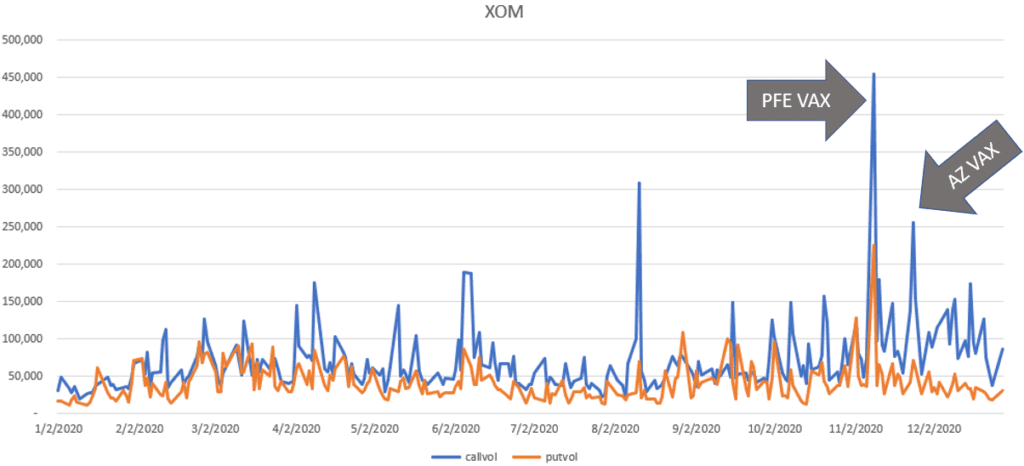

XOM stock has bounced sharply since November as positive news regarding Covid vaccines sparked a relief rally.

Much of the way traders expressed their bullish sentiment was in call buying, with 11/9 seeing an incredible surge in XOM calls – but this was also seen in other “back to normal” stocks like Carnival Cruises (CCL). With lack of further clarity around when things actually get back to normal, this call volume was subsided, and the stock is hitting resistance.

Note the chart here which shows XOM vs the preeminent “stay at home” stock, ZM. The 11/9 vaccine news drove a sharp dichotomy in performance.

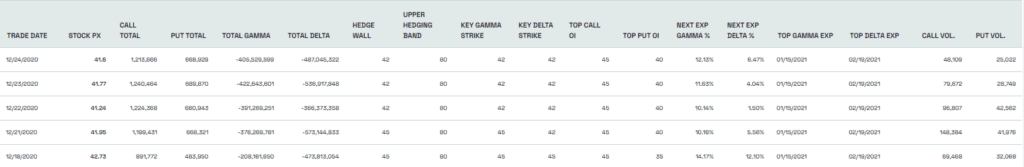

This rapid call activity has greatly changed its options profile over the last several weeks. You can see in the table below that call volume has greatly outpaced put volume over the last five days.

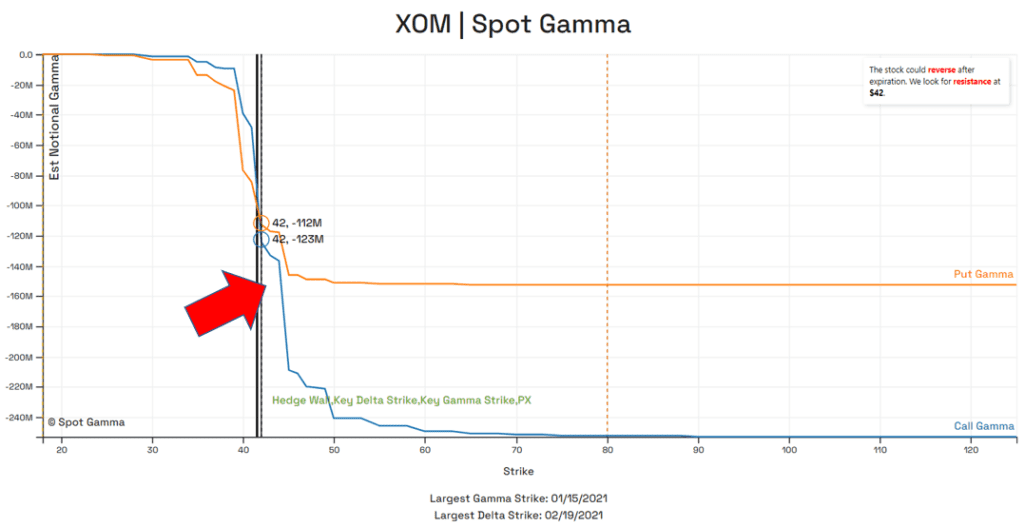

What is interesting is that despite this heavy call volume the stock has not shifted much higher. Our models indicate $42 as a heavy resistance area due to the concentration of options positions at the 42 strike.

This 5 day chart below that the price rejected several tests of $42, and the stock may further consolidate until more clarity arrives around the country re-opening. Mix in the GA elections which could spark some charging political winds in regards to the oil industry which furthers our view that XOM’s run is due to pause.