where it seems 0DTE calls are being used to ‘buy the dips’ after large declines. In a way this suppresses volatility.”

Simply put, SpotGamma’s experience shows that the idea that most 0DTE is being net heavily sold is incorrect.

“There seems to be a desire to package 0DTE flow as “all retail” or “all sellers” but we believe it is a mix of strategies and entities (funds, retail, dealers).”

“The risk from 0DTE (in our view) comes from a heavy imbalance (ex: too many non-hedgers short downside). We think a lot of 0DTE is one dynamic-hedger trading with another dynamic hedger, and/or underling replacement (i.e. buy calls instead of long stock).”

In March, JPMorgan’s quant group added some more color by confirming that 0-DTE is not retail players (which was Kolanoivic’s fear – retail muppets driving intraday chaos leave dealers with gamma exposures that could cause Volmageddon).

While they go out of their way to defend a possible massive downside move (on total market liquidation), they “do not observe a significant pickup in retail participation” since CBOE first made daily options expiry available to investors last year. In fact, they find that only around 5% of the SPX 0DTE options are initiated by retail.

And SpotGamma’s Brent Kochuba noted at the time that their scary scenario analysis assumes a static market environment.

“We’d anticipate that a large number of traders would rapidly adjust positions into a sharp decline,” said Kochuba.

The point here is that Kochuba explains as portfolios add equity exposure, the need for meaningful hedges should increase, in turn. This adds volatility-potential during market downturns, possibly in a way which wasn’t seen in the back half of ’22. During times of fear and volatility driven by “real money” hedging, we suspect those 0DTE flows will suddenly subside.

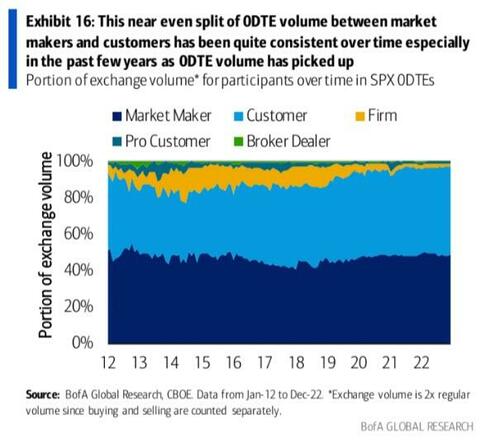

BofA’s global quants jumped in last week showing that evidence continues to mount in favor of their previously established view that positioning in SPX 0DTE options has thus far been generally well-balanced, rather than a one-sided market overrun by sellers (or buyers).

While they are well aware of the risk that investors panic sell (or buy) equities intraday, in what is already a fragile market with thin liquidity, out of fear that 0DTEs are moving the market (similar to the fear-induced selling in Aug 2015 driven by the perception of massive quant-fund deleveraging that Kolanovic feared), and thus cannot rule out the risk of a 0DTE-related intraday “accident” if the stars align; the evidence so far points to a market with diverse participants, a wide array of use cases, and ultimately imbalances that have been manageable from a risk perspective.

In fact, the near even split of 0DTE volume between market makers and customers has been quite consistent over time, especially in the past few years as 0DTE volume has picked up

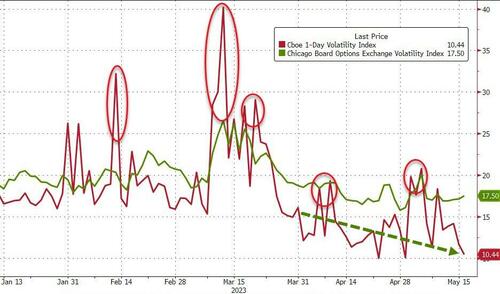

And most notably, since Kolanovic’s fearmongering in February we have seen numerous days of extreme 0-DTE vol expansion (around CPI, FOMC, or payrolls event risk), with little to no bleed over at all into the mainstream market…

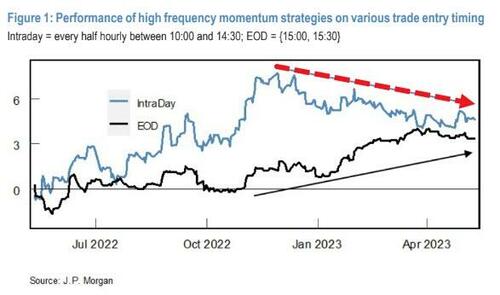

And now, no lesser analysts than JPMorgan’s quant group themselves, note that the interplay of zero-day stock options – fast-expiring contracts whose use exploded in the last year – and more conventional longer-dated ones is combining to dampen big and decisive moves in the broader market.

A possible consequence, they argue is the roughly 150-point trading range that has prevailed in the S&P 500 since March has gotten harder to break out of.

So, instead of Kolanovic’s ‘Volmageddon’, JPMorgan’s quants have observed more intraday reversal behavior (which matches SpotGamma and BofA’s findings).

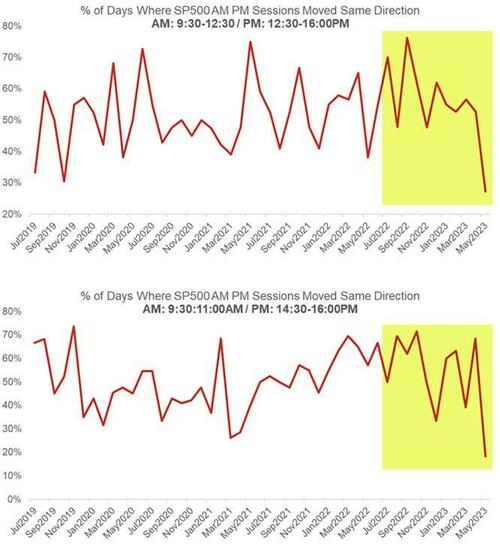

Interestingly, Nomura’s Charlie McElligott also opined on 0-DTE today, pointing out that the share of sessions during which US equities move in the same direction in morning and afternoon trading has plummeted.

“Traders are selling ODTE puts into selloffs to fund free cheap same day calls, which has been arresting deeper morning selloffs and in turn assisting equities as they have often reversed and rallied off morning lows thereafter,” McElligott said, adding that there are myriad reasons why markets are moving away from momentum and towards the reversal dynamic illustrated above by JPMorgan’s quants.

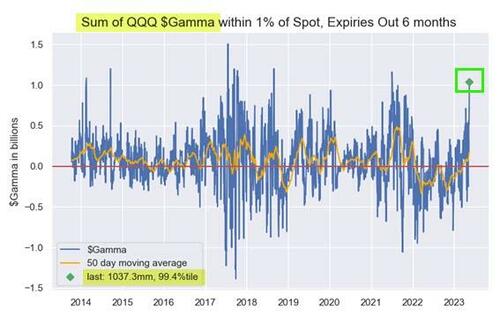

Market participants are “willing to short vol again as the Fed cycle seemingly turns, which is seeing dealers stuffed long gamma in longer dated options as well” McElligott went on.

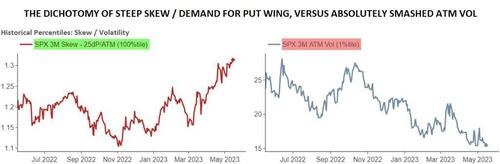

And yet, as we noted last week, there’s demand for left-tail protection again, given the sheer number of prospective catastrophes waiting to “realize” including the debt ceiling drama in D.C., the war, the banking stress and generalized geopolitical friction.

The result, according to McElligott, is a “moneyness” juxtaposition. Sharpes for systematic vol-selling have been high thanks to and because this is very self-referential, because of the dynamics pinning spot in a narrow range, but fear of various worst case scenarios is driving demand for “crashy downside”.

What all of this lengthy and complicated post shows is that no one is really sure how this all works and the potential interplay between 0-DTE options trading and the rest of the market, but as we previously noted, we have a couple of thoughts on all this:

Of course the market is unstable: that’s hardly news; in fact the market has been fragile and illiquid since the start of QE1, and has only gotten worse the more central bank intervention it benefited from over the years. But that fragility was a double edged sword since any resulting selloff would prompt the Fed to intervene. In fact, some bulls should hope that Kolanovic is right because a market crash would only precipitate a faster end to tightening and QT and lead to a far more powerful and sustainable rally. Another point is that we have seen 0DTE aggressively expand its presence for the past 3 years, so far without any dramatic consequences; and while it is certain that one day we will have Volmageddon 2.0 (whether due to 0DTE or something else), it could be tomorrow or it could be in one year, and by then the S&P could be at 4,500… or 5,000… or 6,000. One thing is certain: now that he is in full-blown bear mode again, don’t expect Marko to tell you when stocks will rise, only that they will fall (eventually), and if one week, or one month, or one year from today stocks are (much) higher, the Croat will have a detailed and convincing explanation for why the rally simply refuses to end (as it has so far). If only he also had a just as convincing way to make his clients some money…

Expect the intraday noise to increase, but not the volmageddon risk.