### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

GME

GME Options Implode – The Tax of IV Decline

$GME vol has totally faded, just like the interest in @TheRoaringKitty twitter feed (sooo many video clips – that can’t be him posting). Anyway, here we see the peak in 1-month IV at +340% on Tuesday (yellow) when the stock hit >$60. Stock up, vol up. Now the IV’s (and GME’s stock price) have come […]

The Setup for a Gamma Squeeze in GME

Here we identify the options setup needed for a gamma squeeze in a stock like GME. Using our EquityHub we analyze the existing options position, and then look for signs of strong live options orderflow via our HIRO application. Specifically, you want to see large open interest at call strikes just above where a stock […]

GME Pinning Options Levels After a Huge Rally

On Friday Brent was joined by Saad from ShiftSearch to analyze the >20% rally in GME last week. They discussed why GME was ripe for a pullback, and why $120 was the big level of support for today, Tuesday May 31st. Below you can see how that $120 level has acted as major support today. […]

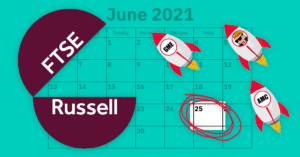

Will GME (GameStop), AMC Or Other Meme Stocks Be Included In Russell 1000?

Every June, the Russell Index rebalances by removing stocks that no longer meet their criteria. After a wildly popular start to 2021, will meme stocks like GME and AMC get added to Russell this year? Many traders are starting to discuss the upcoming Russell Index rebalances, and the prospect of GME, AMC or other meme […]

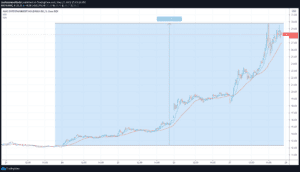

AMC RKT Gamma Squeeze: “Escape Vol-ocity!”

AMC, RKT and other meme stocks are ripping higher due to an options gamma squeeze. As traders buy call options, options market makers must buy stock to stay hedged. We believe this hedging flow is whats causing massive stock moves. AMC is up nearly 140% this week alone. As you can see the stock hit […]

GME Getting Squeezed…Again?!?!

GME may be setting up for another options gamma squeeze as it approaches June 8th earnings. While GameStop stock is pushing higher, the cost of call options are very high, which may cap some of that gamma squeeze.

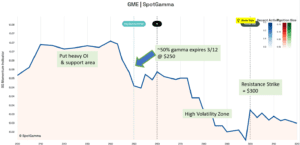

GME Gamma Squeeze Update

Yesterday we added a video which provided an update on our GME gamma squeeze model. We noted that some 50% of total GME gamma was set to expire at the close of trading on Friday, March 12th. The strike with the largest gamma position was the $250 strike, with most of that held in puts. […]

GME Gamma Squeeze: Round 2

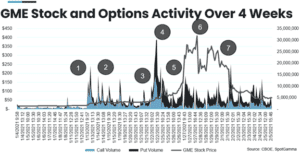

GME Gamma Squeeze – What Happened? Yesterday GME saw another massive price move with the stock ripping over 100% from $45 up over $160 in after hours trading. This move was likely fueled by an options gamma squeeze as we’ll explain here. First, note the existing options positions in GME, from the day prior to […]

The GME Gamma Squeeze

In late January 2021, GameStop experienced a once-in-a-decade squeeze that has captivated the world’s attention. This was a premeditated and programmatic exercise, orchestrated by coordinated stock and option buying across the retail and professional community, that resulted in large institutional entities losing billions of dollars. These investment houses with significant short positions did not expect a stock with […]