Global markets are a mess, and there seems to a be a distinct possibility that we see a market closure of some type before this calm. The NYSE and CBOE are closing their trading floors (where humans congregate) due to coronavirus but their electronic exchanges will remain open.

Here is the quick summary if you are short on time:

- Exchange halt or some type of closure with “little/no advanced warning” (ex: circuit breaker): use the following days opening price

- Closure given advanced notice (announced market holiday) appear to use the following trading days closing price

What happens to Options if the Exchanges Close?

Fortunately we have an updated memo from the OCC (Options Clearing Corp) to clear this up. It is a bit confusing how the exchanges may delineate what type of closure we have, so please speak with a broker or exchange if these scenarios are of particular importance to you.

If there is a sudden outage, like chipmunk eats a wire (it happened once):

Equity/ETF Options: “The OCC will apply OCC Rule 805 in assigning a settlement price. OCC Rule 805 permits the use of the last available sale price during regular trading hours on the most recent trading day for expiration processing for equity and ETF options.” 805

Index Options: “settlement prices for cash settled index options shall be determined by a panel(s) of exchanges in the event that exercise settlement amounts are unavailable.”

If there is an unexpected closure:

I am posting this directly from the OCC as its a bit unclear what “advanced notice” is versus “little to no advanced notice”:

Unscheduled Market Closure with Little to No Advanced Notice – Index Products In the event of an unscheduled market closure that is announced with little to no advanced notice of the closure, it is anticipated that the SOQ settlement price from the next trading day following the closure will typically be used for expiration processing.

This “unscheduled” closure is not a circuit breaker. Specifically they note a market circuit breaker (usually down 20%) that halts trading for the rest of the day may use the SOQ price, too.

The SOQ is the index calculated opening price of the next day.

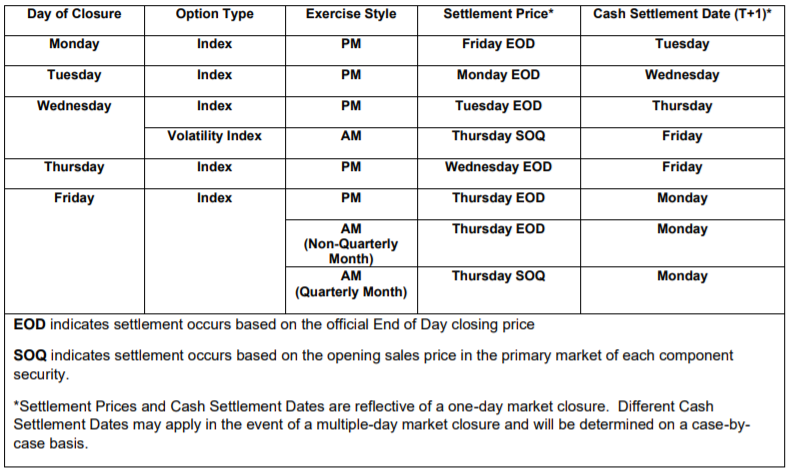

Unscheduled Market Closure with Advanced Notice – Index Products In the event of an unscheduled market closure that is announced with some advanced notice, such as would be expected for an unscheduled but officially declared holiday, it is anticipated that the following settlement prices will be used for expiration processing:

We will update this if we get clarity on things, such as what qualifies as “advanced notice”. Questions? Email us.