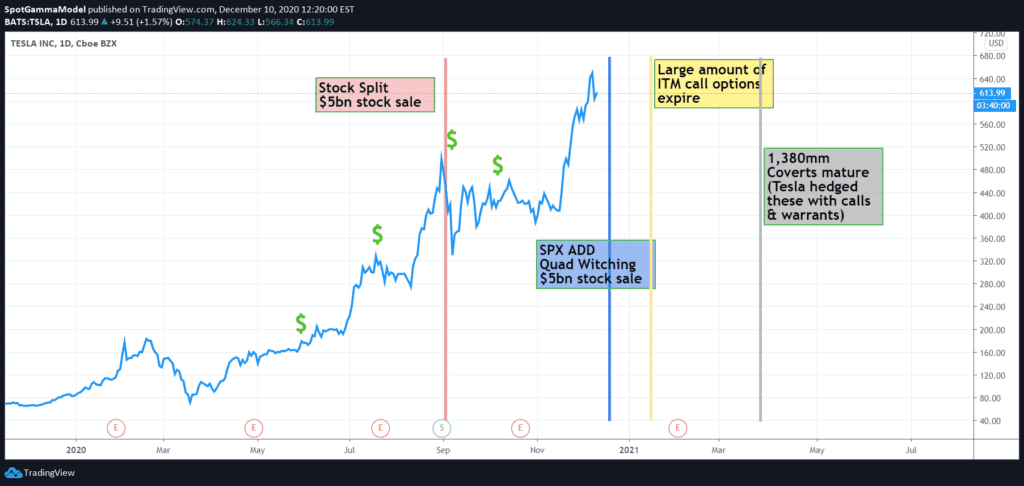

TSLA will be added to the S&P500 Index next week, and will be approximately 1.5% of the index. We covered the mechanics of this add, here. The chart below highlights the key recent events, and some relevant future dates. The “$” markets indicate where Musk has received a bonus in the form of TSLA options.

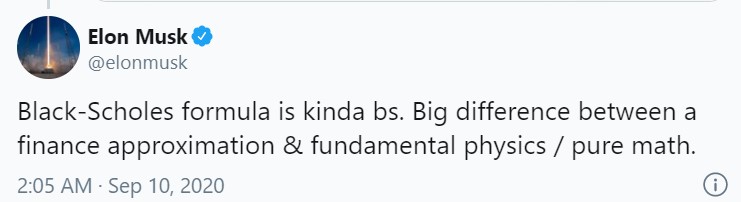

On Sep 10th Elon remarked on Twitter about the popular options pricing model Black-Scholes. Its quite interesting given his compensation is in the form of stock options, and it is call options that have had such a large impact on TSLA’s stock price.

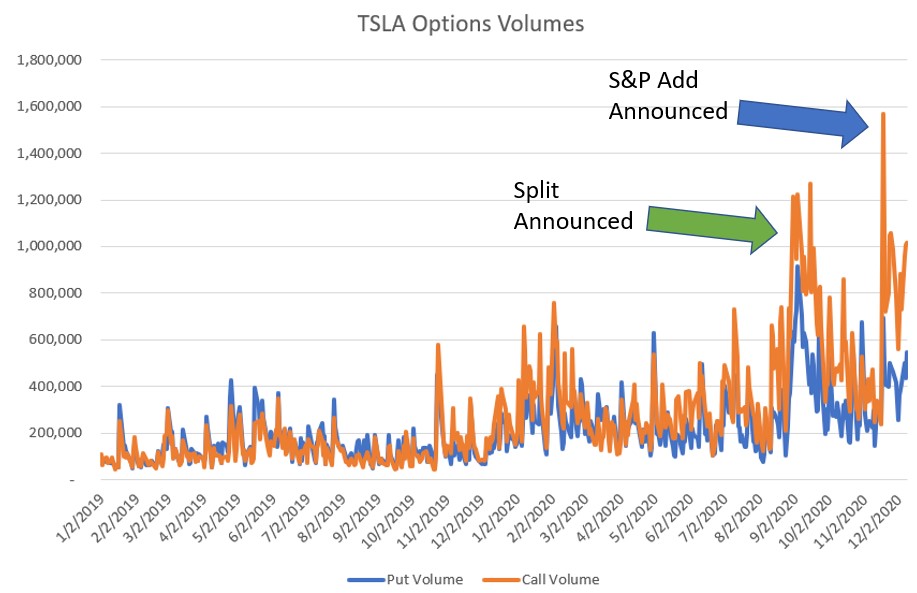

Below you can see just how heavy the options volume in TSLA has been. As traders flood into call options, dealers may have to buy TSLA stock to hedge. This essentially allows smaller retail traders to force the stock higher using leverage.

Consider the median bank estimate of TSLA is $430. With the stock at $600, this call volume may have been “artificially” inflating the value of the stock, and this premium price is about to be transferred to the S&P index community.

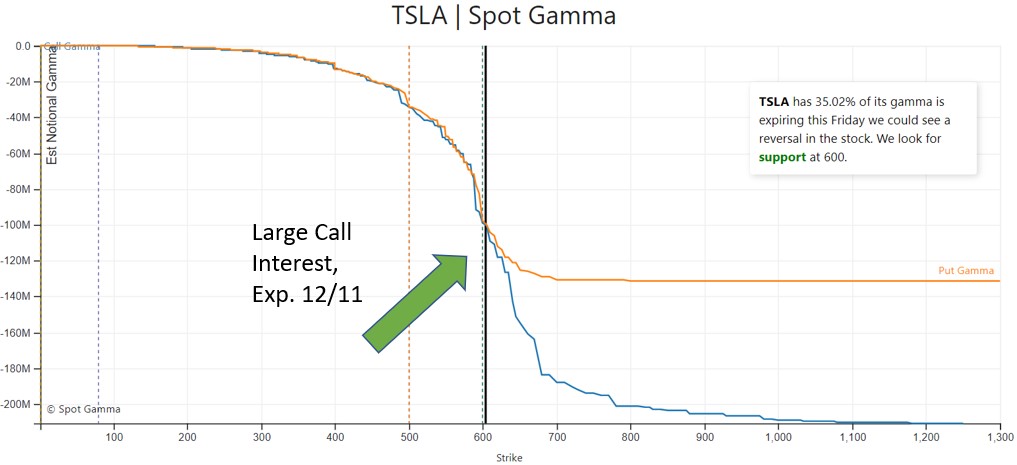

Into next weeks event our EquityHub options data shows there are a large amount of options expiring Friday, 12/11 on the close. As the trend has been for traders to use the shortest data expiration, we expect large rush of call options to reload into next weeks S&P500 add (12/18). The 700 strike currently holds the most call options for the 12/18 expiration.

Volatility in TSLA may reduce after this index add event, as TSLA will be tethered to a massive $11 trillion pool of assets.