The prevailing narrative with these large meme-stock movements is that entities like the wallstreetbets message board are responsible for amazing returns. Its a wonderful story of the retail “David” vs the Wall Street “Goliath”, and how these new forums are changing the long held dynamics of how markets work.

We certainly believe there is a retail “spark” to these large moves. However, there are many reasons to question this prevailing narrative that its primarily a retail-driven phenomenon. It is also challenging for retail to “beat” Wall Street in a game that is constructed and operated by “Wall Street”.

These Stocks Pin Major Options Levels

SpotGamma has extensively documented how closely meme stocks trade toward options strikes with significant open interest. This suggests that option market makers and other options-linked stock flow is a major driver of the stock.

Take for example AMC shown below, which has pinned its major options level with each Friday expiration the last two weeks. There are countless other examples of this phenomenon, too (ex: TSLA & the S&P500).

Extreme Correlations:

The meme stocks move with an extremely high correlation. The odds that this is a coordinated intra-day retail trading scheme is essentially zero. This correlation is likely the result of very large fund(s) executing systematic strategies. These funds can use computerized trading algorithms to simultaneously trade multiple assets, often versus another asset (like an option, or an Index).

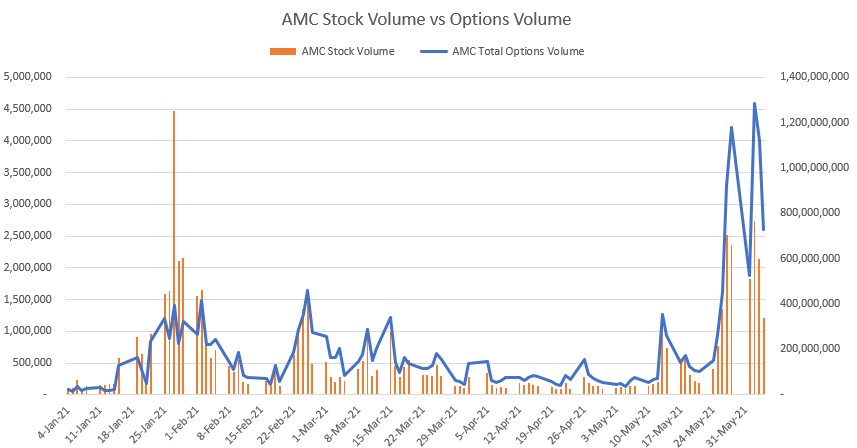

We also point out the correlation between stock and options volume in these meme names. Take for example AMC, in which its clear there is a major link between higher options volume, and larger stock volume. When options volumes increase, stock flow should increase in sync because of, amongst other things, options market maker hedging requirements.

Short Selling:

The great thing about demonizing “the shorts” is that it assigns an common enemy for meme traders to rally against. Retail analysts were in a frenzy last week as Melissa Lee said “naked shorts” on TV. Its a challenge to agree with the idea that Melissa is privy to some secret Wall Street short selling conspiracy against retail.

However we do have some qualitative points that short interest is not simply rampant “naked” selling:

- Prime brokers have been cutting risk in both meme stocks, and risk overall after Archegos. This likely means naked short selling and/or exposure to negative convexity has been curtailed since January.

- Much of new short selling could actually be hedges against options flow. Firms that run volatility trading strategies will short stock against short puts and/or long calls. With implied volatility in AMC, GME and the like at >500% its likely that volatility trading funds have high activity in these stocks.

Regardless of Meme Direction, Wall Street Profits

Wall Street as a whole has profited massively from this frenzy, the clearest winner out of meme-mania is in fact “Goliath”. Case in point is Robinhood, which made $330 million dollars in Q1 ’21 despite being blamed as having single handedly destroyed the January GME melt up.

Also, many of the companies which saw their stocks exploding higher have issued stock. This makes sense given their ability to raise capital at valuations previously though impossible. These large transactions generate large fees for investment banks.

Furthermore the executives in these companies have been selling their personal holdings. Take AMC in which “Six AMC executives made more than $8 million in total after selling 150,000 shares”, while simultaneously offering their retail holders free popcorn.