In this episode of the OPEX Effect we discuss how the stock market turned right at February VIX expiration resulting in a 10% SPX market crash into this weeks massive March OPEX.

Brent flags how put values are “maxed out” into OPEX, and why that dynamic combines with 5,500 – 5,565 as a major support zone into March 31st.

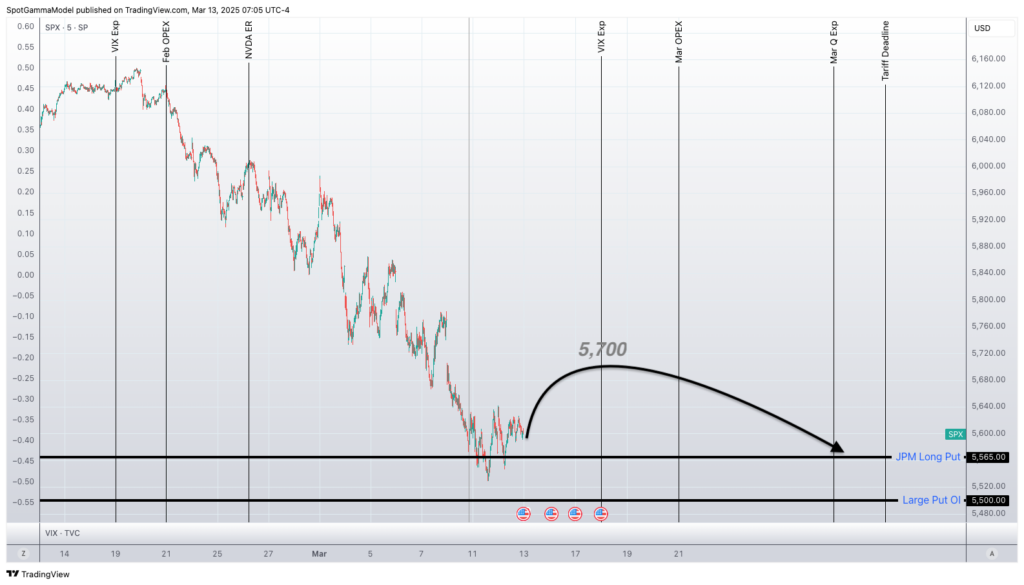

These options market flows led us to call for a short term market rally this week, with our Members receiving this note & chart on Thursday:

“That [options positioning] leaves us looking for a path that mirrors the one plotted below, wherein the SPX can stage a ~2% rally into the at 5,700 area before being pulled back down into the 5,550 area into expiration(s).”

Read Thursday’s Founder’s Note free, here.