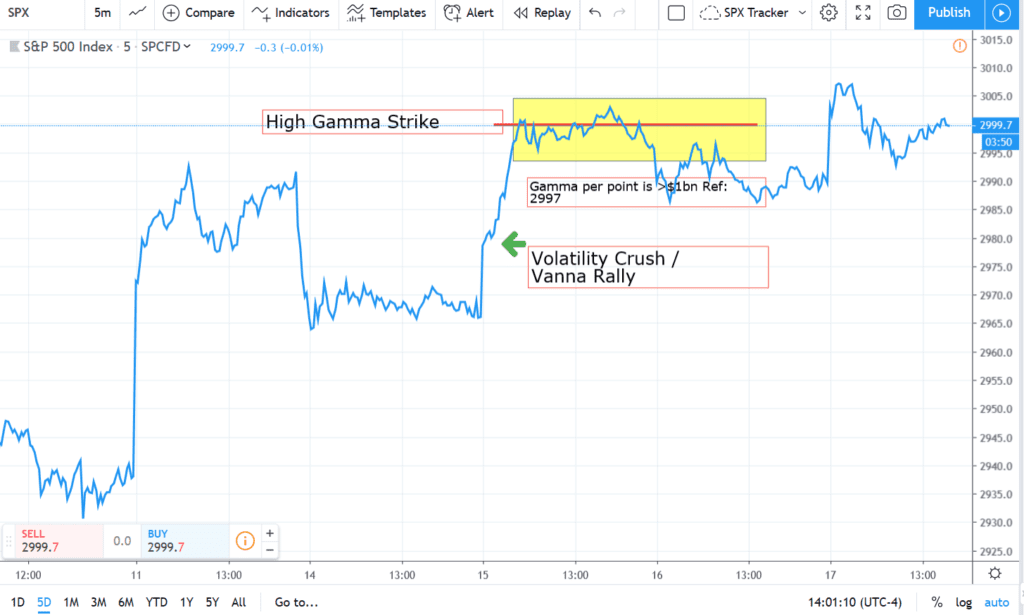

The current October options expiration portrays how an options pin can play out. For several days we have seen 3000 as our high gamma strike, with options volume at 3000 strike dominating the market. As the market moves away from this strike options dealers and other options hedgers move the price “back in line” to 3000 as they hedge. This led us to put up the following chart 2 days ago:

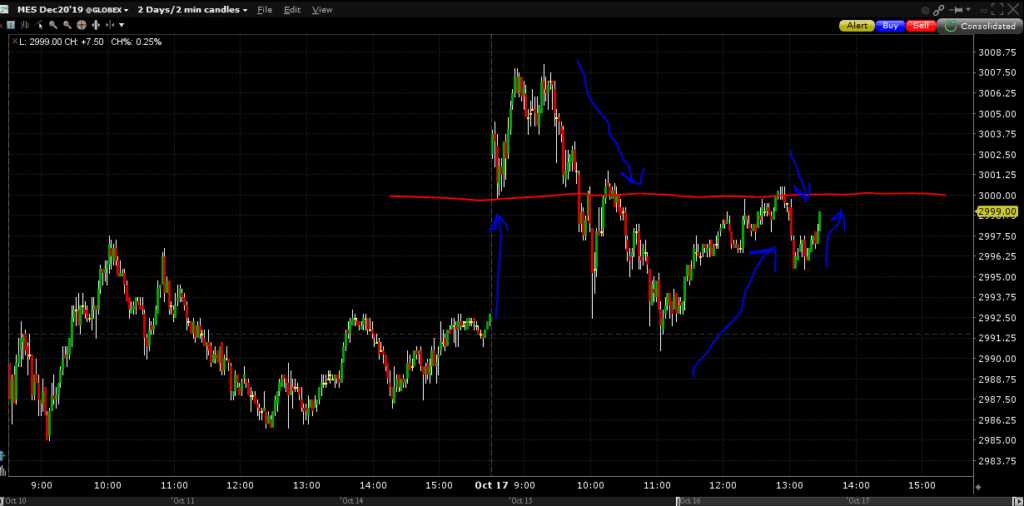

Here is the pin on an intraday basis:

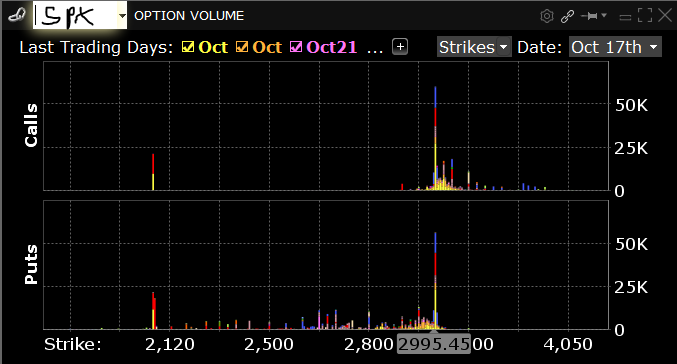

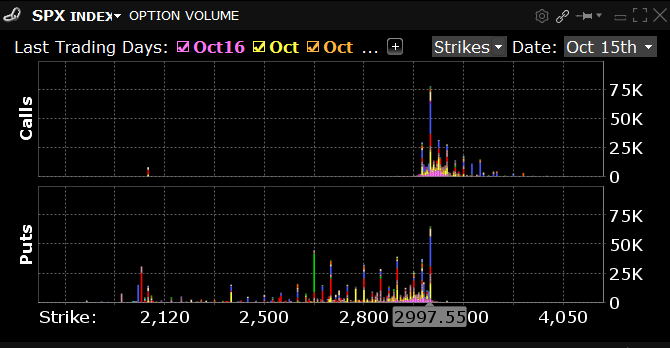

Tomorrow AM a large chunk of options expire, which may “free up” the market to move to its next level. Below are screen shots showing the volume at 3000.