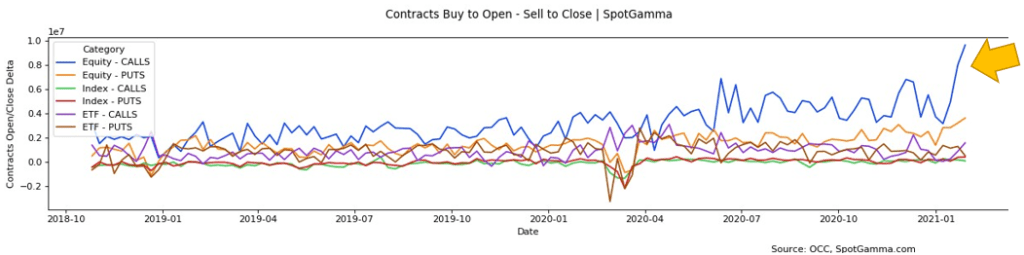

The latest options data revealed that equity option call buying surged this week, blowing out the previous record week. Shown in the chart below is the total number of contracts bought to open netted against contracts sold to close. This suggests that traders on net did not elect to close out of their long calls this week, but in essence doubled down. We think much of this activity is the desire of traders to play these surging small cap names like GME, AMC and WKHS. This buying comes at a time when the price of these options has risen exponentially (an example of this is at the bottom of this post).

The other thing of note in the chart above is that Index option put activity (red line) increased and Index call option activity (green) decreased. Generally, we view Index options as being a barometer for large fund activity, particularly when it comes to hedging downside risk. Larger Index put activity is not particularly surprising given how weak markets were on Thursday and Friday, but it implies large funds are hedging downside risk at the same time equity options traders are increasing upside risk.

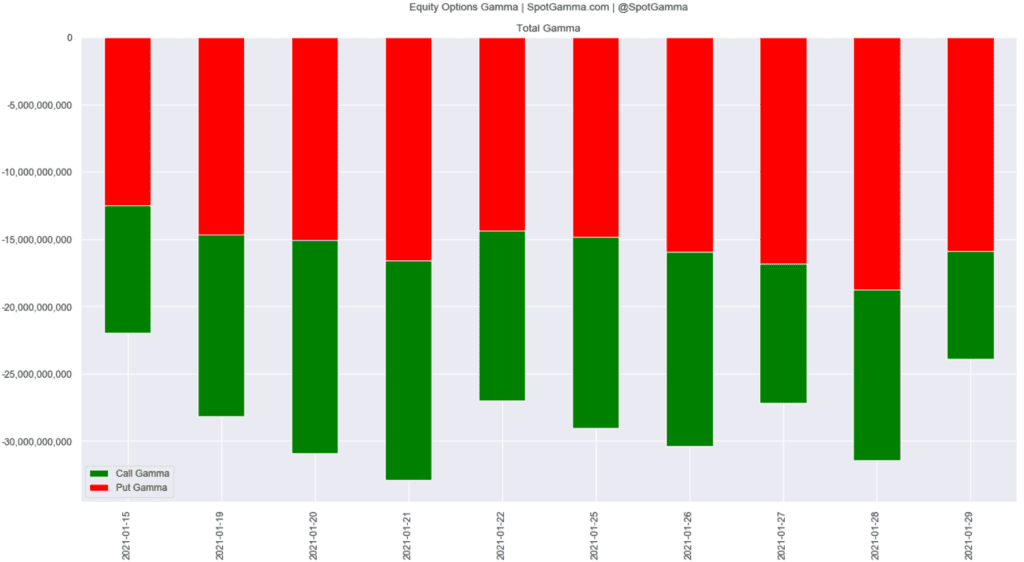

Despite the addition of many new equity call positions, equity call options gamma levels (in green) dropped. This implies that most of those new call positions were out of the money options, as out of the money options have lower gamma levels. Less gamma also means it’s likely that options market makers have less hedging to do as well.

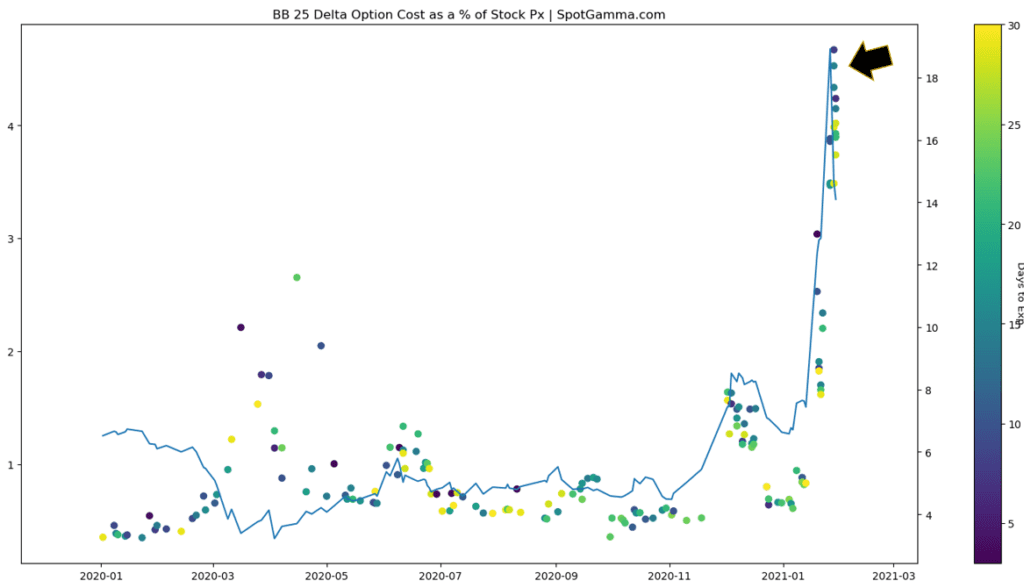

Traders are likely to have to buy farther out of the money call options because the cost of many of these call options surged this past week. As volatility in a stock increases the cost of options increases, too. As an example we’ve provided this chart below of BB (Blackberry), which was a popular “weaponized gamma/squeeze play” this week. This chart shows us across time the cost to buy a slightly out of the money option, and we show it as a percent of the stocks price.

Back in the summer of 2020 a trader could spend <1% of the stock’s price to purchase an option which represented 25 shares (aka 25 delta) of BB stock. The cost of that same bet surged to well over 4% this week. Recall too that this price of this stock rocketed higher (like many of these retail squeeze plays). Therefore, a trader is paying 4x more for this option at a time when the stock is 4x higher in price.

What’s therefore happening is that traders are buying calls at prices that are exponentially higher as these meme stocks prices rise exponentially higher. They are also buying options into the prospect of brokers halting trades and adjusting margin requirements. It is certainly possible a lot of this volume is from sophisticated investors hedging (short stock vs long calls), but there is plenty of evidence that indicates a great deal of retail speculative activity.

Many are now aware of the “gamma squeeze”, which we coined as Weaponized Gamma, wherein traders buy long calls, forcing options dealers to hedge by buying stock. However, if traders keep paying exponentially higher prices for these calls at some point the probability of ever getting a return on that call option drops towards zero. The more expensive call options relative to price (recall the BB chart above) may mean that market makers need lower amounts of stock to buy as a hedge. As the very expensive options decay and lose value, dealers then shift to being sellers of the stock as their long stock hedge requirements decline.

The “unknown” here is the size of demand for buyers to keep buying the underlying stock. However, as the price of a stock rises (and if margin requirements increase) that eliminates buyers particularly on the retail side (i.e. there are more people who can buy a $20 share than a $300 share).