Volatility announced its return last week as the S&P 500 swung across intraday trading ranges of 150+ handles. SPX tested both the 6,550 and the 6,700 key levels we mentioned in our AM Founder’s Note on Monday before closing up 1.7% for the week at 6,674.

Persistent negative gamma set the stage for heightened realized volatility, as dealers hedged with price action rather than against it — removing a key ingredient for market stability over the past four months.

Equally important is that this past week delivered the expected vol normalization after months of significant imbalance: VIX closed at 21 and short-dated IV spiked, largely ending the discrepancy between longer-dated and shorter-dated vols.

However, the fact that we’re only down ~1-2% from all-time highs with VIX above 20 tells us everything about the underlying tension. Stabilizing dealer positioning has been significantly reduced from Friday’s October OPEX, and we see negative gamma across much of the SPX 6,500-6,700 range.

There is a fair amount of positive gamma centered around SPX 6,650 that should help anchor the market somewhat. However, below that level we see increasingly negative gamma through 6,330 where the massive 12/31 JPM Collar resides.

The GLD Game: Last Week’s Shorts Pay Off

Precious metals have been on a tear, breaking record highs with GLD up 60% and SLV up 76% year-to-date. One of the most interesting stories from last week was SLV’s explosive 4% surge on Monday, driven by a historic short squeeze. Silver prices soared above $50/oz, surpassing the infamous 1980 event orchestrated by the billionaire Hunt brothers.

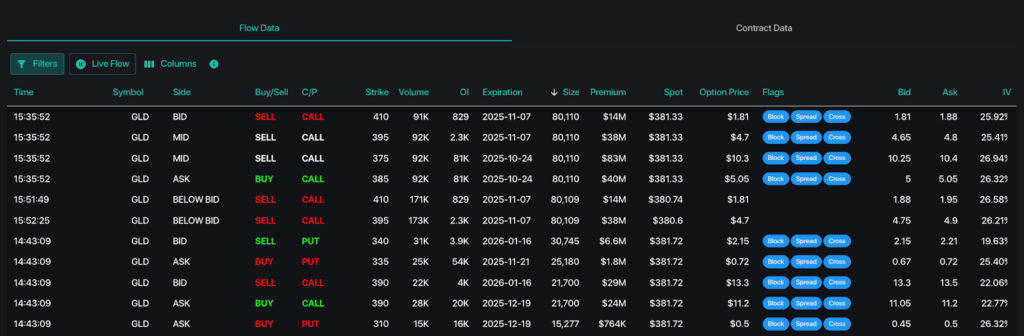

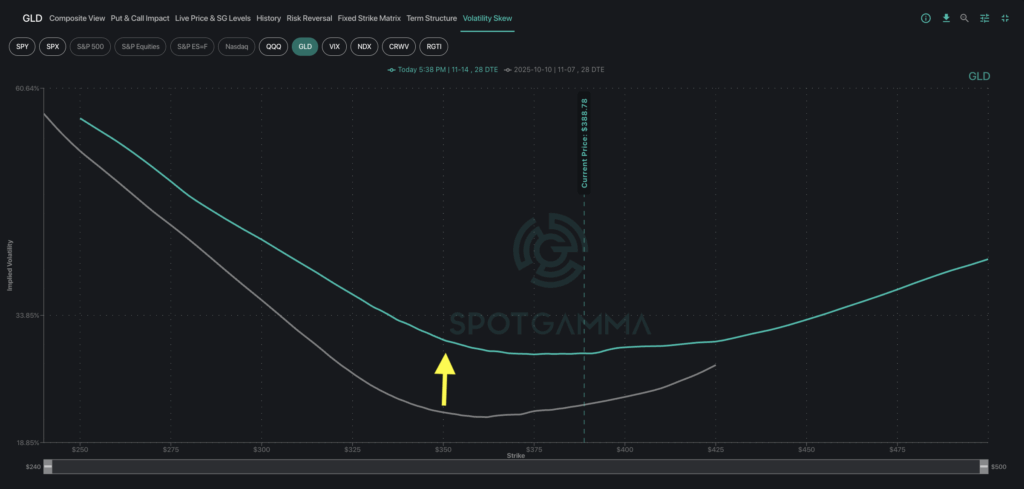

For GLD, traders both sold calls and bought puts on Tuesday and Wednesday — indicating the potential for a local top. GLD then fell into a “spot up, vol up” scenario where puts gained value despite the underlying price rising. This set up an interesting mean reversion trade, with GLD down over 3% from highs on Thursday evening.

The GLD 375 1-month puts were specifically called out in our subscriber webinar last week — and this contract gained 30% in just one week, fueled by rising IVs.

The Week Ahead: Navigating the Negative Gamma Regime

Next week presents a concentrated barrage of market events that could either validate last week’s recovery, or trigger another volatility spike:

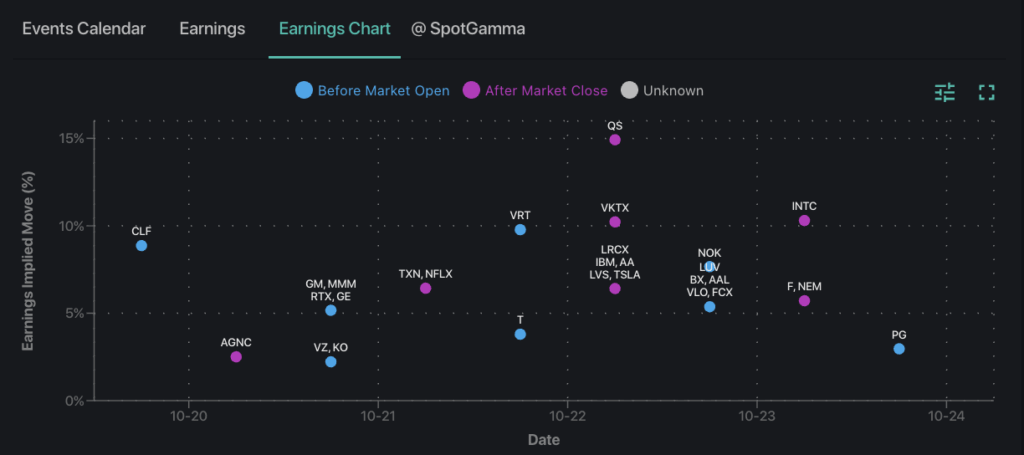

- Oct 21 (Tue): GE and NFLX earnings

- Oct 22 (Wed): VIX expiration, TSLA earnings

- Oct 23 (Thu): INTC earnings

- Oct 24 (Fri): CPI data

Earnings season intensifies with big tech names reporting throughout the week. Options markets are pricing in elevated implied moves (6% for NFLX and TSLA, 11% for INTC), suggesting traders are bracing for single-stock volatility to continue.

Wednesday’s VIX expiration could provide some vol relief as October VIX call holders monetize positions, creating tailwind for equities if volatility compresses.

However, Friday’s CPI report looms as the week’s most critical macro event, given the absence of most data points as a result of the federal government shutdown. We expect forward volatility to hold elevated premiums until this data prints.

For a deeper understanding of how volatility impacts options alongside other veiled forces from the options market, join us for Hidden Forces Unmasked on October 28 — where we will share exclusive access to five new tools designed to protect your PnL and optimize your trading.