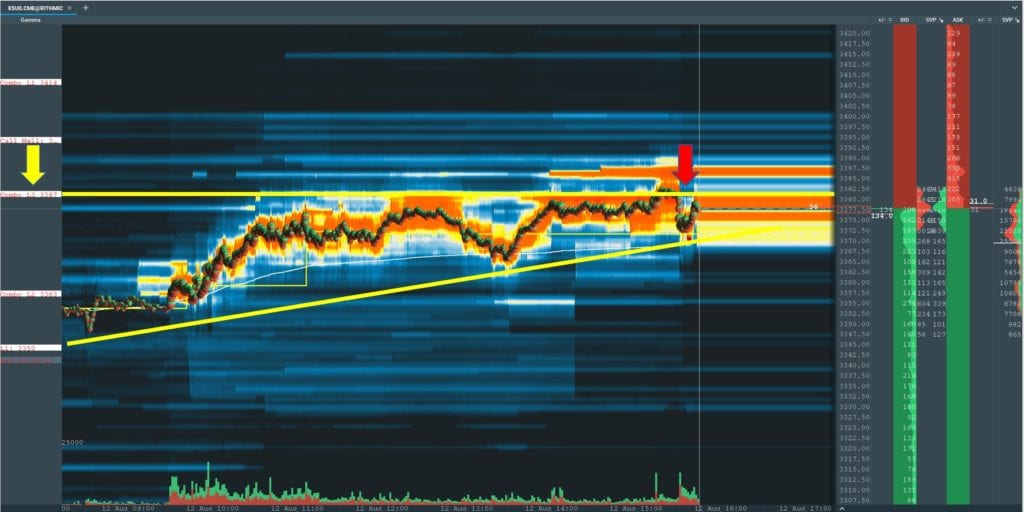

Today provided an excellent example of key resistance at an important options level in the SPX/ES. As you can see the market had a consistent bid from the open right into our 3387 SPX level (yellow arrow, left). The market spend much of the afternoon up against that resistance area, and finally rejected it towards the close of trading.

Our view here is that hedging flow is capping the market here, but light buying volume creates a “pin” area of sorts as the flows match at the 3387 price area. As soon as buying volume releases (red arrow, at right) you see the options related flow push the market lower. When that hedge volume pulls back we see a mean reversion back to the 3387 price area.