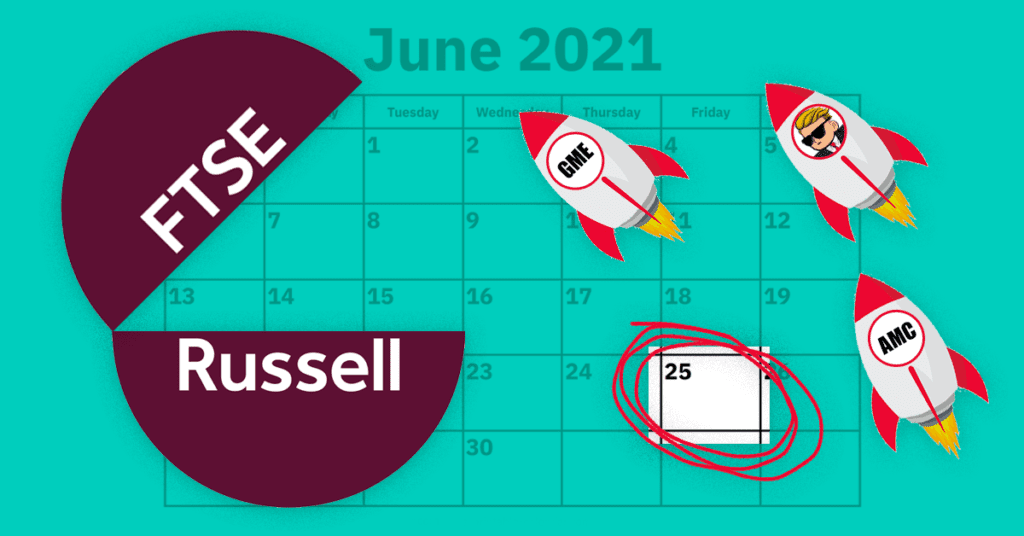

Every June, the Russell Index rebalances by removing stocks that no longer meet their criteria. After a wildly popular start to 2021, will meme stocks like GME and AMC get added to Russell this year?

Many traders are starting to discuss the upcoming Russell Index rebalances, and the prospect of GME, AMC or other meme stocks being added to Russell 1000.

Each year in June (Friday, June 25 this year) the FTSE Russell uses a set of criteria to determine which companies stock will be tracked by their benchmark indices. There are many ways investors can track these indices, such as through an ETF like IWM.

For massive assets like pension funds, they track by owning the individual stock components of the index.

For example if the FTSE adds a 1% weighting of GameStop to the Russell 2000 Index, everyone that tracks the Russell 2000 must buy GME shares. To offset this addition, the Russell will reduce or remove other stock(s) that not longer meet their criteria.

*Note: While this post discusses the Russell, the mechanics are the same for the S&P Indices, too.

Analysts spend a lot of time trying to assess which stocks will be added or removed from the indices during this annual rebalance.

According to the FTSE Russell approximately $16 trillion assets track the Russell indices, so a lot of shares may have to be bought and sold so that all of these various funds conform to the appropriate benchmark.

With volume like that, one can see the value of knowing which stocks may be bought and sold before these large funds start their adjustment.

Join now for full access to all SpotGamma insights

➡ Sign up today

Knowing what stocks will be added or removed from indices, such as Russell, is a huge opportunity for traders

TSLA was a prime example of how traders got ahead of these additions. In late November 2020, it was announced that TSLA would be added to the S&P500 Index. As you can see on the chart below, the stock traded nearly 50% higher from the announcement date to the actual addition date.

It’s important to mention that Tesla’s massive move into the index addition was quite an aberration, and traders should not expect ~50% moves for all index events.

Mechanically, this is how an index rebalance trade may take place

Theoretical Example:

The Huge State Pension Fund (like: CALPERS, Texas Teachers, etc.) has $1 billion tracking the Russell 2000 Index. It’s announced that at the close of trading on June 25th, GME will be added to the Russell 2000.

Huge State Pension Fund must therefore buy:

- $1,000,000,000 (AUM) * 1.0% (index weighting) = $10,000,000 notional of GME stock

- $10,000,000/$225 (GME share price) =

- 44,444 shares of GME stock

The index fund’s goal is to track the benchmark, and so they often work with bank dealers to try and buy these shares at the close of trading on June 25. Accordingly, bank dealers may start to build an inventory of shares in the days leading to the actual rebalance.

The hypothetical example above shows how many shares would be bought with just one relatively small fund. You can imagine how the share count increases when you start to allocate trillions of dollars of capital to the index re-weighting.

Want more insights like this and access to all SpotGamma levels and tools?

Sign up today and join the thousands of other traders in our community.